Answered step by step

Verified Expert Solution

Question

1 Approved Answer

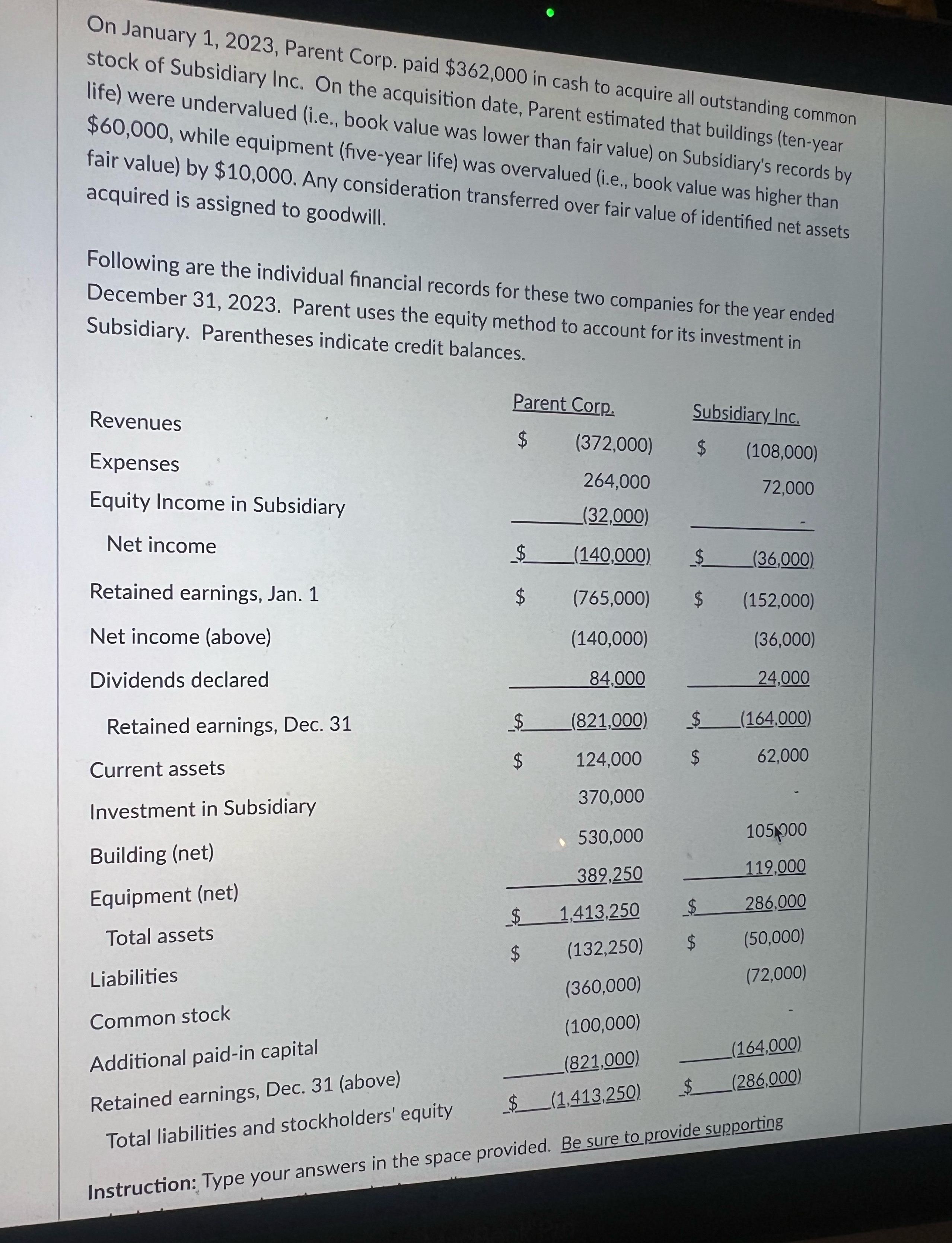

Consolidated balance for:Goodwill:Buildings:Equipment:Investment in Sub :Consolidated Net Income:Common Stock: On January 1, 2023, Parent Corp. paid $362,000 in cash to acquire all outstanding common stock

Consolidated balance for:Goodwill:Buildings:Equipment:Investment in Sub :Consolidated Net Income:Common Stock:

On January 1, 2023, Parent Corp. paid $362,000 in cash to acquire all outstanding common stock of Subsidiary Inc. On the acquisition date, Parent estimated that buildings (ten-year life) were undervalued (i.e., book value was lower than fair value) on Subsidiary's records by $60,000, while equipment (five-year life) was overvalued (i.e., book value was higher than fair value) by $10,000. Any consideration transferred over fair value of identified net assets acquired is assigned to goodwill. Following are the individual financial records for these two companies for the year ended December 31, 2023. Parent uses the equity method to account for its investment in Subsidiary. Parentheses indicate credit balances. Parent Corp. Revenues Subsidiary Inc. SA $ (372,000) $ Expenses (108,000) Equity Income in Subsidiary 264,000 (32,000) 72,000 Net income $ (140,000) $ (36,000) Retained earnings, Jan. 1 Net income (above) Dividends declared Retained earnings, Dec. 31 $ (765,000) $ (152,000) (140,000) (36,000) 84,000 24,000 $ (821,000) $ (164,000) Current assets $ 124,000 $ SA 62,000 Investment in Subsidiary Building (net) Equipment (net) 370,000 530,000 105,000 389,250 119,000 $ 1,413,250 $ 286,000 Total assets 59 (132,250) tA (50,000) Liabilities (72,000) (360,000) Common stock Additional paid-in capital (100,000) Retained earnings, Dec. 31 (above) (821,000) (164,000) Total liabilities and stockholders' equity $ (1,413,250) $ (286,000) Instruction: Type your answers in the space provided. Be sure to provide supporting

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started