Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consolidated Pasta is currently expected to pay a dividend of $10 million in perpetuity. However, the president is proposing to pay a one-time bumper dividend

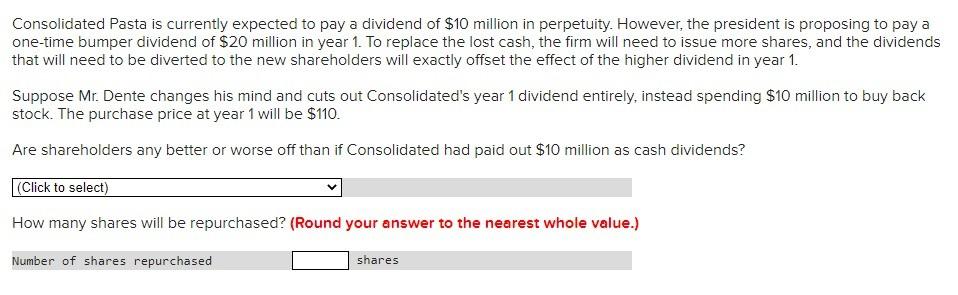

Consolidated Pasta is currently expected to pay a dividend of $10 million in perpetuity. However, the president is proposing to pay a one-time bumper dividend of $20 million in year 1. To replace the lost cash, the firm will need to issue more shares, and the dividends that will need to be diverted to the new shareholders will exactly offset the effect of the higher dividend in year 1. Suppose Mr. Dente changes his mind and cuts out Consolidated's year 1 dividend entirely, instead spending $10 million to buy back stock. The purchase price at year 1 will be $110. Are shareholders any better or worse off than if Consolidated had paid out $10 million as cash dividends? (Click to select) How many shares will be repurchased? (Round your answer to the nearest whole value.) Number of shares repurchased shares

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started