Answered step by step

Verified Expert Solution

Question

1 Approved Answer

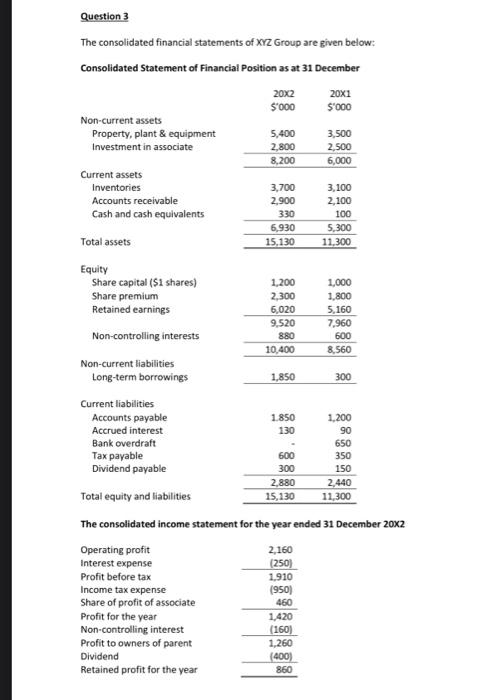

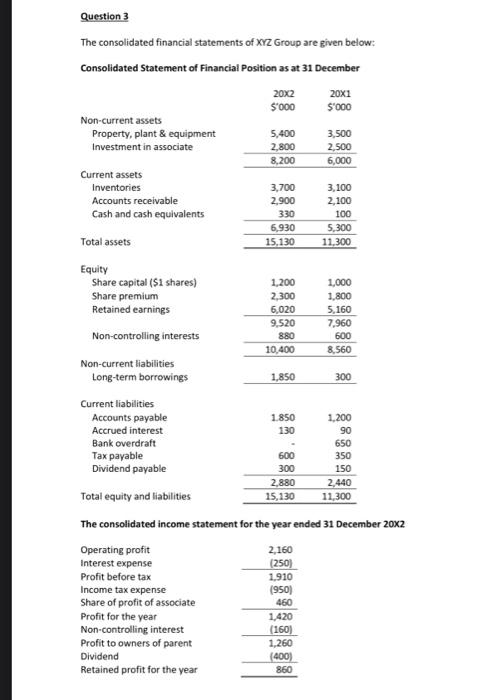

Consolidated cash flow statement Question 3 Question 3 The consolidated financial statements of XYZ Group are given below: The consolidated income statement for the year

Consolidated cash flow statement

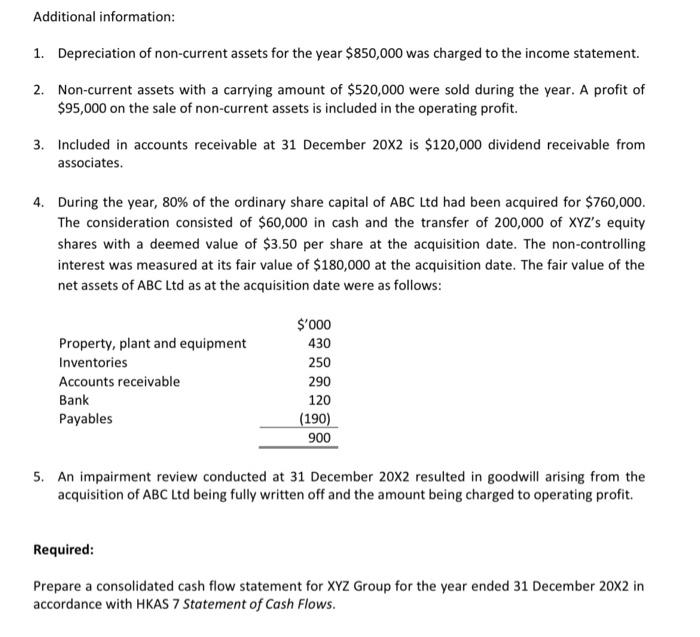

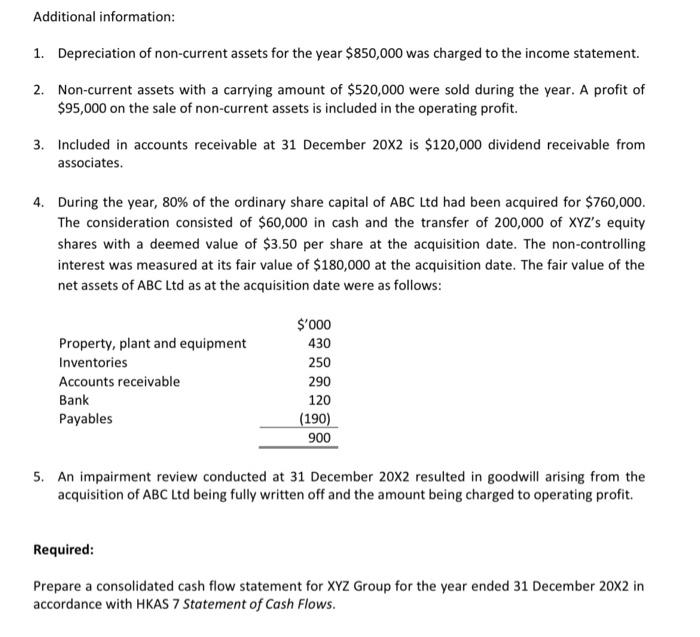

Question 3 The consolidated financial statements of XYZ Group are given below: The consolidated income statement for the year ended 31 December 202 Additional information: 1. Depreciation of non-current assets for the year $850,000 was charged to the income statement. 2. Non-current assets with a carrying amount of $520,000 were sold during the year. A profit of $95,000 on the sale of non-current assets is included in the operating profit. 3. Included in accounts receivable at 31 December 202 is $120,000 dividend receivable from associates. 4. During the year, 80% of the ordinary share capital of ABC Ltd had been acquired for $760,000. The consideration consisted of $60,000 in cash and the transfer of 200,000 of XYZ's equity shares with a deemed value of $3.50 per share at the acquisition date. The non-controlling interest was measured at its fair value of $180,000 at the acquisition date. The fair value of the net assets of ABC Ltd as at the acquisition date were as follows: 5. An impairment review conducted at 31 December 202 resulted in goodwill arising from the acquisition of ABC Ltd being fully written off and the amount being charged to operating profit. Required: Prepare a consolidated cash flow statement for XYZ Group for the year ended 31 December 20X2 in accordance with HKAS 7 Statement of Cash Flows. Question 3 The consolidated financial statements of XYZ Group are given below: The consolidated income statement for the year ended 31 December 202 Additional information: 1. Depreciation of non-current assets for the year $850,000 was charged to the income statement. 2. Non-current assets with a carrying amount of $520,000 were sold during the year. A profit of $95,000 on the sale of non-current assets is included in the operating profit. 3. Included in accounts receivable at 31 December 202 is $120,000 dividend receivable from associates. 4. During the year, 80% of the ordinary share capital of ABC Ltd had been acquired for $760,000. The consideration consisted of $60,000 in cash and the transfer of 200,000 of XYZ's equity shares with a deemed value of $3.50 per share at the acquisition date. The non-controlling interest was measured at its fair value of $180,000 at the acquisition date. The fair value of the net assets of ABC Ltd as at the acquisition date were as follows: 5. An impairment review conducted at 31 December 202 resulted in goodwill arising from the acquisition of ABC Ltd being fully written off and the amount being charged to operating profit. Required: Prepare a consolidated cash flow statement for XYZ Group for the year ended 31 December 20X2 in accordance with HKAS 7 Statement of Cash Flows Question 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started