Answered step by step

Verified Expert Solution

Question

1 Approved Answer

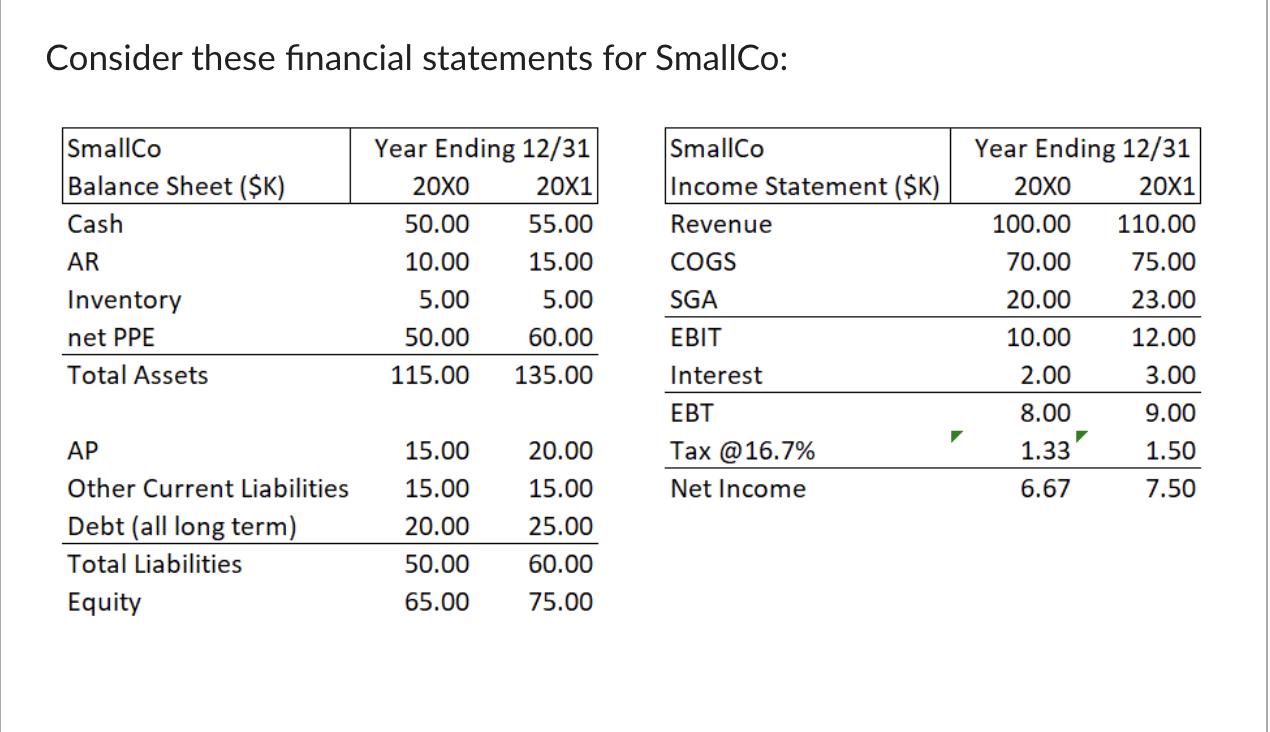

Consider these financial statements for SmallCo: SmallCo Balance Sheet (SK) Cash AR Inventory net PPE Total Assets AP Other Current Liabilities Debt (all long

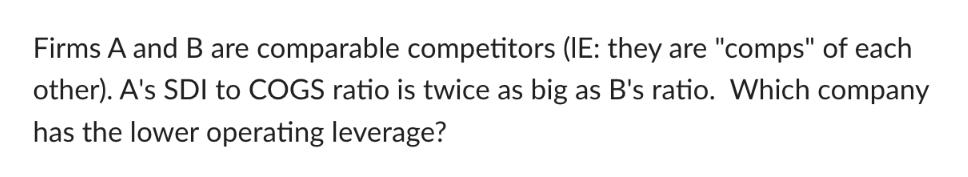

Consider these financial statements for SmallCo: SmallCo Balance Sheet (SK) Cash AR Inventory net PPE Total Assets AP Other Current Liabilities Debt (all long term) Total Liabilities Equity Year Ending 12/31 20X1 55.00 15.00 5.00 60.00 135.00 20X0 50.00 10.00 5.00 50.00 115.00 15.00 15.00 20.00 50.00 65.00 20.00 15.00 25.00 60.00 75.00 SmallCo Income Statement ($K) Revenue COGS SGA EBIT Interest EBT Tax @16.7% Net Income Year Ending 12/31 20X1 110.00 75.00 23.00 12.00 3.00 9.00 1.50 7.50 20X0 100.00 70.00 20.00 10.00 2.00 8.00 1.33 6.67 Firms A and B are comparable competitors (IE: they are "comps" of each other). A's SDI to COGS ratio is twice as big as B's ratio. Which company has the lower operating leverage?

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To determine which company has the lower operating leverage we need to compare the operating leverag...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started