Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider two firms A and B. Firm B supplies an input to firm A at price p, and firm A uses the input to

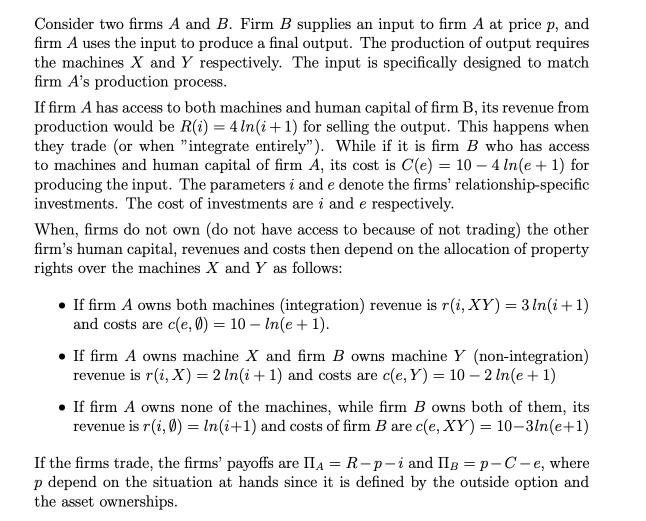

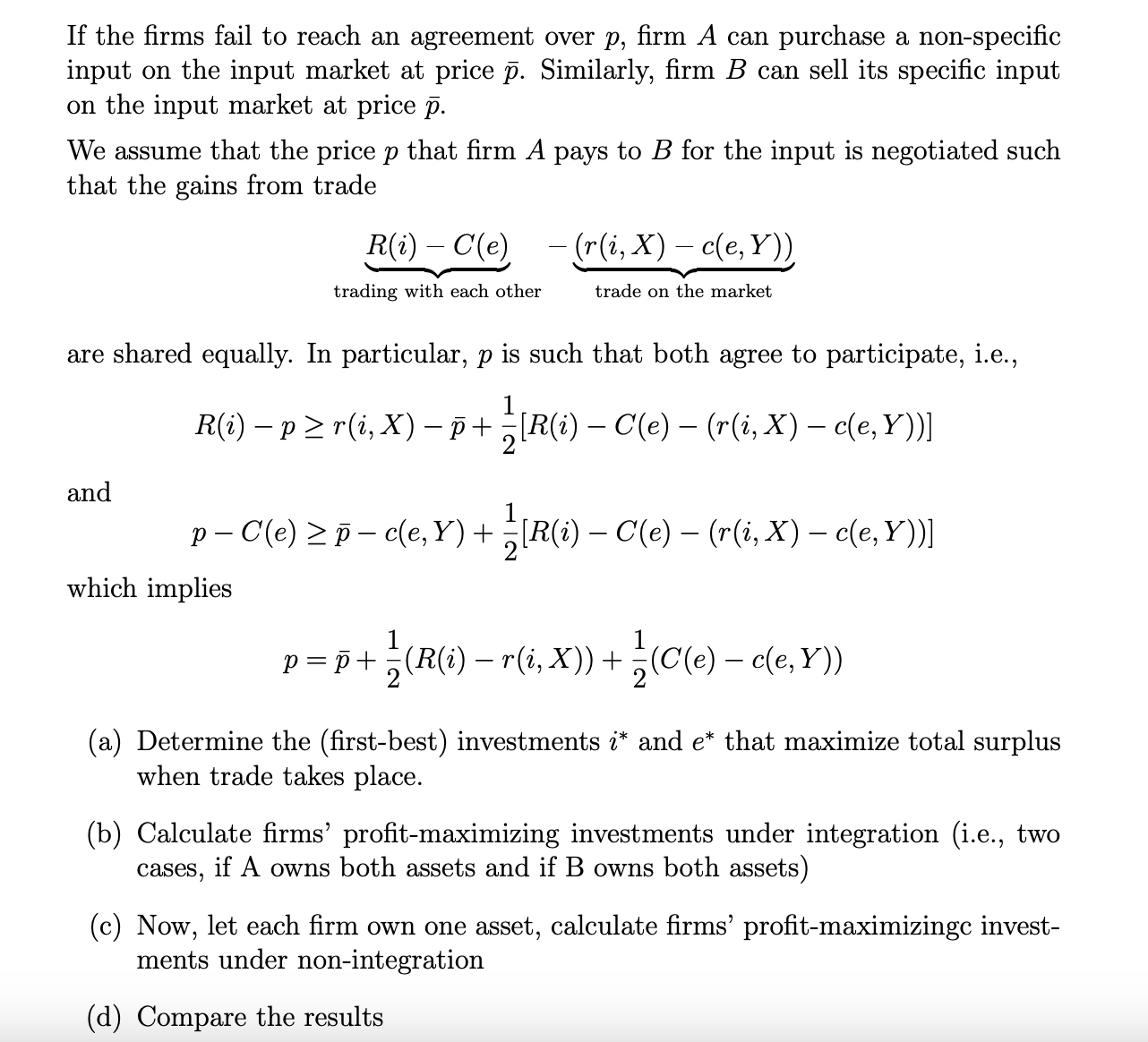

Consider two firms A and B. Firm B supplies an input to firm A at price p, and firm A uses the input to produce a final output. The production of output requires the machines X and Y respectively. The input is specifically designed to match firm A's production process. If firm A has access to both machines and human capital of firm B, its revenue from production would be R(i) = 4 ln(i+1) for selling the output. This happens when they trade (or when "integrate entirely"). While if it is firm B who has access to machines and human capital of firm A, its cost is C(e) = 10 - 4 In(e+1) for producing the input. The parameters i and e denote the firms' relationship-specific investments. The cost of investments are i and e respectively. When, firms do not own (do not have access to because of not trading) the other firm's human capital, revenues and costs then depend on the allocation of property rights over the machines X and Y as follows: If firm A owns both machines (integration) revenue is r(i, XY) = 3 ln(i+1) and costs are c(e, 0) = 10 - In(e + 1). If firm A owns machine X and firm B owns machine Y (non-integration) revenue is r(i, X) = 2 In(i+1) and costs are c(e, Y) = 10 - 2 In(e + 1) If firm A owns none of the machines, while firm B owns both of them, its revenue is r(1,0) = In(i+1) and costs of firm B are c(e, XY) = 10-3ln(e+1) If the firms trade, the firms' payoffs are IIA = R-p-i and IIg = p-C-e, where p depend on the situation at hands since it is defined by the outside option and the asset ownerships. If the firms fail to reach an agreement over p, firm A can purchase a non-specific input on the input market at price p. Similarly, firm B can sell its specific input on the input market at price p. We assume that the price p that firm A pays to B for the input is negotiated such that the gains from trade are shared equally. In particular, p is such that both agree to participate, i.e., R(i) p r(i, X) p + [R(i) C(e) (r(i, X) c(e, Y))] and R(i) - C(e) - (r(i, X) c(e, Y)) trading with each other trade on the market p C(e) c(e, Y) + [R(i) C(e) (r(i, X) c(e, Y))] - which implies p=+ (R(i) r(i, X)) + (C(e) c(e, Y)) (a) Determine the (first-best) investments i* and e* that maximize total surplus when trade takes place. (b) Calculate firms' profit-maximizing investments under integration (i.e., two cases, if A owns both assets and if B owns both assets) (c) Now, let each firm own one asset, calculate firms' profit-maximizingc invest- ments under non-integration (d) Compare the results

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the firstbest investments and profitmaximizing investments under different scenarios we need to maximize the total surplus or firms profits Lets calculate the investments for each case a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started