Answered step by step

Verified Expert Solution

Question

1 Approved Answer

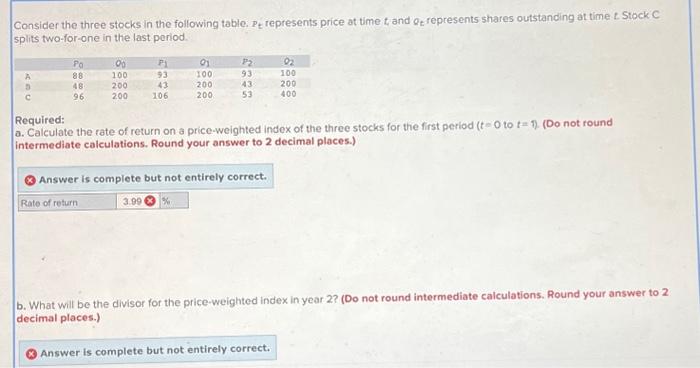

Consider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits

Consider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two-for-one in the last period. A B C PO 88 48 96 20 100 200 200 P1 93 43 106 Rate of return 01 100 200 200 P2 93 43 53 Required: a. Calculate the rate of return on a price-weighted index of the three stocks for the first period (t=0 to t= 1). (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct. 3.99 % 22 100 200 400 b. What will be the divisor for the price-weighted index in year 2? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started