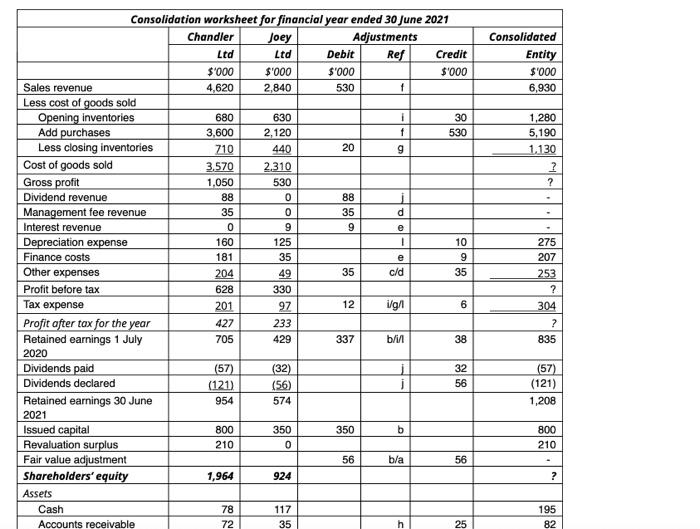

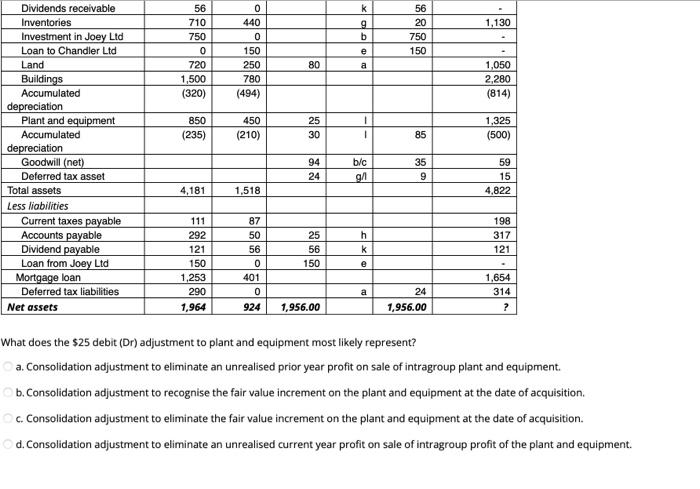

Consolidated Entity $'000 6,930 20 1,280 5,190 1.130 ? ? 0 Consolidation worksheet for financial year ended 30 June 2021 Chandler Joey Adjustments Ltd Ltd Debit Ref Credit $'000 $'000 $'000 $'000 Sales revenue 4,620 2,840 530 + Less cost of goods sold Opening inventories 680 630 1 30 Add purchases 3,600 2,120 1 530 Less closing inventories 710 440 g Cost of goods sold 3.570 2.310 Gross profit 1,050 530 Dividend revenue 88 88 i Management fee revenue 35 0 35 d Interest revenue 0 9 9 e Depreciation expense 160 125 1 10 Finance costs 181 35 e 9 Other expenses 204 49 35 c/d 35 Profit before tax 628 330 Tax expense 201 97 12 ig/1 6 Profit after tax for the year 427 233 Retained earnings 1 July 705 429 337 blir 38 2020 Dividends paid (57) (32) 32 Dividends declared (121) (56) 56 Retained earnings 30 June 954 574 2021 Issued capital 800 350 350 b Revaluation surplus 210 0 Fair value adjustment 56 b/a 56 Shareholders' equity 1,964 924 Assets Cash 78 117 Accounts receivable 72 35 h 25 275 207 253 ? 304 ? 835 (57) (121) 1,208 800 210 ? 195 82 k 9 b 1,130 56 710 750 0 720 1,500 (320) 0 440 0 150 250 780 (494) 56 20 750 150 e 80 a 1,050 2,280 (814) 850 450 (210) 25 30 ! 1 1,325 (500) (235) 85 Dividends receivable Inventories Investment in Joey Ltd Loan to Chandler Ltd Land Buildings Accumulated depreciation Plant and equipment Accumulated depreciation Goodwill (net) Deferred tax asset Total assets Less liabilities Current taxes payable Accounts payable Dividend payable Loan from Joey Ltd Mortgage loan Deferred tax liabilities Net assets 94 24 b/c g/ 35 9 59 15 4,822 4,181 1.518 h 198 317 121 111 292 121 150 1,253 290 1,964 25 56 150 k 87 50 56 0 401 0 e a 24 1,956.00 1,654 314 ? 924 1,956.00 What does the $25 debit (Dr) adjustment to plant and equipment most likely represent? a. Consolidation adjustment to eliminate an unrealised prior year profit on sale of intragroup plant and equipment. b. Consolidation adjustment to recognise the fair value increment on the plant and equipment at the date of acquisition c. Consolidation adjustment to eliminate the fair value increment on the plant and equipment at the date of acquisition. d. Consolidation adjustment to eliminate an unrealised current year profit on sale of intragroup profit of the plant and equipment