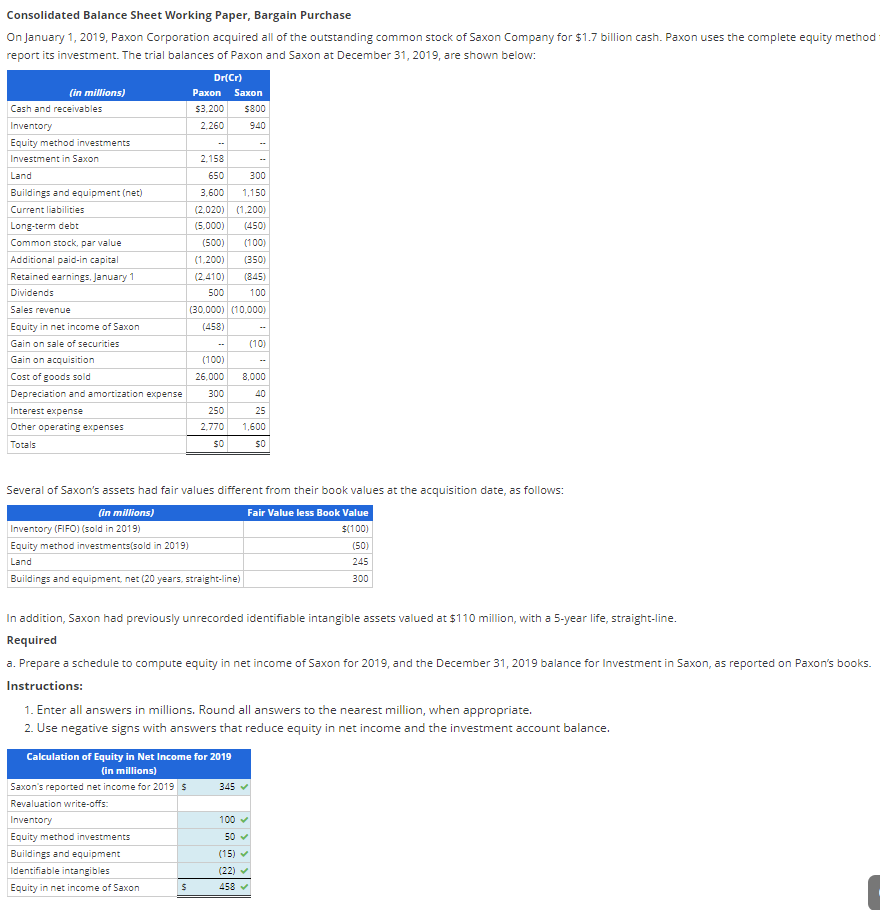

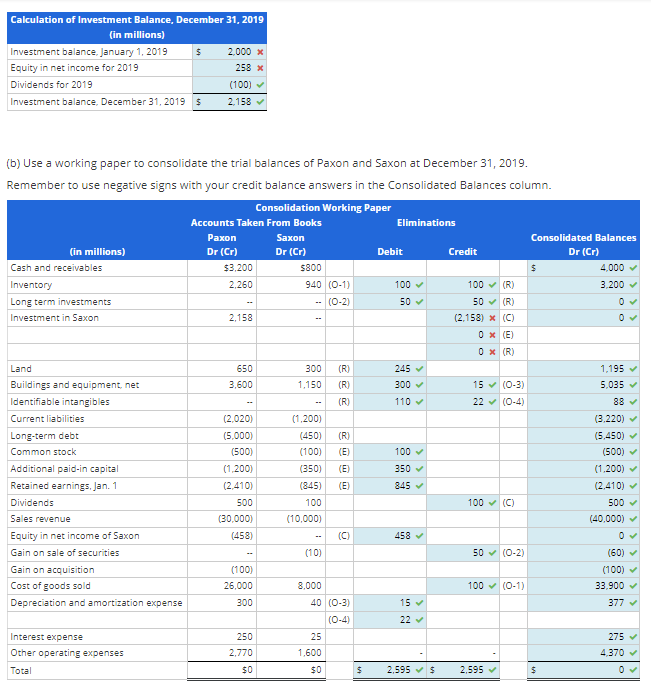

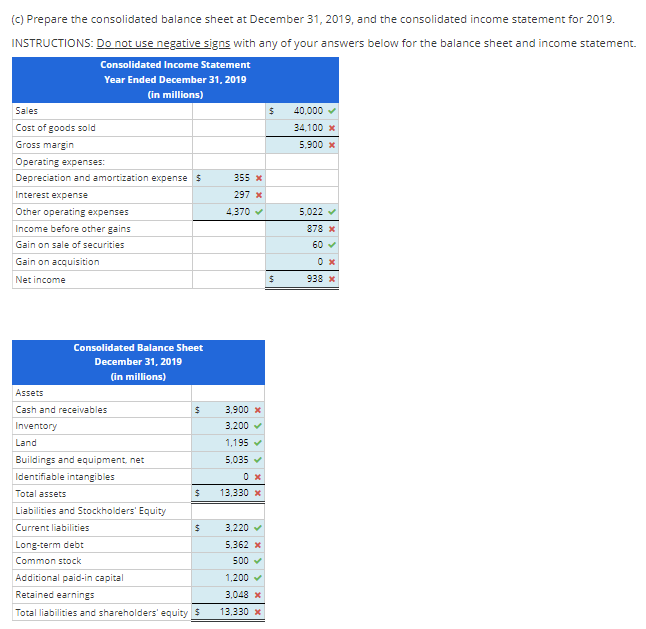

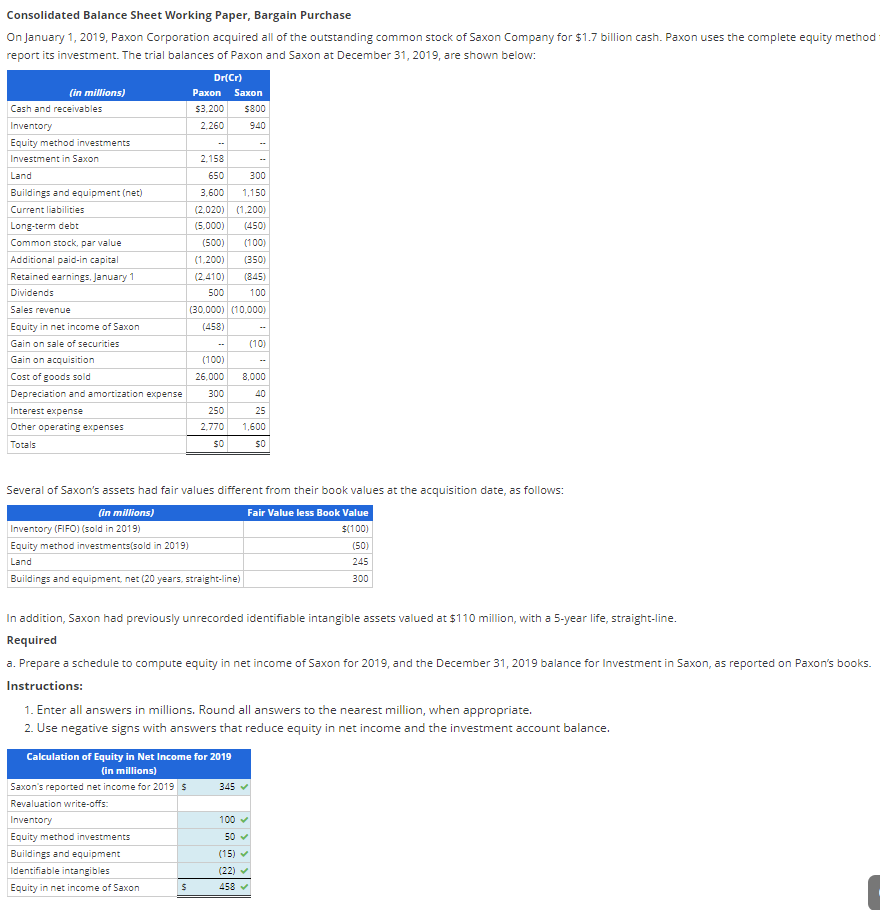

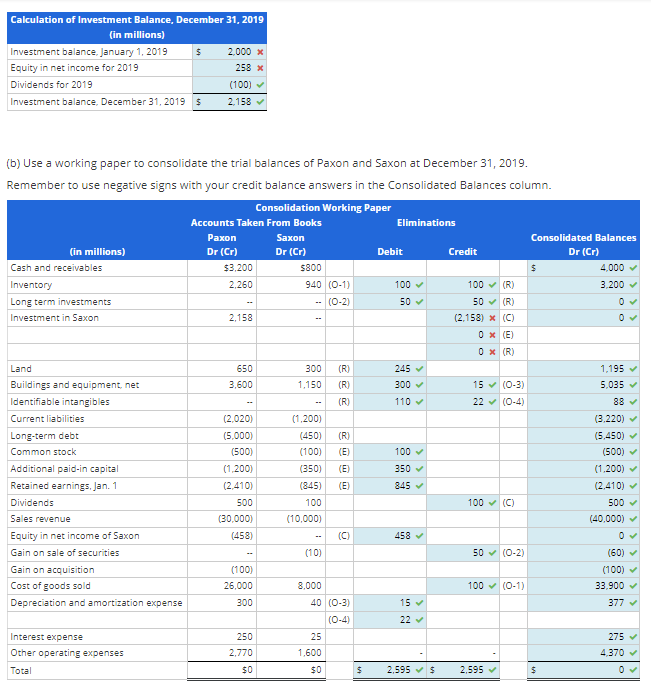

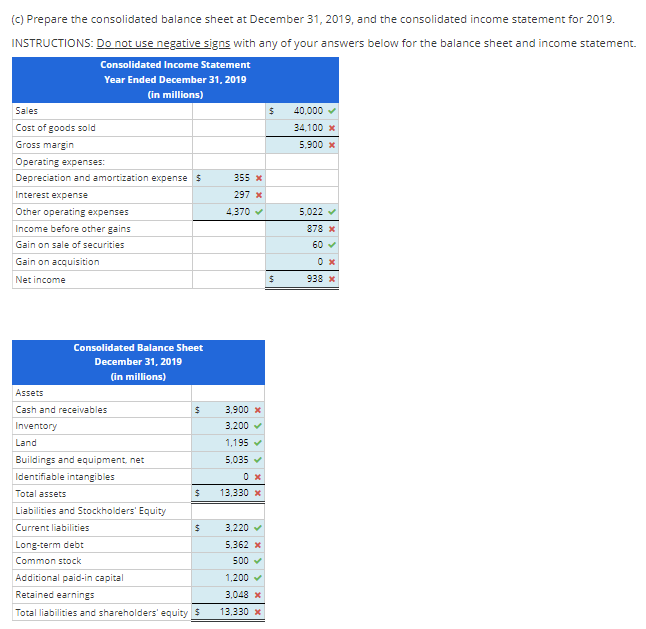

Consolidated Balance Sheet Working Paper, Bargain Purchase On January 1, 2019, Paxon Corporation acquired all of the outstanding common stock of Saxon Company for $1.7 billion cash. Paxon uses the complete equity method report its investment. The trial balances of Paxon and Saxon at December 31, 2019, are shown below: Dr(Cr) (in millions) Cash and receivables Inventory Equity method investments Paxon Saxon 53.200 5800 2.260 940 Investment in Saxon Land Buildings and equipment (net) Current liabilities Long-term debt Common stock, par value Additional paid-in capital Retained earnings, January 1 Dividends Sales revenue Equity in net income of Saxon Gain on sale of securities Gain on acquisition Cost of goods sold Depreciation and amortization expense Interest expense Other operating expenses Totals 2,158 650 300 3,600 1.150 (2,020) (1,200) (5,000) (450) (500) (100) (1,200) (350) (2,410) (845) 500 100 (30.000) (10,000) (458) (10) (100) 26,000 8,000 8: 300 40 250 2.770 25 1,600 SO SO Several of Saxon's assets had fair values different from their book values at the acquisition date, as follows: (in millions) Fair Value less Book Value Inventory (FIFO) (sold in 2019) $(100) Equity method investments(sold in 2019) (50) Land 245 Buildings and equipment, net 20 years, straight-line) 300 In addition, Saxon had previously unrecorded identifiable intangible assets valued at $110 million, with a 5-year life, straight-line. Required a. Prepare a schedule to compute equity in net income of Saxon for 2019, and the December 31, 2019 balance for Investment in Saxon, as reported on Paxon's books. Instructions: 1. Enter all answers in millions. Round all answers to the nearest million, when appropriate. 2. Use negative signs with answers that reduce equity in net income and the investment account balance. Calculation of Equity in Net Income for 2019 (in millions) Saxon's reported net income for 2019 $ 345 Revaluation write-offs: Inventory Equity method investments Buildings and equipment (15) Identifiable intangibles (22) Equity in net income of Saxon 100 50 s 458 $ Calculation of Investment Balance, December 31, 2019 (in millions) Investment balance, January 1, 2019 2.000 x Equity in net income for 2019 258 x Dividends for 2019 (100) Investment balance December 31, 2019 $ 2.158 (b) Use a working paper to consolidate the trial balances of Paxon and Saxon at December 31, 2019. Remember to use negative signs with your credit balance answers in the Consolidated Balances column. Consolidation Working Paper Accounts Taken From Books Eliminations Paxon Saxon Consolidated Balances (in millions) Dr (Cr) Dr (Cr) Dr (Cr) Debit Credit Cash and receivables $ $3,200 2.260 4.000 3,200 Inventory Long term investments Investment in Saxon 5800 940 (0-1) (0-2) 100 50 100 (R) 50 (R) (2.158) X (C) 0X (E) 2,158 0 X (R) 300 650 3,600 1.150 (R) 245 300 110 15 (0-3) 22 (0-4) 1,195 5,035 88 (R) (1,200) (450 (100) (E) 100 (E) Land Buildings and equipment, net Identifiable intangibles Current liabilities Long-term debt Common stock Additional paid-in capital Retained earnings, Jan. 1 Dividends Sales revenue Equity in net income of Saxon Gain on sale of securities Gain on acquisition Cost of goods sold Depreciation and amortization expense (2.020) (5,000) (500) (1.200) (2.410) 500 (30,000) (458) 350 845 (350) (845) 100 (10.000) (3.220) (5,450) (500) (1.200) (2,410) 500 (40.000) 100 (C) (C) 