Answered step by step

Verified Expert Solution

Question

1 Approved Answer

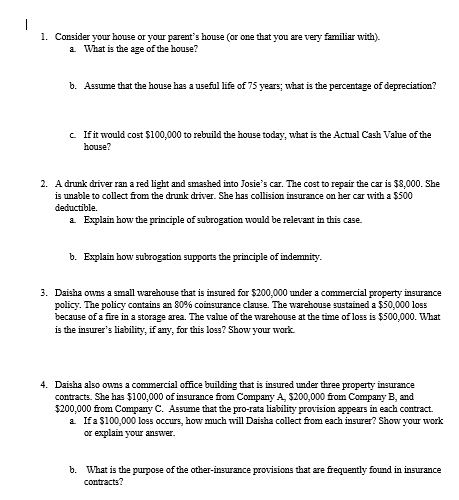

Consider your house or your parents house is 45 years old? Assume that the house has a useful life of 75 years; what is the

- Consider your house or your parents house is 45 years old?

- Assume that the house has a useful life of 75 years; what is the percentage of depreciation?

- If it would cost $100,000 to rebuild the house today, what is the Actual Cash Value of the house?

- A drunk driver ran a red light and smashed into Josies car. The cost to repair the car is $8,000. She is unable to collect from the drunk driver. She has collision insurance on her car with a $500 deductible.

- Explain how the principle of subrogation would be relevant in this case.

- Explain how subrogation supports the principle of indemnity.

- Daisha owns a small warehouse that is insured for $200,000 under a commercial property insurance policy. The policy contains an 80% coinsurance clause. The warehouse sustained a $50,000 loss because of a fire in a storage area. The value of the warehouse at the time of loss is $500,000. What is the insurers liability, if any, for this loss? Show your work.

- Daisha also owns a commercial office building that is insured under three property insurance contracts. She has $100,000 of insurance from Company A, $200,000 from Company B, and $200,000 from Company C. Assume that the pro-rata liability provision appears in each contract.

- If a $100,000 loss occurs, how much will Daisha collect from each insurer? Show your work or explain your answer.

- What is the purpose of the other-insurance provisions that are frequently found in insurance contracts?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started