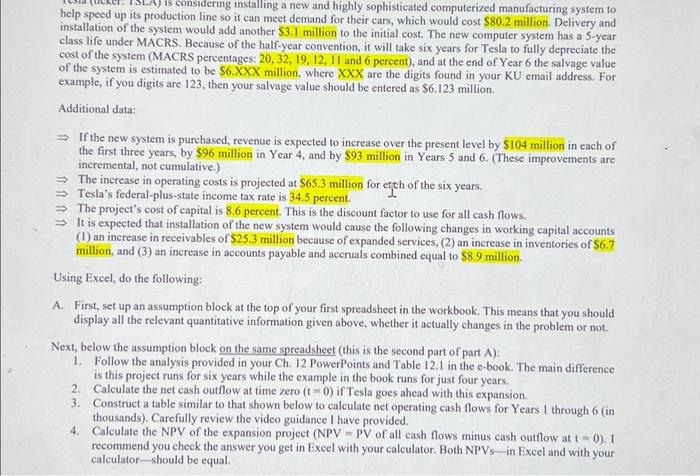

considering installing a new and highly sophisticated computerized manufacturing system to help speed up its production line so it can meet demand for their cars, which would cost $80.2 million. Delivery and installation of the system would add another $3.1 million to the initial cost. The new computer system has a 5-year class life under MACRS. Because of the half-year convention, it will take six years for Tesla to fully depreciate the cost of the system (MACRS percentages: 20, 32, 19, 12, 11 and 6 percent), and at the end of Year 6 the salvage value of the system is estimated to be $6.XXX million, where XXX are the digits found in your KU email address. For example, if you digits are 123, then your salvage value should be entered as $6.123 million. Additional data: = If the new system is purchased, revenue is expected to increase over the present level by $104 million in each of the first three years, by $96 million in Year 4, and by $93 million in Years 5 and 6. (These improvements are incremental, not cumulative.) = The increase in operating costs is projected at 865.3 million for etch of the six years. = Tesla's federal-plus-state income tax rate is 34.5 percent The project's cost of capital is 8.6 percent. This is the discount factor to use for all cash flows. = It is expected that installation of the new system would cause the following changes in working capital accounts (1) an increase in receivables of $25.3 million because of expanded services, (2) an increase in inventories of $6.7 million, and (3) an increase in accounts payable and accruals combined equal to $8.9 million. Using Excel, do the following: A. First, set up an assumption block at the top of your first spreadsheet in the workbook. This means that you should display all the relevant quantitative information given above, whether it actually changes in the problem or not. Next, below the assumption block on the same spreadsheet (this is the second part of part A): 1. Follow the analysis provided in your Ch. 12 PowerPoints and Table 12.1 in the e-book. The main difference is this project runs for six years while the example in the book runs for just four years, 2. Calculate the net cash outflow at time zero ( 0) if Tesla goes ahead with this expansion 3. Construct a table similar to that shown below to calculate net operating cash flows for Years through 6 (in thousands). Carefully review the video guidance I have provided 4. Calculate the NPV of the expansion project (NPV - PV of all cash flows minus cash outflow at t = 0). 1 recommend you check the answer you get in Excel with your calculator. Both NPVs-in Excel and with your calculator-should be equal