Question

Consider the three institutional investors: (i) Omega Investment Group (OIG), (ii) Delta Capital Ventures (DCV), and (iii) Epsilon Investments Inc. (EII) - each with distinct

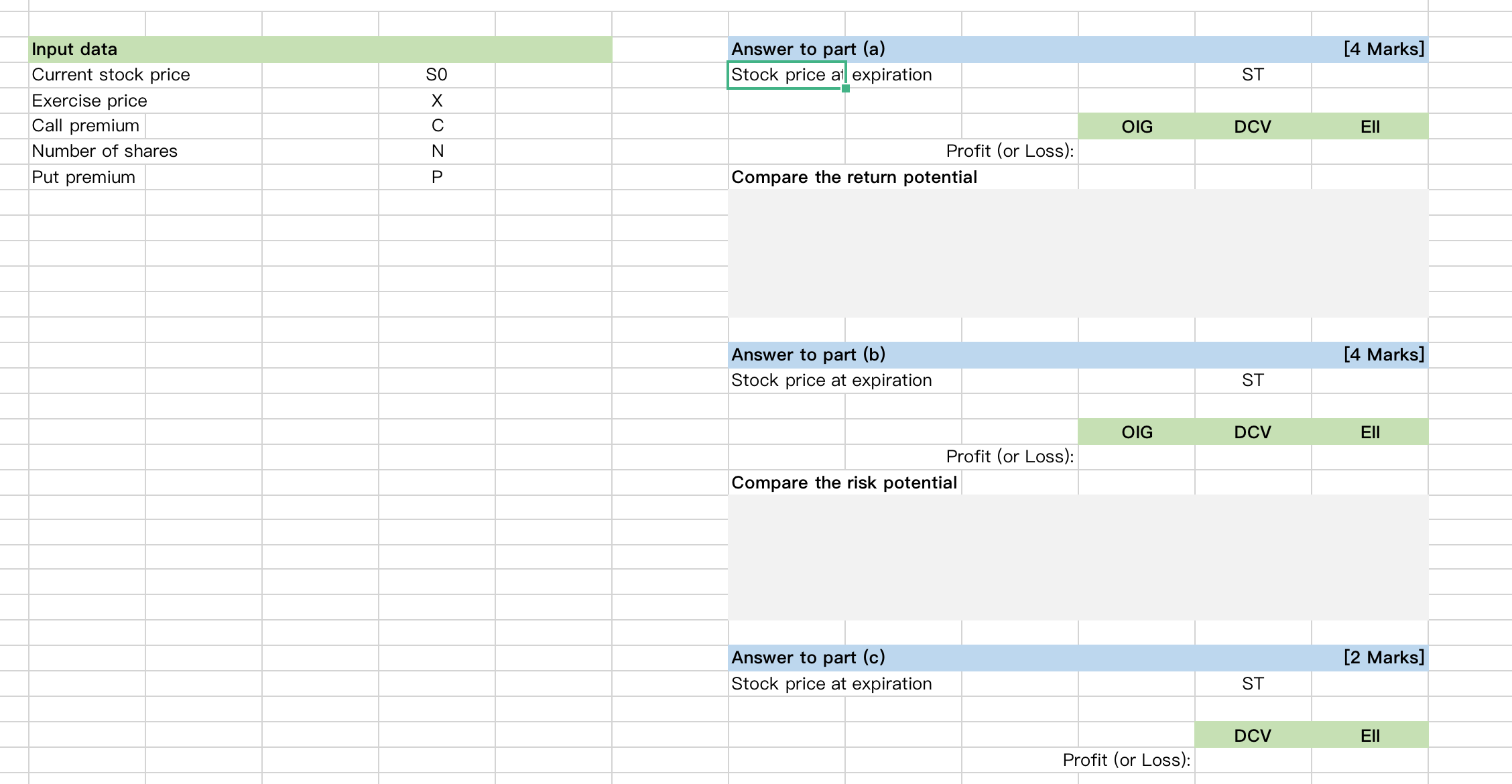

Consider the three institutional investors: (i) Omega Investment Group (OIG), (ii) Delta Capital Ventures (DCV), and (iii) Epsilon Investments Inc. (EII) - each with distinct investment strategies when it comes to evaluating Apple Inc. (Ticker: AAPL) stock. OIG leans towards conventional investment methods, aiming for direct stock investments on the stock exchange (spot market). Meanwhile, both DCV and EII specialize in options trading and seek exposure to AAPL through call options within the options market. Olivia Reynolds, the Chief Investment Officer of OIG, is an advocate for comprehensive, long-term investment strategies. She has meticulously assessed AAPL's financial performance, market dynamics, and potential for growth. Olivia firmly believes in the company's fundamental strengths and anticipates consistent returns over time. In line with OIG's conservative investment philosophy, Olivia leans towards a direct investment route, involving the acquisition of AAPL's stock on the stock exchange. Samuel Price, the Director of Investment Strategies at DCV, maintains an optimistic view of AAPL's stock trajectory. To gain exposure to AAPL's stock while managing potential downside risks and conserving capital outlay, he adopts an indirect approach by investing in AAPL's stock through call options. He, therefore, takes a long position in call options, granting DCV the ability to capitalize on the stock's potential upward price movement without immediately committing the entire investment sum. Eliza Collins, the Chief Investment Officer of EII, holds a bearish outlook on AAPL's stock trajectory. To attain exposure to AAPL's stock while prudently managing potential downside risks and preserving capital outlay, she contemplates an indirect approach involving a short position in call options with AAPL as the underlying asset. This approach grants EII the capability to capitalize on the stock's potential decline without the immediate commitment of the entire investment sum. Assume that APPL's current stock price is $170.10 per share and a call option based on it has an exercise price of $170 per share and a premium of $3 per share.

a) Calculate and contrast the profits (or losses) for OIG, DCV, and EII if the stock price rises to $200 per share upon expiration.

b) Determine and compare the profits (or losses) for OIG, DCV, and EII if the stock price falls to $160 per share upon expiration.

c) Compute the profits (or losses) for DCV and EII when adopting short and long positions on put options, respectively, in the event that the price decreases to $160 per share at expiration.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started