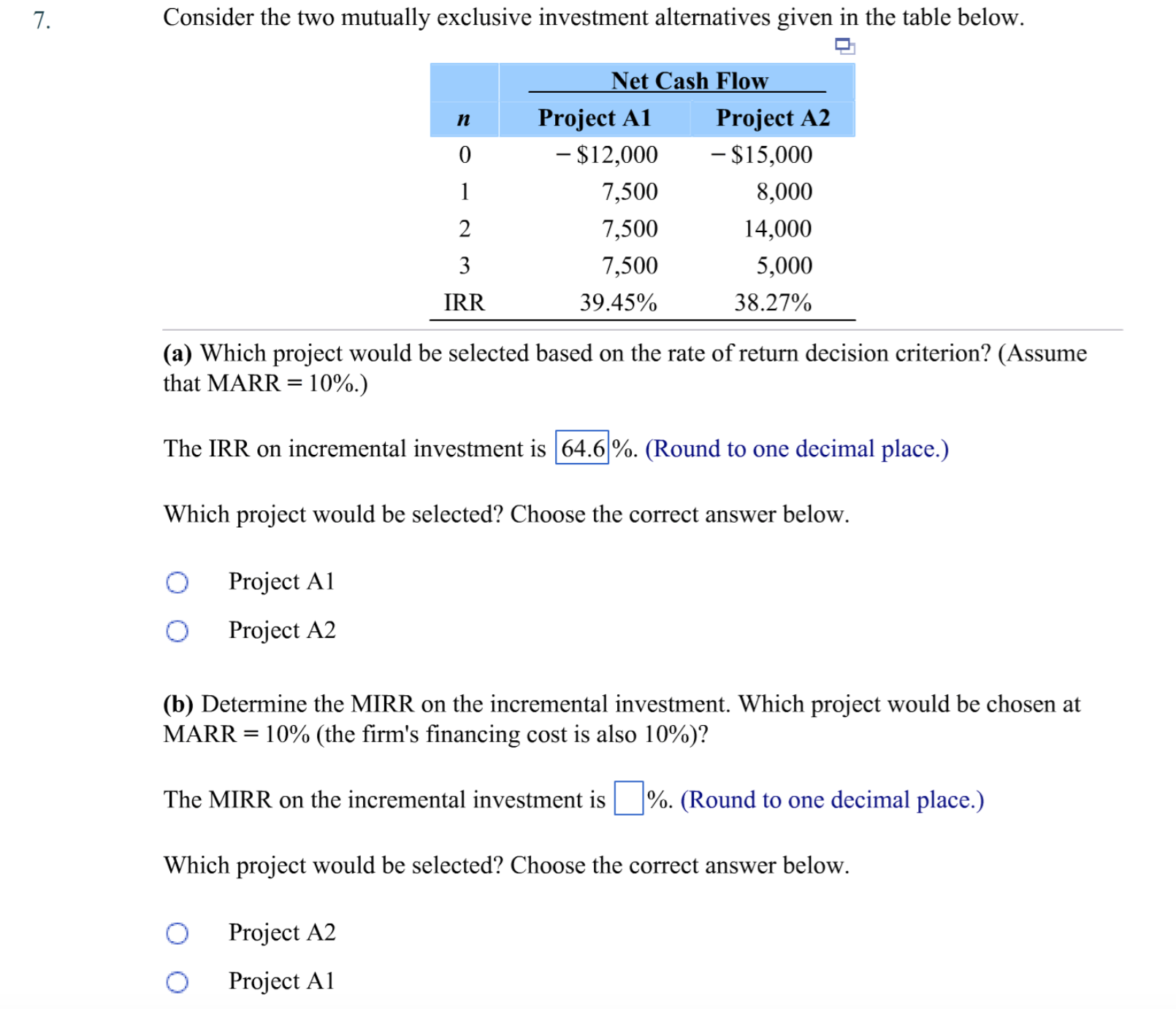

Question: Consider the two mutually exclusive investment alternatives given in the table below. Which project would be selected based on the rate of return decision criterion?(Assume

Consider the two mutually exclusive investment alternatives given in the table below. Which project would be selected based on the rate of return decision criterion?(Assume that MARR=10%) The IRR on incremental investment is 64.6% (Round to one decimal place.) Which project would be selected? Choose the correct answer below. Project A1 Project A2 Determine the MIRR on the incremental investment. Which project would be chosen at Marr=10%(the firm's financing cost is also 10%)? The MIRR on the incremental investment is %(Round to one decimal place.) Which project would be selected? Choose the correct answer below. Project A2 Project A1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts