Answered step by step

Verified Expert Solution

Question

1 Approved Answer

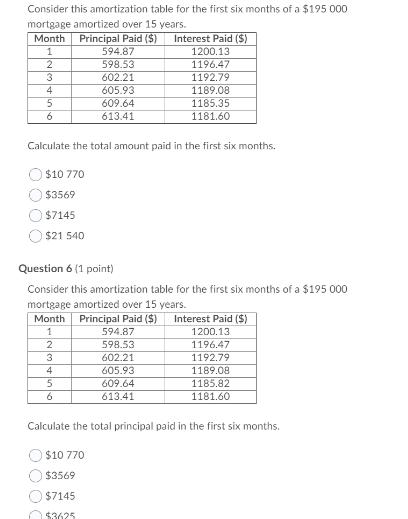

Consider this amortization table for the first six months of a $195 000 mortgage amortized over 15 years. Month Principal Paid ($) 1 2

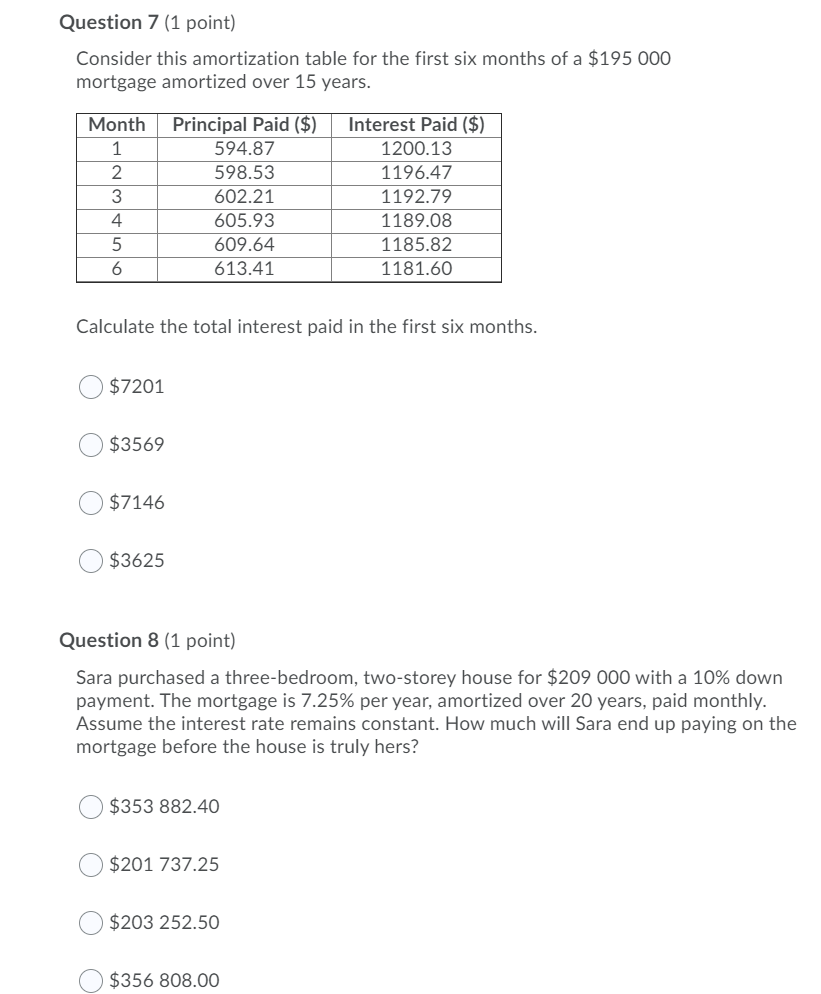

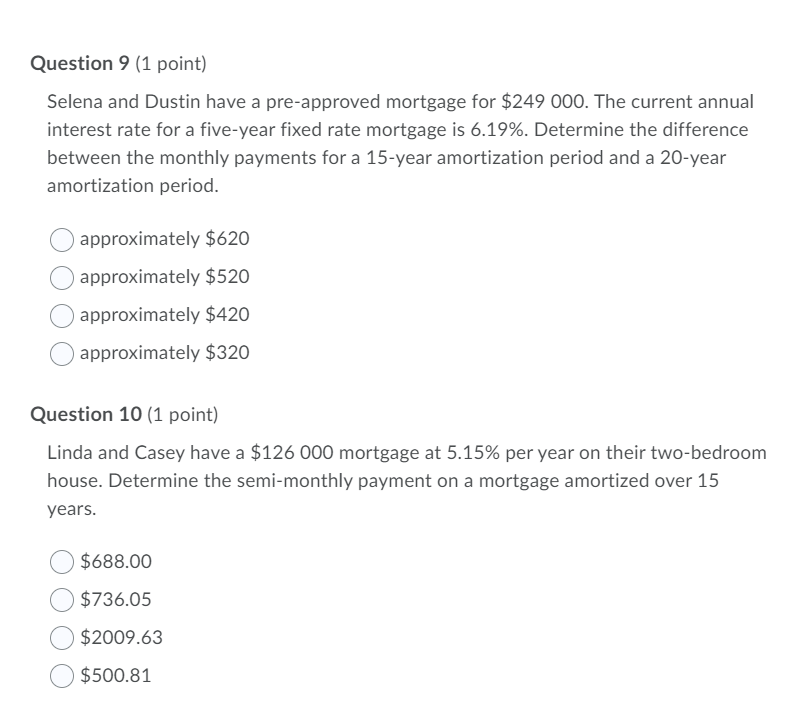

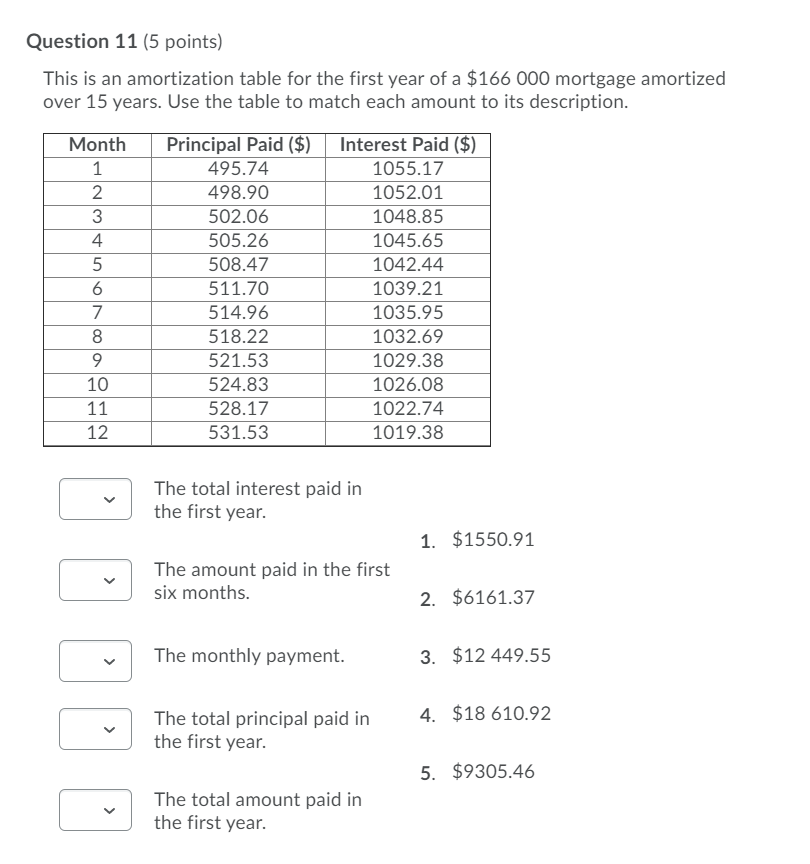

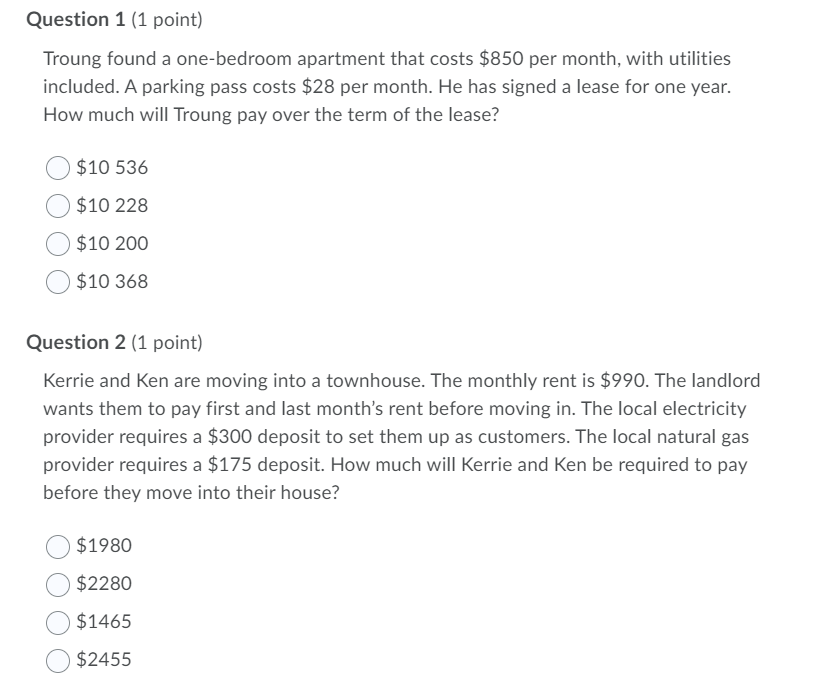

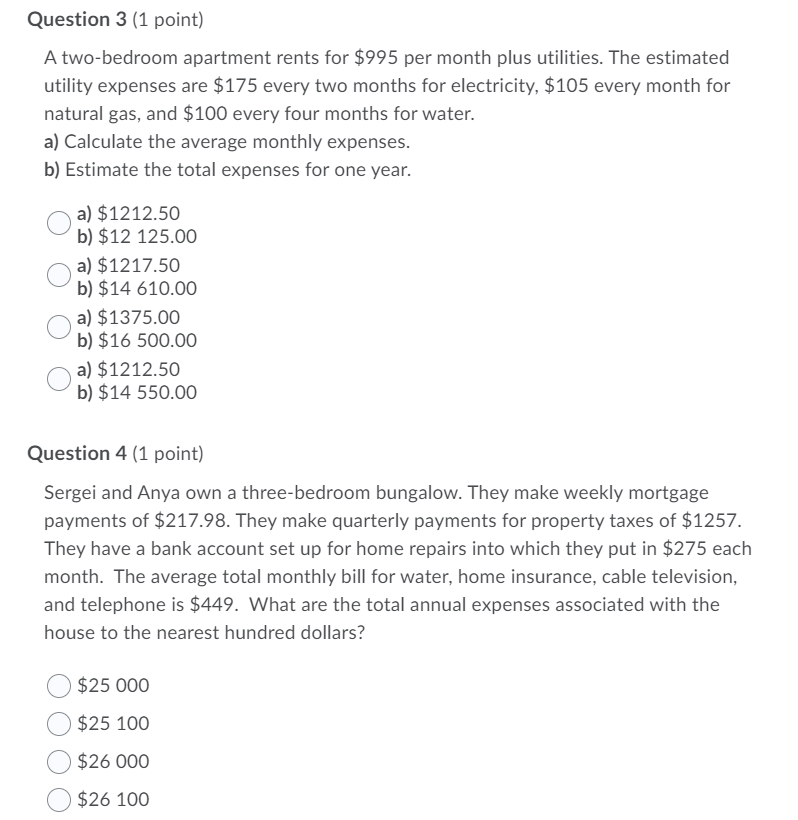

Consider this amortization table for the first six months of a $195 000 mortgage amortized over 15 years. Month Principal Paid ($) 1 2 3 4 5 6 594.87 598.53 602.21 605.93 609.64 613.41 $10 770 $3569 $7145 $21 540 Interest Paid ($) 1200.13 1196.47 1192.79 1189.08 Calculate the total amount paid in the first six months. 1185.35 1181.60 594.87 598.53 602.21 605.93 609.64 613.41 Question 6 (1 point) Consider this amortization table for the first six months of a $195.000 mortgage amortized over 15 years.. Month Principal Paid ($) Interest Paid ($) 1 2 3 4 5 6 1200.13 1196.47 1192.79 1189.08. 1185.82 1181.60 Calculate the total principal paid in the first six months. $10 770 $3569 $7145 $3625 Question 7 (1 point) Consider this amortization table for the first six months of a $195 000 