Question

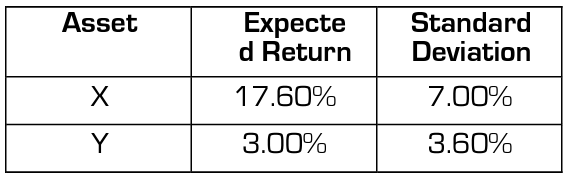

Consider two financial assets, X and Y, traded isolated or as part of a portfolio. All investors take decisions according to mean-variance analysis. Historic return

Consider two financial assets, X and Y, traded isolated or as part of a portfolio.

All investors take decisions according to mean-variance analysis. Historic return information is available at no cost for everybody. The following estimates are computed with that information.

a) What will be the expected return and risk (standard deviation) of the global minimum variance two-asset portfolio if the linear correlation is perfectly negative?

b) What will be the expected return and risk (standard deviation) of the global minimum variance two-asset portfolio if the linear correlation is -0.5?

c) What will be the expected return and risk (standard deviation) of the global minimum variance two-asset portfolio if the linear correlation is perfectly positive?

d) Design a portfolio for an investor who would like to obtain an expected return of 12%. What is its risk (standard deviation) if pXY = -1, pXY = -0.5 and pXY = 1? Which case is best?

e) Draw an expected return-standard deviation diagram indicating single assets and portfolios.

f) If E(R)=12%, for which value of XY is the portfolio risk (standard deviation) equal to the weighted average of the risk (standard deviation) of the single assets?

g) If an investor would like to assume a risk (standard deviation) of 4%, design a portfolio if pXY = -1, pXY = - 0.5 and pXY = 1. Which case is best?

\begin{tabular}{|c|c|c|} \hline Asset & ExpectedReturn & StandardDeviation \\ \hline X & 17.60% & 7.00% \\ \hline Y & 3.00% & 3.60% \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started