Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider your clients' retirement accounts . a. Looking only at their retirement saving and investment accounts, determine their current general asset allocation between stocks, bonds,

Consider your clients' retirement accounts .

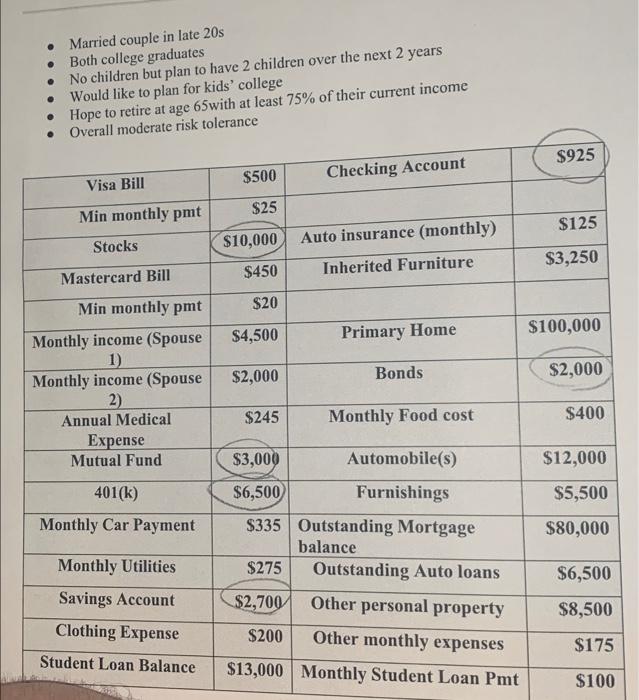

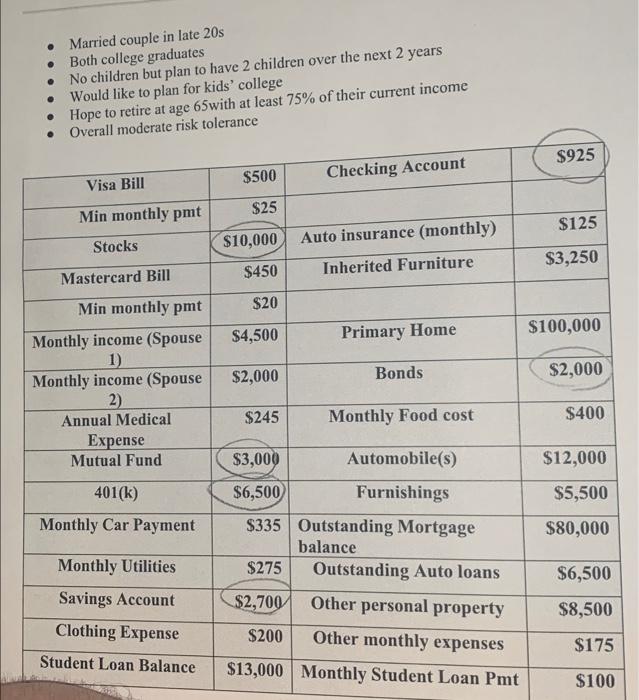

. Married couple in late 20s Both college graduates No children but plan to have 2 children over the next 2 years 2. Would like to plan for kids' college Hope to retire at age 65with at least 75% of their current income Overall moderate risk tolerance . . $925 $500 Checking Account Visa Bill $25 Min monthly pmt Stocks $125 $10,000 $450 Auto insurance (monthly) Inherited Furniture $3,250 Mastercard Bill $20 $100,000 $4,500 Primary Home $2,000 Bonds Min monthly pmt Monthly income (Spouse 1) Monthly income (Spouse 2) Annual Medical Expense Mutual Fund $2,000 $245 Monthly Food cost $400 $12,000 $5,500 401(k) Monthly Car Payment $80,000 Monthly Utilities $3,000 Automobile(s) $6,500 Furnishings $335 Outstanding Mortgage balance $275 Outstanding Auto loans $2,700 Other personal property $200 Other monthly expenses $13,000 Monthly Student Loan Pmt $6,500 Savings Account Clothing Expense $8,500 $175 Student Loan Balance $100 . Married couple in late 20s Both college graduates No children but plan to have 2 children over the next 2 years 2. Would like to plan for kids' college Hope to retire at age 65with at least 75% of their current income Overall moderate risk tolerance . . $925 $500 Checking Account Visa Bill $25 Min monthly pmt Stocks $125 $10,000 $450 Auto insurance (monthly) Inherited Furniture $3,250 Mastercard Bill $20 $100,000 $4,500 Primary Home $2,000 Bonds Min monthly pmt Monthly income (Spouse 1) Monthly income (Spouse 2) Annual Medical Expense Mutual Fund $2,000 $245 Monthly Food cost $400 $12,000 $5,500 401(k) Monthly Car Payment $80,000 Monthly Utilities $3,000 Automobile(s) $6,500 Furnishings $335 Outstanding Mortgage balance $275 Outstanding Auto loans $2,700 Other personal property $200 Other monthly expenses $13,000 Monthly Student Loan Pmt $6,500 Savings Account Clothing Expense $8,500 $175 Student Loan Balance $100 a. Looking only at their retirement saving and investment accounts, determine their current general asset allocation between stocks, bonds, and cash.

b. Taking into account your client's risk, commnet on the allocation you determined in part (a) . do you believe it to be appropriate or would you recommend changes? What about their specific investment choices? would you recommend any specific investment options? Detail your recommmendations and indicate your reasons for them

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started