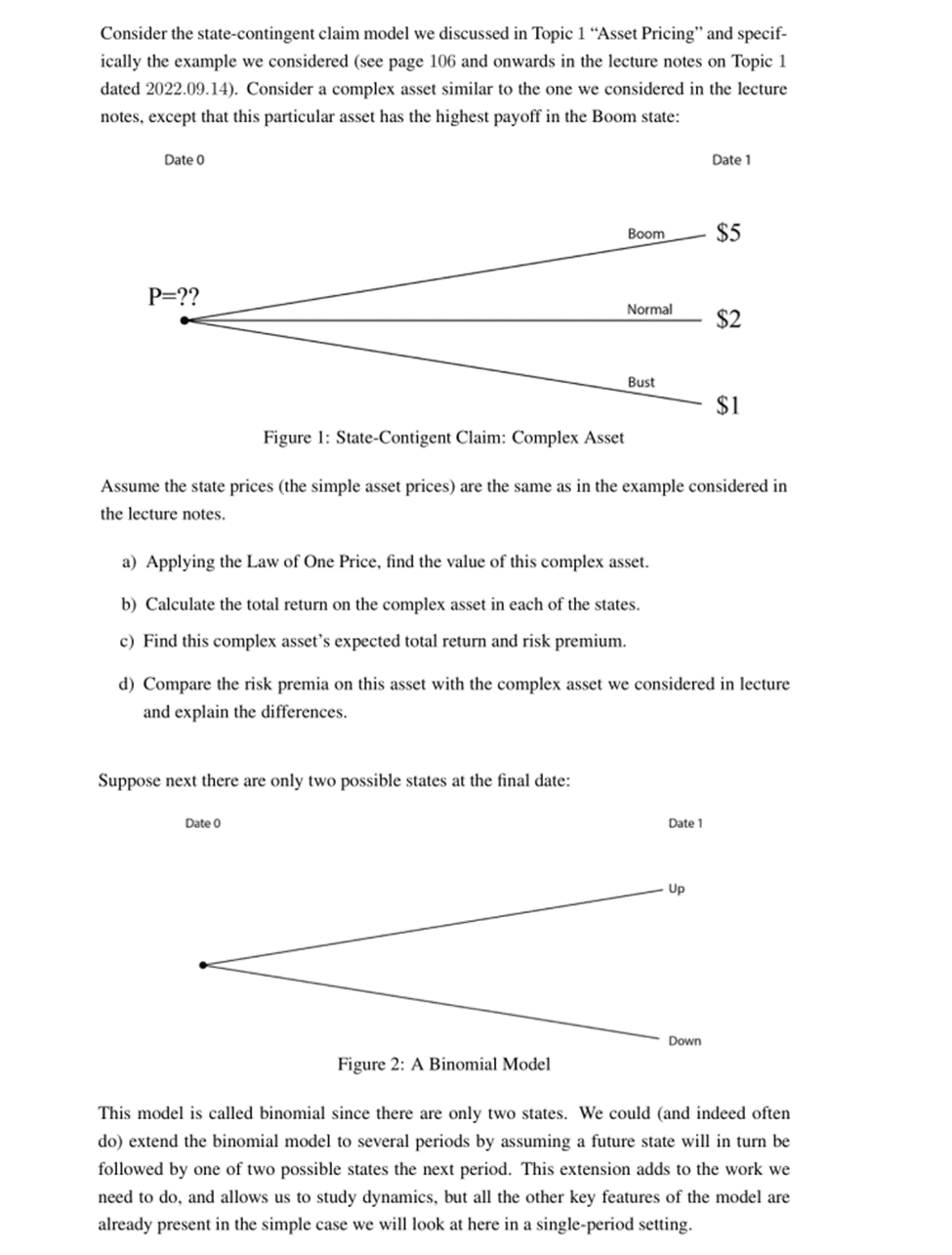

Consider the state-contingent claim model we discussed in Topic 1 "Asset Pricing" and specifically the example we considered (see page 106 and onwards in the lecture notes on Topic 1 dated 2022.09.14). Consider a complex asset similar to the one we considered in the lecture notes, except that this particular asset has the highest payoff in the Boom state: Assume the state prices (the simple asset prices) are the same as in the example considered in the lecture notes. a) Applying the Law of One Price, find the value of this complex asset. b) Calculate the total return on the complex asset in each of the states. c) Find this complex asset's expected total return and risk premium. d) Compare the risk premia on this asset with the complex asset we considered in lecture and explain the differences. Suppose next there are only two possible states at the final date: This model is called binomial since there are only two states. We could (and indeed often do) extend the binomial model to several periods by assuming a future state will in turn be followed by one of two possible states the next period. This extension adds to the work we need to do, and allows us to study dynamics, but all the other key features of the model are already present in the simple case we will look at here in a single-period setting. Consider the state-contingent claim model we discussed in Topic 1 "Asset Pricing" and specifically the example we considered (see page 106 and onwards in the lecture notes on Topic 1 dated 2022.09.14). Consider a complex asset similar to the one we considered in the lecture notes, except that this particular asset has the highest payoff in the Boom state: Assume the state prices (the simple asset prices) are the same as in the example considered in the lecture notes. a) Applying the Law of One Price, find the value of this complex asset. b) Calculate the total return on the complex asset in each of the states. c) Find this complex asset's expected total return and risk premium. d) Compare the risk premia on this asset with the complex asset we considered in lecture and explain the differences. Suppose next there are only two possible states at the final date: This model is called binomial since there are only two states. We could (and indeed often do) extend the binomial model to several periods by assuming a future state will in turn be followed by one of two possible states the next period. This extension adds to the work we need to do, and allows us to study dynamics, but all the other key features of the model are already present in the simple case we will look at here in a single-period setting