Question

Consider the Put option on the Canada 6s of 2038 which expires (matures) in July 2021. Suppose the put premium for one contract on the

Consider the Put option on the Canada 6s of 2038 which expires (matures) in July 2021. Suppose the put premium for one contract on the bond was $1,240 for a strike price of $102,643 in March 2021, and the call premium for the same strike price was $1,220. If the Canada 6s of 2038 bond sold for $102,470 in July 2021.

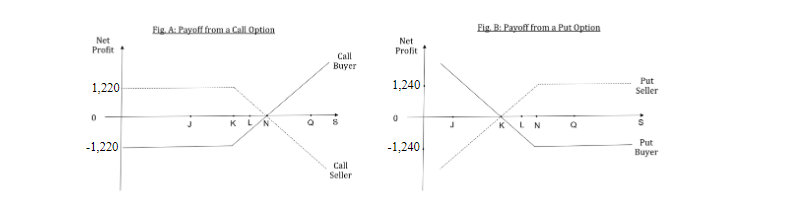

Part 6: The value of point N in Fig. B (the Put Option graph) is:

Part 7: The value of point K in Fig. B (the Put Option graph) is:

Part 8: At point L in Fig. B (Put Option), the Put buyer: (choose one option below)

Does not exercise the option and take a loss of $1240.

Exercise the option and takes a lesser loss than $1250.

Does not exercise the option and takes a lesser loss at $1240.

Exercise the option and make a lower profit than $1240.

Exercise the option and break even.

Part 9: At higher prices of the underlying than point N in the Put option (Fig. B): (choose one option below)

The put seller makes a profit of 1240.

The put is at the money and will not be exercised.

The buyer exercises the put for a profit of 1240 per contract.

The buyer and the seller receive an identical payoff of 1240 per contract.

The put is in the money and the buyer excessive for a profit of 1240.

Elg. A: Payoff from a Call Option Fig. B: Payoff from a Put Option Elg. A: Payoff from a Call Option Fig. B: Payoff from a Put OptionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started