Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the situation of the copper futures trader discussed in problem 2 above. If the trader were working for a company that was using the

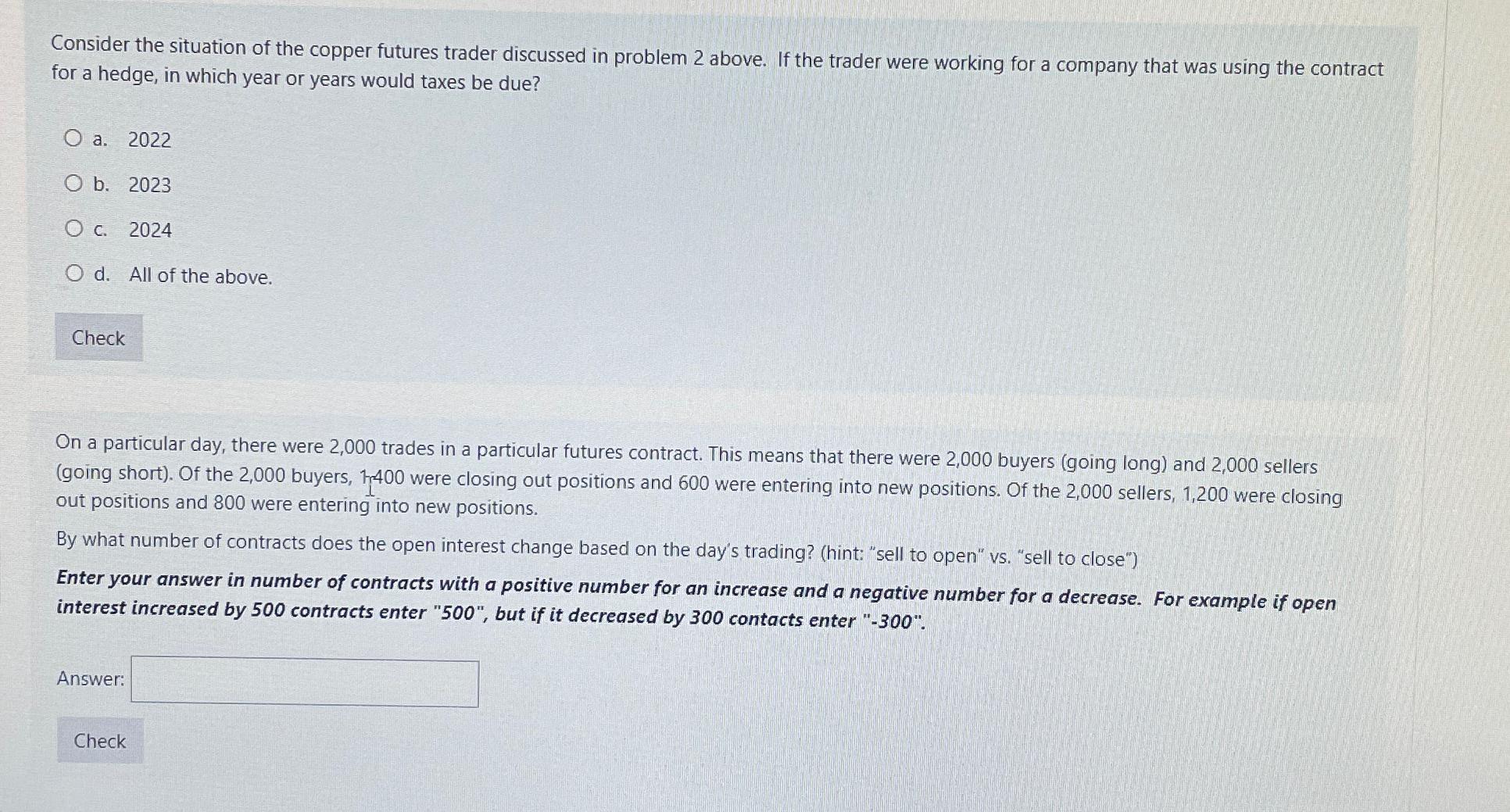

Consider the situation of the copper futures trader discussed in problem above. If the trader were working for a company that was using the contract for a hedge, in which year or years would taxes be due?

a

b

c

d All of the above.

On a particular day, there were trades in a particular futures contract. This means that there were buyers going long and sellers going short Of the buyers, were closing out positions and were entering into new positions. Of the sellers, were closing out positions and were entering into new positions.

By what number of contracts does the open interest change based on the day's trading? hint: "sell to open" vs "sell to close"

Enter your answer in number of contracts with a positive number for an increase and a negative number for a decrease. For example if open interest increased by contracts enter but if it decreased by contacts enter

Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started