Question

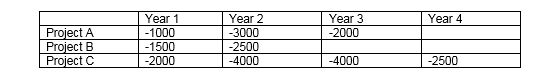

Consider three projects A, B and C. The capital costs (in US$) are given in the table below: Project A generates revenue from year 4

Consider three projects A, B and C. The capital costs (in US$) are given in the table below:

Project A generates revenue from year 4 until year 15. However, in year 4, the revenue is only $500; in year 5 it is $1000, and thereafter $1500 for every subsequent year.

Project B generates revenue of $500 in the first year of operation (i.e. year 3), $1000 in the second year of operation, and $1500 for every year thereafter until year 10.

Project C generates revenue of $500 in the first year of operation, $1000 in the second year of operation, $1500 in the third year of operation, and $2000 in the fourth year of operation, and thereafter $2500 for every year until year 20. In addition, there is some additional revenue (residual value of assets) of $250 in year 20.

Note 1. Production will not be possible until the entire project investment is complete.

Questions:

i) If these projects are mutually exclusive, which project would be selected? Use a discount rate of 8% for your calculations. (35% of marks)

ii) If the discount rate were 10%, would your decision change and why? (10% of marks)

iii) If the projects are not mutually exclusive, but funds available in years 1-4 are restricted to $14,000, which project(s) would you choose? You must interpret your results and explain the theoretical principles and methodology you have used in making your decision and comment on the validity and limitations of your results. (55% of marks)

Note 2. Please include all workings and spreadsheet tables in your answer.

Year 4 Year 3 -2000 Project A Project B Project Year 1 -1000 -1500 -2000 Year 2 -3000 -2500 -4000 -4000 -2500 Year 4 Year 3 -2000 Project A Project B Project Year 1 -1000 -1500 -2000 Year 2 -3000 -2500 -4000 -4000 -2500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started