458 (10) 50 (0-2) (100) 26,000 300 (60) (100) 33.900 100 (0-1) 8.000 40 (0-3) (0-4) 377 15 22 Interest expense Other operating expenses Total 250 2.770 $0 25 1,600 $0 275 4.370 $ 2.595 $ 2,595 $ $ (c) Prepare the consolidated balance sheet at December 31, 2019, and the consolidated income statement for 2019. INSTRUCTIONS: Do not use negative signs with any of your answers below for the balance sheet and income statement. Consolidated Income Statement Year Ended December 31, 2019 (in millions) Sales 40,000 Cost of goods sold 34,100 x Gross margin 5.900 x Operating expenses: Depreciation and amortization expense $ 355 x Interest expense 297 x Other operating expenses 4 370 5,022 Income before other gains 878 x Gain on sale of securities 60 Gain on acquisition Ox $ Net income 938 x 3.900 X 3.200 1,195 5,035 Consolidated Balance Sheet December 31, 2019 (in millions) Assets Cash and receivables $ Inventory Land Buildings and equipment, net Identifiable intangibles Total assets $ Liabilities and Stockholders' Equity Current liabilities Long-term debt Common stock Additional paid-in capital Retained earnings Total liabilities and shareholders' equity $ OX 13,330 x 3,220 5.362 x 500 1,200 3.048 x 13.330 X