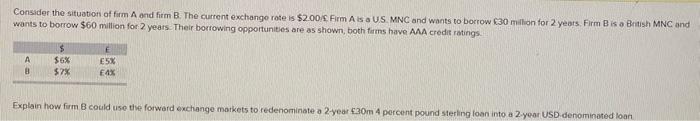

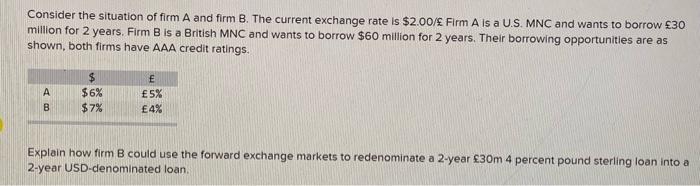

Consider the situation of flm And im The current exchange rates $2.00. FormAUS MNC and wants to borrow 30 million for 2 years Format MNC and wants to borrow 560 million for 2 years The borrowing opportunities are as shown both firmave AAA credit ratings A # TOR 57 58 ex Explain how im B could use the forward exchange markets to redominate a 2 year com 4 percent pound sterling loan nito a 2-year USD denominated loan Consider the situation of farm A ond firm B. The current exchange rate is $2.00/. Firm A is a U.S.MNC and wants to borrow 630 million for 2 years Firm Bis a British MNC and wants to borrow $60 million for 2 years. Their borrowing opportunities are as shown both firms have AAA credit ratings A 8 $ $6% 57% E5X E4% Explain how firm B could use the forward exchange markets to redenominate a 2 year 30m 4 percent pound Sterling loan into a 2 year USD denominated loan Consider the situation of firm A and firm B. The current exchange rate is $2.00/ Firm A is a U.S. MNC and wants to borrow 30 million for 2 years Firm B is a British MNC and wants to borrow $60 million for 2 years. Their borrowing opportunities are as shown, both firms have AAA credit ratings. B $ $6% $7% E 5% 4% Explain how firm B could use the forward exchange markets to redenominate a 2-year 30m 4 percent pound sterling loan into a 2-year USD-denominated loan. Consider the situation of flm And im The current exchange rates $2.00. FormAUS MNC and wants to borrow 30 million for 2 years Format MNC and wants to borrow 560 million for 2 years The borrowing opportunities are as shown both firmave AAA credit ratings A # TOR 57 58 ex Explain how im B could use the forward exchange markets to redominate a 2 year com 4 percent pound sterling loan nito a 2-year USD denominated loan Consider the situation of farm A ond firm B. The current exchange rate is $2.00/. Firm A is a U.S.MNC and wants to borrow 630 million for 2 years Firm Bis a British MNC and wants to borrow $60 million for 2 years. Their borrowing opportunities are as shown both firms have AAA credit ratings A 8 $ $6% 57% E5X E4% Explain how firm B could use the forward exchange markets to redenominate a 2 year 30m 4 percent pound Sterling loan into a 2 year USD denominated loan Consider the situation of firm A and firm B. The current exchange rate is $2.00/ Firm A is a U.S. MNC and wants to borrow 30 million for 2 years Firm B is a British MNC and wants to borrow $60 million for 2 years. Their borrowing opportunities are as shown, both firms have AAA credit ratings. B $ $6% $7% E 5% 4% Explain how firm B could use the forward exchange markets to redenominate a 2-year 30m 4 percent pound sterling loan into a 2-year USD-denominated loan