Answered step by step

Verified Expert Solution

Question

1 Approved Answer

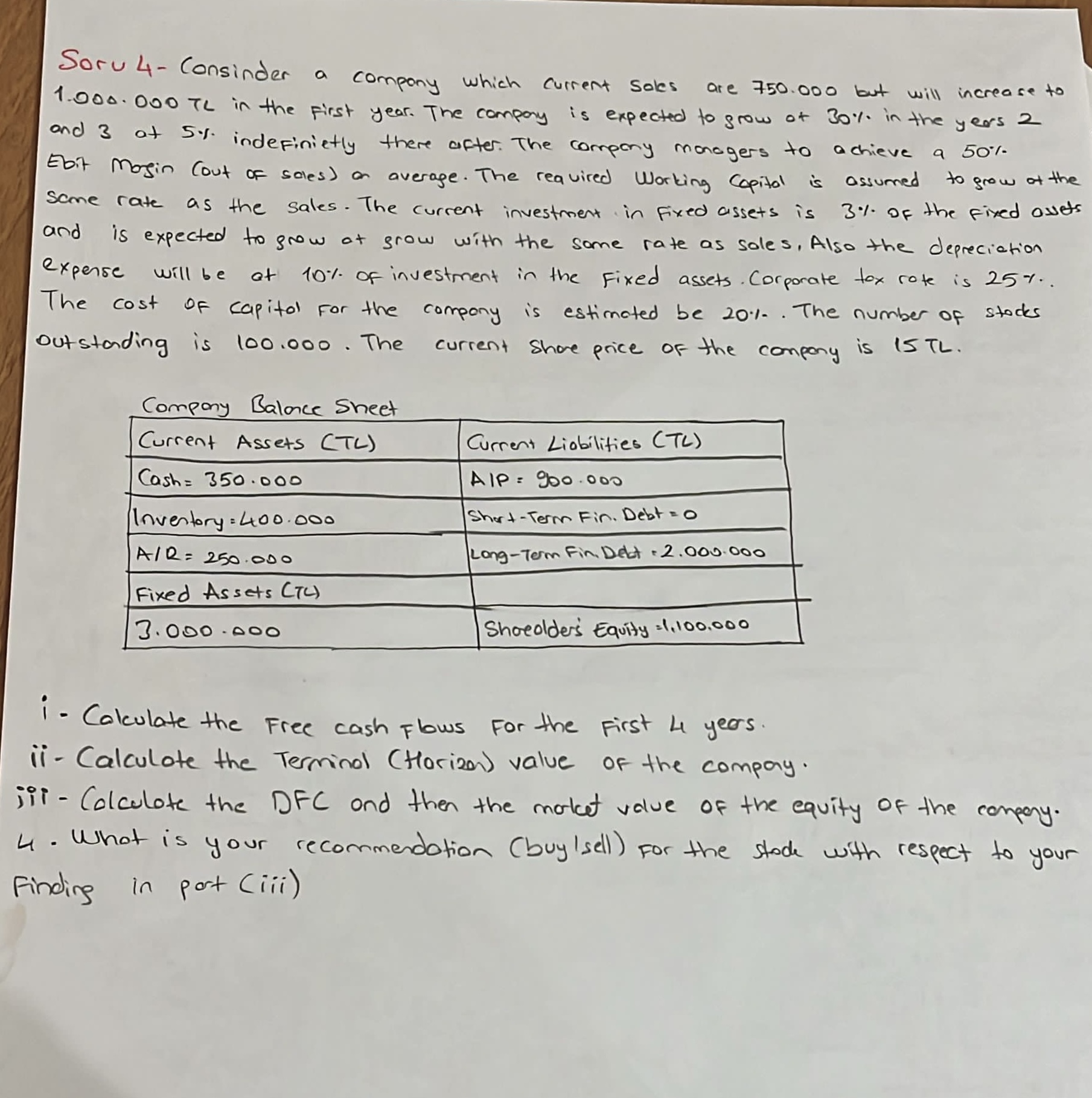

- Consinder a company which current sales are 7 5 0 . 0 0 0 but will increase to 1 . 0 0 0 .

Consinder a company which current sales are but will increase to

TL in the first year. The compary is expected to grow of in the years

and at indefinietly there after. The company managers to achieve a

Ebit mogin out of soles an average. The reavired Working Capital is assumed to grow at the

same rate as the sales. The current investment in fixed assets is of the fixed assets

and is expected to grow at grow with the same rate as sales. Also the depreciation

expense will be at of investment in the fixed assets. Corporate tox rote is

The cost of capital for the company is estimated be The number of stocks

outstading is The current share price of the compeny is

Company Balonce Sheet

i Calculate the Free cash flows for the first years.

ii Calculate the Terminal Horizon value of the compay.

iiiCalculate the DFC and then the moket value of the equity of the company

What is your recommendation buylsell for the stode with respect to your

Finding in port iii

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started