mortgage amortized over 15 years. Month Principal Paid ($) 1 2 3 4 5 6 $7201 $3569 Calculate the total interest paid in the first six months. $7146 594.87 598.53 602.21 605.93 $3625 609.64 613.41 Question 8 (1 point) Sara purchased a three-bedroom, two-storey house for $209 000 with a 10% down payment. The mortgage is 7.25% per year, amortized over 20 years, paid monthly. Assume the interest rate remains constant. How much will Sara end up paying on the mortgage before the house is truly hers? $353 882.40 $201 737.25 Interest Paid ($) 1200.13 1196.47 1192.79 1189.08 1185.82 1181.60 $203 252.50 $356 808.00 Question 9 (1 point) Selena and Dustin have a pre-approved mortgage for $249 000. The current annual interest rate for a five-year fixed rate mortgage is 6.19%. Determine the difference between the monthly payments for a 15-year amortization period and a 20-year amortization period. approximately $620 approximately $520 approximately $420 approximately $320 Question 10 (1 point) Linda and Casey have a $126 000 mortgage at 5.15% per year on their two-bedroom house. Determine the semi-monthly payment on a mortgage amortized over 15 years. $688.00 $736.05 $2009.63 $500.81 Question 11 (5 points) This is an amortization table for the first year of a $166 000 mortgage amortized over 15 years. Use the table to match each amount to its description. Month 1 2 3 4 5 6 7 8 9 10 11 12 Principal Paid ($) 495.74 498.90 502.06 505.26 508.47 511.70 514.96 518.22 521.53 524.83 528.17 531.53 Interest Paid ($) 1055.17 1052.01 1048.85 1045.65 1042.44 1039.21 1035.95 1032.69 1029.38 1026.08 1022.74 1019.38 The total interest paid in the first year. The amount paid in the first six months. The monthly payment. The total principal paid in the first year. The total amount paid in the first year. 1. $1550.91 2. $6161.37 3. $12 449.55 4. $18 610.92 5. $9305.46 Question 1 (1 point) Troung found a one-bedroom apartment that costs $850 per month, with utilities included. A parking pass costs $28 per month. He has signed a lease for one year. How much will Troung pay over the term of the lease? $10 536 $10 228 $10 200 $10 368 Question 2 (1 point) Kerrie and Ken are moving into a townhouse. The monthly rent is $990. The landlord wants them to pay first and last month's rent before moving in. The local electricity provider requires a $300 deposit to set them up as customers. The local natural gas provider requires a $175 deposit. How much will Kerrie and Ken be required to pay before they move into their house? $1980 $2280 $1465 $2455 Question 3 (1 point) A two-bedroom apartment rents for $995 per month plus utilities. The estimated utility expenses are $175 every two months for electricity, $105 every month for natural gas, and $100 every four months for water. a) Calculate the average monthly expenses. b) Estimate the total expenses for one year. a) $1212.50 b) $12 125.00 a) $1217.50 b) $14 610.00 a) $1375.00 b) $16 500.00 a) $1212.50 b) $14 550.00 Question 4 (1 point) Sergei and Anya own a three-bedroom bungalow. They make weekly mortgage payments of $217.98. They make quarterly payments for property taxes of $1257. They have a bank account set up for home repairs into which they put in $275 each month. The average total monthly bill for water, home insurance, cable television, and telephone is $449. What are the total annual expenses associated with the house to the nearest hundred dollars? $25 000 $25 100 $26 000 $26 100

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Question 6 Calculate the total principal paid in the first six months To calculate the total principal paid in the first six months you need to sum up the principal amounts paid in each month Principa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started