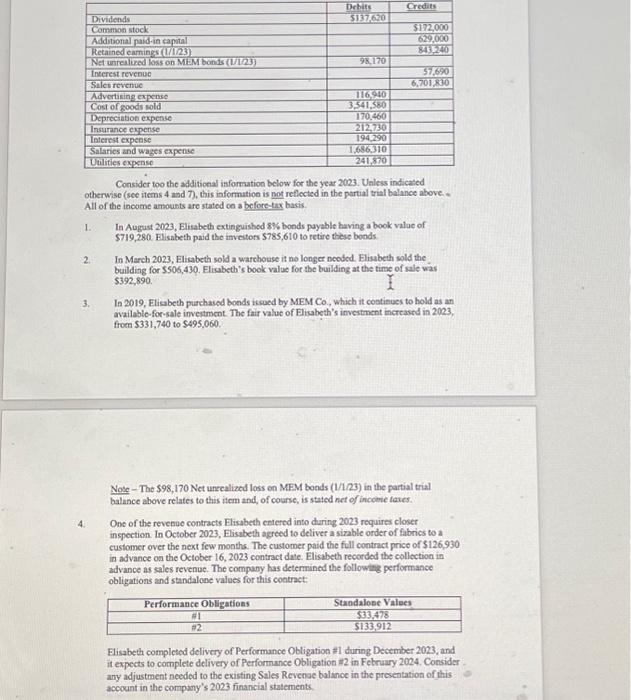

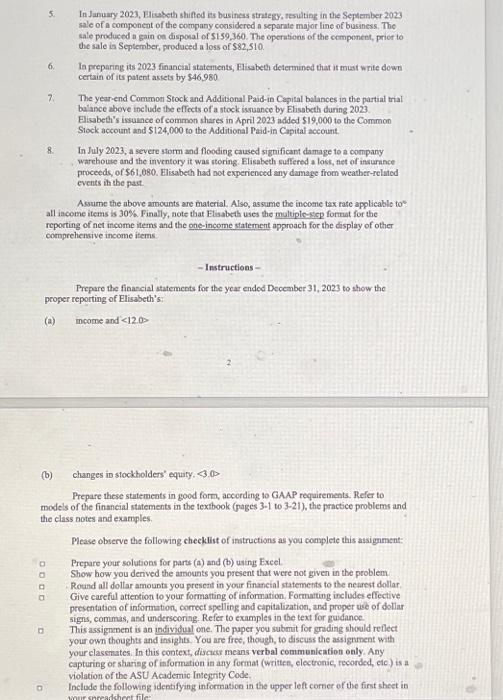

Consider too the additional isformation below for the year 2023. Uniless indicated otherwise (see items 4 and 7 ), this information is pot reflected in the partial trial balance above. All of the income amounts are stated co a beforc-tax basis. 1. In August 2023 , Elisabeth extinguished 8% bonds payable having a book value of $719,280. Flisabeth paid the investors $785,610 to retire these bonds. 2. In March 2023, Elisabeth sold a warchouse it no longer neoded. Elisabeth sold the building for $506,430. Elisabeth's book value for the building at the time of sale was $392,890. 3. Is 2019, Elisabeth purchasod bonds issued by MEM Co., which it cootieues to hold as an available-for-sale inveitment. The fair value of Elicabeth's investment increased in 2023 , froen $331,740 to $495,060. Nole - The 598,170 Net unecalized loss on MEM bonds (1/1/23) in the partial trial balance above relates to this item and, of course, is stated net of income texes. 4. One of the revenue contracts Flisabeth entered into during 2023 requires closer inspection. In October 2023, Elisabeth agreed to deliver a sizable order of fabrics to a customer over the next few months. The customer paid the full contract price of \$126,930 in advance oa the October 16, 2023 contract date. Elisabeth recorded the collection in advance as sales revenue. The company has determined the following performance obligations and standalone values for this coatract: Elisabeth completed delivery of Performance Obligation =1 during December 2023, and it expects to complete delivery of Performance Obligation =2 in Fetruary 2024. Consider any adjustment needed to the existing Sales Revenoe balance in the presentation of this account in the company's 2023 financial statements. 5. In January 2023, Elicabeth shifod its business strategy, resulting in the September 2023 sale of a componeat of the company considered a separate major line of business. The sale produced a gain on disponal of $159,360. The operntions of the component, prior to the sale is September, produced a loss of $82,510. 6. Ia preparing its 2023 financial statements, Elisabeth determined that it must write down certain of its patent assets by $46,980 7. The year-end Common Stock and Addrtional Paid-in Capisal balances in the partial trial balance above include the effects of a stock issuance by Elissbeth during 2023. Elisabeth's issunce of common shares in April 2023 added $19,000 to the Common Siock account and $124,000 to the Additional Paid-in Capital account. 8. In July 2023, a severe storm and flooding caused significant damage to a company warehouse and the inventory it was storing. Elisabeth suffered a loss, fet of insurance proceeds, of \$61,080. Elisabeth had not experienced any damage from weather-related events ith the past. Assume the above amounts are material. Also, assume the income tax rate applicable to all iacome items is 30%. Finally, note that Elisabeth uses the multiple-sicp format for the reporting of net income items and the one-income statement approach for the display of other comprehensive income items: - Instructions - Prepare the finascial statements for the year ended Decenber 31,2023 to show the proper reporting of Elisabeth's: (a) incorre and 12.0 2 (b) changes in stockholders' equity, 3,0 Prepare these statemeats in good form, according to GAAP requirements. Refer to models of the financial statements in the textbook (pages 3-1 to 3-21), the practice problems and the class notes and examples. Pease observe the following checklist of instructions as you complete this assignment: Prepare your solutions for parts (a) and (b) using Excel. Show how you denved the amounts you present that were not given in the problem. Round all dollar amouns you present in your finaneial statements to the nearest dollar, Give careful attention to your formatting of infonmation. Formatting includes effective presentation of information, correct spelling and capitalization, and proper wec of dollar signs, commas, asd underscoring. Refer to examples in the text for guidanoe. This assignment is an individul one. The puper you submit for griding should reflect your own thoughts and insights. You are free, though, to discuss the assignment with your clasemates. In this context, discacer means verbal communication only. Any capturing or sharisg of information in any format (Writtes, electronic, recorded, etc) is a violation of the ASU Academic Integrity Code. Inclode the followisg identifying information in the upper left corner of the first sheet in Consider too the additional isformation below for the year 2023. Uniless indicated otherwise (see items 4 and 7 ), this information is pot reflected in the partial trial balance above. All of the income amounts are stated co a beforc-tax basis. 