Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider two investors, A and B, trading the stock. Each investor solves the mean-variance optimization problem: xE[Re]212x2, where x is the position in stock measured

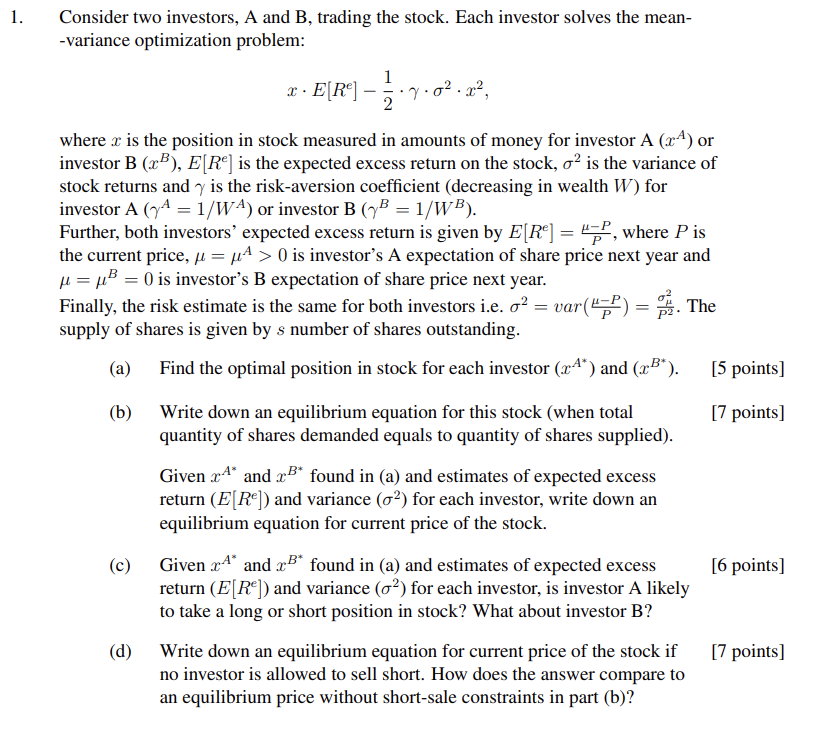

Consider two investors, A and B, trading the stock. Each investor solves the mean-variance optimization problem: xE[Re]212x2, where x is the position in stock measured in amounts of money for investor A(xA) or investor B(xB),E[Re] is the expected excess return on the stock, 2 is the variance of stock returns and is the risk-aversion coefficient (decreasing in wealth W ) for investor A(A=1/WA) or investor B(B=1/WB). Further, both investors' expected excess return is given by E[Re]=PP, where P is the current price, =A>0 is investor's A expectation of share price next year and =B=0 is investor's B expectation of share price next year. Finally, the risk estimate is the same for both investors i.e. 2=var(PP)=P22. The supply of shares is given by s number of shares outstanding. (a) Find the optimal position in stock for each investor (xA) and (xB). (b) Write down an equilibrium equation for this stock (when total quantity of shares demanded equals to quantity of shares supplied). Given xA and xB found in (a) and estimates of expected excess return (E[Re]) and variance (2) for each investor, write down an equilibrium equation for current price of the stock. (c) Given xA and xB found in (a) and estimates of expected excess return (E[Re]) and variance (2) for each investor, is investor A likely to take a long or short position in stock? What about investor B? (d) Write down an equilibrium equation for current price of the stock if no investor is allowed to sell short. How does the answer compare to an equilibrium price without short-sale constraints in part (b)

Consider two investors, A and B, trading the stock. Each investor solves the mean-variance optimization problem: xE[Re]212x2, where x is the position in stock measured in amounts of money for investor A(xA) or investor B(xB),E[Re] is the expected excess return on the stock, 2 is the variance of stock returns and is the risk-aversion coefficient (decreasing in wealth W ) for investor A(A=1/WA) or investor B(B=1/WB). Further, both investors' expected excess return is given by E[Re]=PP, where P is the current price, =A>0 is investor's A expectation of share price next year and =B=0 is investor's B expectation of share price next year. Finally, the risk estimate is the same for both investors i.e. 2=var(PP)=P22. The supply of shares is given by s number of shares outstanding. (a) Find the optimal position in stock for each investor (xA) and (xB). (b) Write down an equilibrium equation for this stock (when total quantity of shares demanded equals to quantity of shares supplied). Given xA and xB found in (a) and estimates of expected excess return (E[Re]) and variance (2) for each investor, write down an equilibrium equation for current price of the stock. (c) Given xA and xB found in (a) and estimates of expected excess return (E[Re]) and variance (2) for each investor, is investor A likely to take a long or short position in stock? What about investor B? (d) Write down an equilibrium equation for current price of the stock if no investor is allowed to sell short. How does the answer compare to an equilibrium price without short-sale constraints in part (b) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started