Answered step by step

Verified Expert Solution

Question

1 Approved Answer

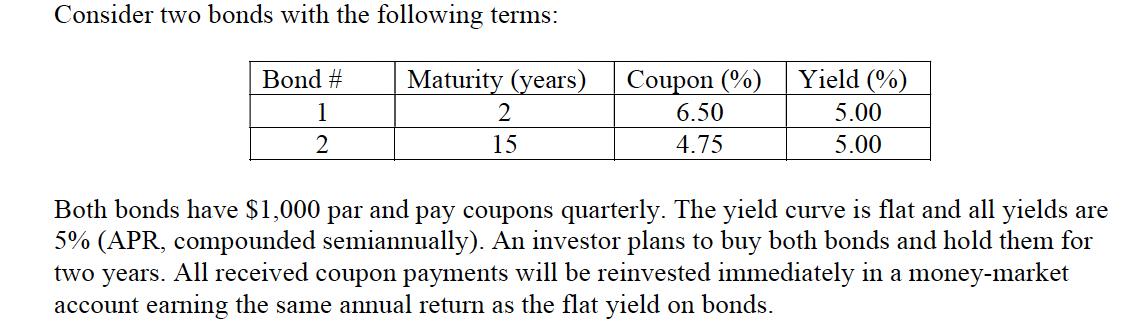

Consider two bonds with the following terms: Bond # Maturity (years) 1 2 2 15 Coupon (%) 6.50 4.75 Yield (%) 5.00 5.00 Both

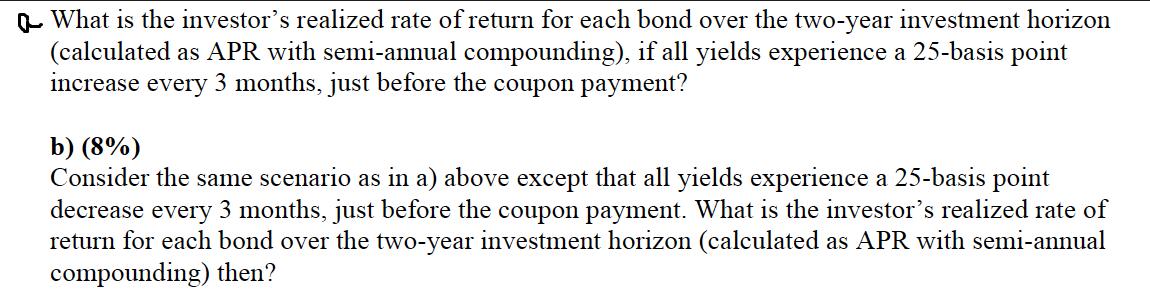

Consider two bonds with the following terms: Bond # Maturity (years) 1 2 2 15 Coupon (%) 6.50 4.75 Yield (%) 5.00 5.00 Both bonds have $1,000 par and pay coupons quarterly. The yield curve is flat and all yields are 5% (APR, compounded semiannually). An investor plans to buy both bonds and hold them for two years. All received coupon payments will be reinvested immediately in a money-market account earning the same annual return as the flat yield on bonds. What is the investor's realized rate of return for each bond over the two-year investment horizon (calculated as APR with semi-annual compounding), if all yields experience a 25-basis point increase every 3 months, just before the coupon payment? b) (8%) Consider the same scenario as in a) above except that all yields experience a 25-basis point decrease every 3 months, just before the coupon payment. What is the investor's realized rate of return for each bond over the two-year investment horizon (calculated as APR with semi-annual compounding) then?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started