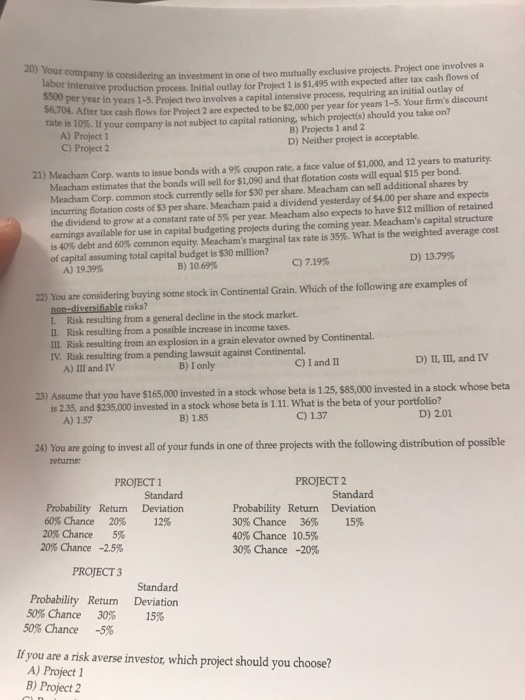

considering an investment in one of two mutually exclusive projects. Project one involves a ,495 with expected after tax cash flows of 20) Your company is in labor $500 $6,704. After tax rate is intensive production process. Initial outlay for Project 1 is $ per year ter tax cash flows for Project 2 are expected to be $2,000 per year for years 1-5. Your firm's discount 10% If your company is not subject to capital rationing, which project(s) should you take on? in years 1-5. Project two involves a capital intensive process, requiring an initial outlay of A) Project 1 C) Project 2 B)Projects 1 and 2 D) Neither project is acceptable. Meacham estimates that the bonds will sell for $1,090 and that flotation costs will equal $15 per bond. Meacham Corp. common stock currently sells for $30 per share. Meacham can sell additional shares by incurring flotation costs of $3 per share. Meacham paid a dividend yesterday of $4.00 per share and expects the dividend to grow at a constant rate of 5% per year. Meacham also expects to have $12 million of retained earnings available for use in capital budgeting projects during the coming year. Meacham's capital structure is40% debt and 60% common equity. Meacham's marginal tax rate is 35% what is the weighted average cost of capital assuming total capital budget is $30 million? 21) Meacham Corp. wants to issue bonds with a 9% coupon rate, a face value of $1,000, and 12 years to maturity. D) 13.79% C) 7.19% B) 10.69% A) 19.39% 22) You are considering buying some stock in Continental Grain. Which of the following are examples of L Risk resulting from a general decline in the stock market. L. Risk resulting from a possible increase in income taxes. IIL Risk resulting from an explosion in a grain elevator owned by Continental. IV. Risk resulting from a pending lawsuit against Continental. C) I and II D) II, III, and IV B) I only A) III and IV that you have $165,000 invested in a stock whose beta is 1.25, $85,000 invested in a stock whose beta is 2.35, and $235,000 invested in a stock whose beta is 1.1. What is the beta of your portfolio? B) 1.85 C) 1.37 D) 2.01 A) 157 24) You are going to invest all of your funds in one of three projects with the following distribution of possible retuns PROJECT1 PROJECT 2 Standard Deviation 12% Standard Deviation 15% Probability Return 60% Chance 20% 20% Chance 5% -25% Probability Return 30% Chance 36% 40%Chance 10.5% 30%Chance -20% 20%Chance PROJECT 3 Probability Return 50% Chance 50% Chance 30% -5% Deviation 15% If you are a risk averse investor, which project should you choose? A) Project 1 B) Project 2