Answered step by step

Verified Expert Solution

Question

1 Approved Answer

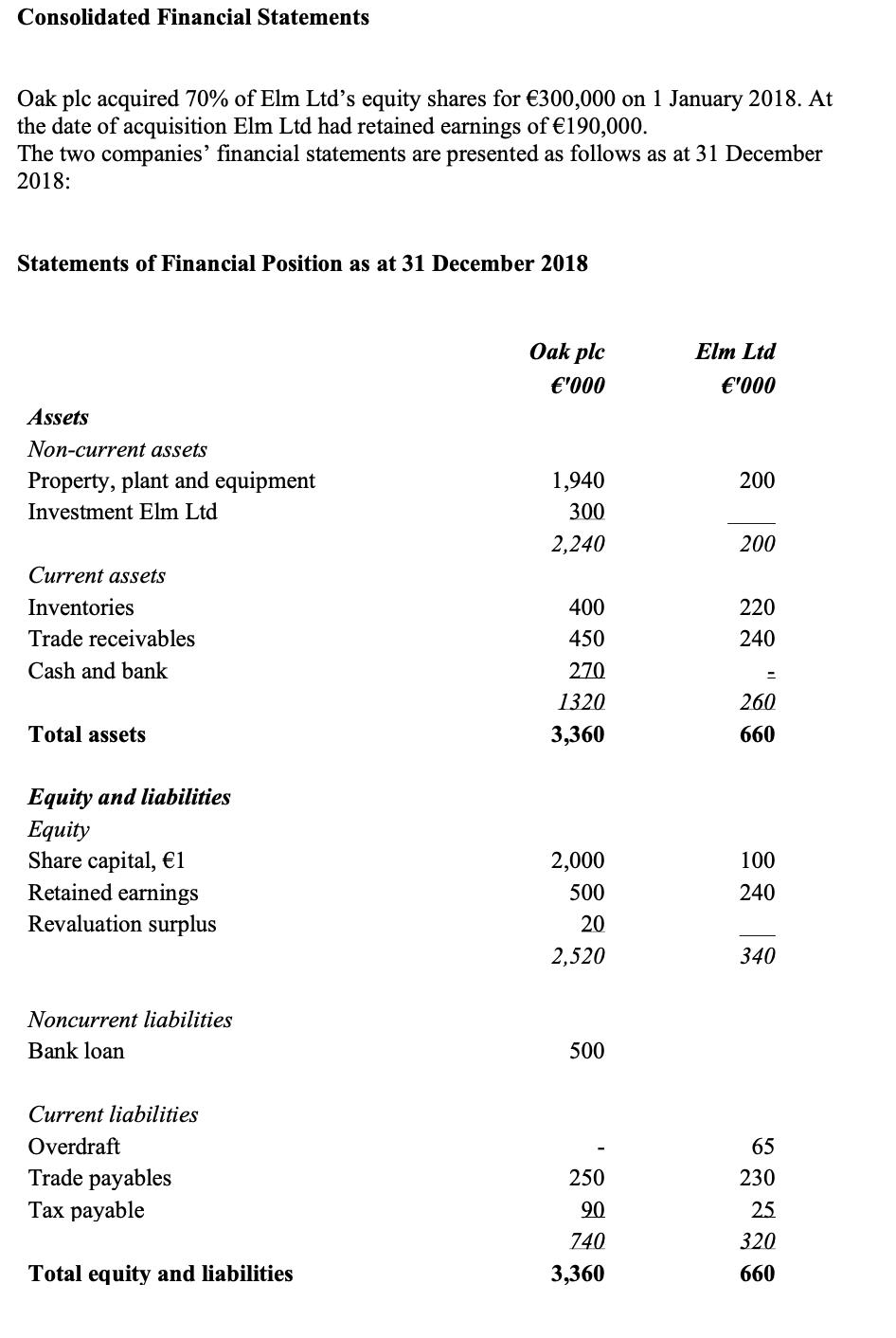

Consolidated Financial Statements Oak plc acquired 70% of Elm Ltd's equity shares for 300,000 on 1 January 2018. At the date of acquisition Elm

