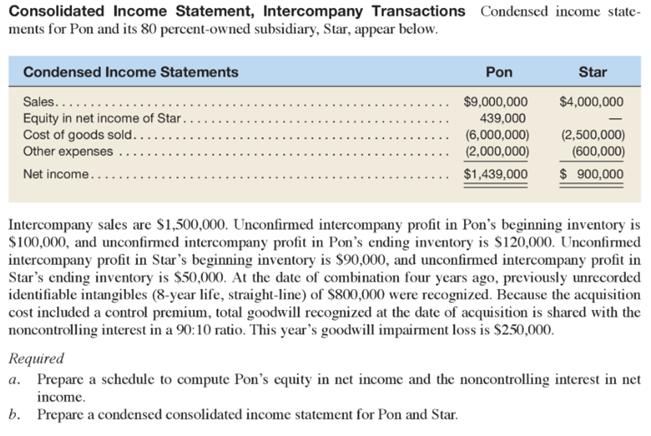

Consolidated Income Statement, Intercompany Transactions ments for Pon and its 80 percent-owned subsidiary, Star, appear below. Condensed income state- Condensed Income Statements Star Pon

Consolidated Income Statement, Intercompany Transactions ments for Pon and its 80 percent-owned subsidiary, Star, appear below. Condensed income state- Condensed Income Statements Star Pon $9,000,000 Sales.... Equity in net income of Star Cost of goods sold.... Other expenses. Net income... $4,000,000 439,000 (6,000,000) (2,000,000) (2,500,000) (600,000) $ 900,000 $1,439,000 Intercompany sales are $1,500,000. Unconfirmed intercompany profit in Pon's beginning inventory is $100,000, and unconfirmed intercompany profit in Pon's ending inventory is $120,000. Unconfirmed intercompany profit in Star's beginning inventory is $90,000, and unconfirmed intercompany profit in Star's ending inventory is $50,000. At the date of combination four years ago, previously unrecorded identifiable intangibles (8-year life, straight-line) of $800,000 were recognized. Because the acquisition cost included a control premium, total goodwill recognized at the date of acquisition is shared with the noncontrolling interest in a 90:10 ratio. This year's goodwill impairment loss is $250,000. Required a. Prepare a schedule to compute Pon's equity in net income and the noncontrolling interest in net income. b. Prepare a condensed consolidated income statement for Pon and Star.

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started