1. In August 2023 , Elisabeth extinguished 8% bonds payable having a book value of $719,280. Flisabeth paid the investors $785,610 to retire these bonds. 2. In March 2023, Elisabeth sold a warchouse it no longer neoded. Elisabeth sold the building for $506,430. Elisabeth's book value for the building at the time of sale was $392,890. 3. Is 2019, Elisabeth purchasod bonds issued by MEM Co., which it cootieues to hold as an available-for-sale inveitment. The fair value of Elicabeth's investment increased in 2023 , froen $331,740 to $495,060. Nole - The 598,170 Net unecalized loss on MEM bonds (1/1/23) in the partial trial balance above relates to this item and, of course, is stated net of income texes. 4. One of the revenue contracts Flisabeth entered into during 2023 requires closer inspection. In October 2023, Elisabeth agreed to deliver a sizable order of fabrics to a customer over the next few months. The customer paid the full contract price of \$126,930 in advance oa the October 16, 2023 contract date. Elisabeth recorded the collection in advance as sales revenue. The company has determined the following performance obligations and standalone values for this coatract: Elisabeth completed delivery of Performance Obligation =1 during December 2023, and it expects to complete delivery of Performance Obligation =2 in Fetruary 2024. Consider any adjustment needed to the existing Sales Revenoe balance in the presentation of this account in the company's 2023 financial statements. 5. In January 2023, Elicabeth shifod its business strategy, resulting in the September 2023 sale of a componeat of the company considered a separate major line of business. The sale produced a gain on disponal of $159,360. The operntions of the component, prior to the sale is September, produced a loss of $82,510. 6. Ia preparing its 2023 financial statements, Elisabeth determined that it must write down certain of its patent assets by $46,980 7. The year-end Common Stock and Addrtional Paid-in Capisal balances in the partial trial balance above include the effects of a stock issuance by Elissbeth during 2023. Elisabeth's issunce of common shares in April 2023 added $19,000 to the Common Siock account and $124,000 to the Additional Paid-in Capital account. 8. In July 2023, a severe storm and flooding caused significant damage to a company warehouse and the inventory it was storing. Elisabeth suffered a loss, fet of insurance proceeds, of \$61,080. Elisabeth had not experienced any damage from weather-related events ith the past. Assume the above amounts are material. Also, assume the income tax rate applicable to all iacome items is 30%. Finally, note that Elisabeth uses the multiple-sicp format for the reporting of net income items and the one-income statement approach for the display of other comprehensive income items: - Instructions - Prepare the finascial statements for the year ended Decenber 31,2023 to show the proper reporting of Elisabeth's: (a) incorre and 12.0 2 (b) changes in stockholders' equity, 3,0 Prepare these statemeats in good form, according to GAAP requirements. Refer to models of the financial statements in the textbook (pages 3-1 to 3-21), the practice problems and the class notes and examples. Pease observe the following checklist of instructions as you complete this assignment: Prepare your solutions for parts (a) and (b) using Excel. Show how you denved the amounts you present that were not given in the problem. Round all dollar amouns you present in your finaneial statements to the nearest dollar, Give careful attention to your formatting of infonmation. Formatting includes effective presentation of information, correct spelling and capitalization, and proper wec of dollar signs, commas, asd underscoring. Refer to examples in the text for guidanoe. This assignment is an individul one. The puper you submit for griding should reflect your own thoughts and insights. You are free, though, to discuss the assignment with your clasemates. In this context, discacer means verbal communication only. Any capturing or sharisg of information in any format (Writtes, electronic, recorded, etc) is a violation of the ASU Academic Integrity Code. Inclode the followisg identifying information in the upper left corner of the first sheet in