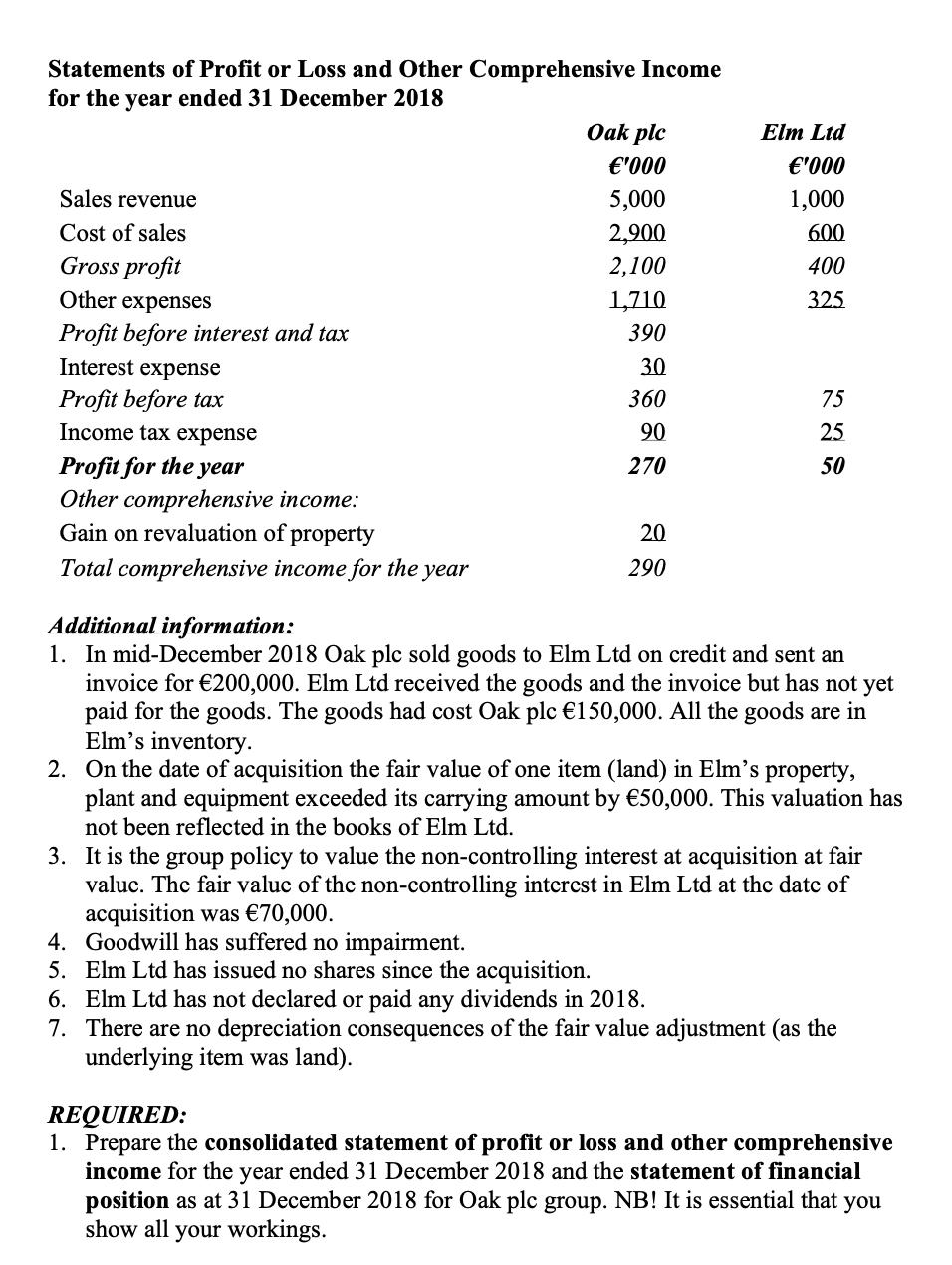

Consolidated Financial Statements Oak plc acquired 70% of Elm Ltd's equity shares for 300,000 on 1 January 2018. At the date of acquisition Elm Ltd had retained earnings of 190,000. The two companies' financial statements are presented as follows as at 31 December 2018: Statements of Financial Position as at 31 December 2018 Assets Non-current assets Property, plant and equipment Investment Elm Ltd Current assets Inventories Trade receivables Cash and bank Total assets Equity and liabilities Equity Share capital, 1 Retained earnings Revaluation surplus Noncurrent liabilities Bank loan Current liabilities Overdraft Trade payables Tax payable Total equity and liabilities Oak plc '000 1,940 300 2,240 400 450 270 1320 3,360 2,000 500 20 2,520 500 250 90 740 3,360 Elm Ltd '000 200 200 220 240 = 260 660 100 240 340 65 230 25 320 660 Statements of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2018 Sales revenue Cost of sales Gross profit Other expenses Profit before interest and tax Interest expense Profit before tax Income tax expense Profit for the year Other comprehensive income: Gain on revaluation of property Total comprehensive income for the year Oak plc '000 5,000 2,900 2,100 1,710 390 30 360 90 270 20 290 Elm Ltd '000 1,000 600 400 325 4. 5. 75 25 50 Additional information: 1. In mid-December 2018 Oak plc sold goods to Elm Ltd on credit and sent an invoice for 200,000. Elm Ltd received the goods and the invoice but has not yet paid for the goods. The goods had cost Oak plc 150,000. All the goods are in Elm's inventory. 2. On the date of acquisition the fair value of one item (land) in Elm's property, plant and equipment exceeded its carrying amount by 50,000. This valuation has not been reflected in the books of Elm Ltd. 3. It is the group policy to value the non-controlling interest at acquisition at fair value. The fair value of the non-controlling interest in Elm Ltd at the date of acquisition was 70,000. Goodwill has suffered no impairment. Elm Ltd has issued no shares since the acquisition. 6. Elm Ltd has not declared or paid any dividends in 2018. 7. There are no depreciation consequences of the fair value adjustment (as the underlying item was land). REQUIRED: 1. Prepare the consolidated statement of profit or loss and other comprehensive income for the year ended 31 December 2018 and the statement of financial position as at 31 December 2018 for Oak plc group. NB! It is essential that you show all your workings.

Step by Step Solution

★★★★★

3.37 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

First we pass elimination entries Property Plant and equipment Dr 50000 Share Capital Dr 100000 Reta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started