Question

Consolidated Pasta is currently expected to pay annual dividends of $10 a share in perpetuity on the 1.7 million shares that are outstanding. Shareholders require

Consolidated Pasta is currently expected to pay annual dividends of $10 a share in perpetuity on the 1.7 million shares that are outstanding. Shareholders require a 10% rate of return from Consolidated stock.

What is the price of Consolidated stock?

Note: Do not round intermediate calculations.

What is the total market value of its equity?

Note: Enter your answer in millions.

Consolidated now decides to increase next years dividend to $20 a share, without changing its investment or borrowing plans. Thereafter the company will revert to its policy of distributing $10 million a year.

How much new equity capital will the company need to raise to finance the extra dividend payment?

Note: Enter your answer in millions.

What will be the total present value of dividends paid each year on the new shares that the company will need to issue?

Note: Enter your answer in millions.

What will be the transfer of value from the old shareholders to the new shareholders?

Note: Enter your answer in millions.

Is this figure more than, less than, or the same as the extra dividend that the old shareholders will receive?

Show transcribed data

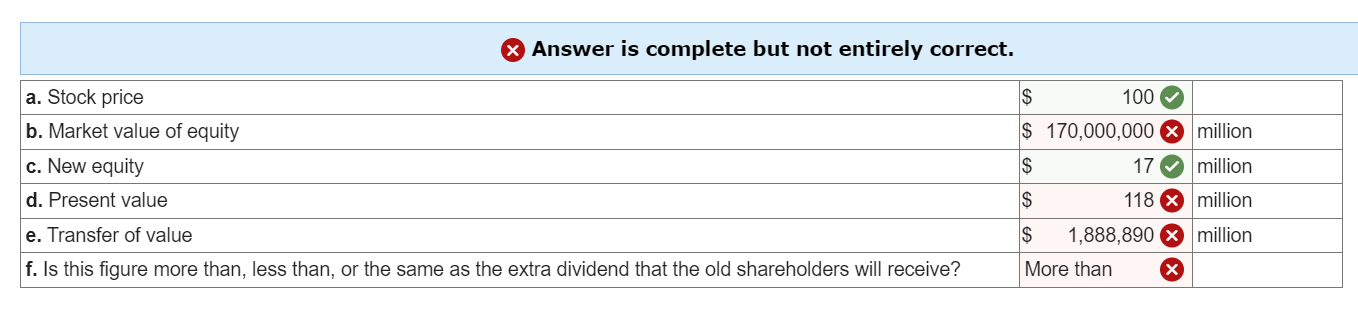

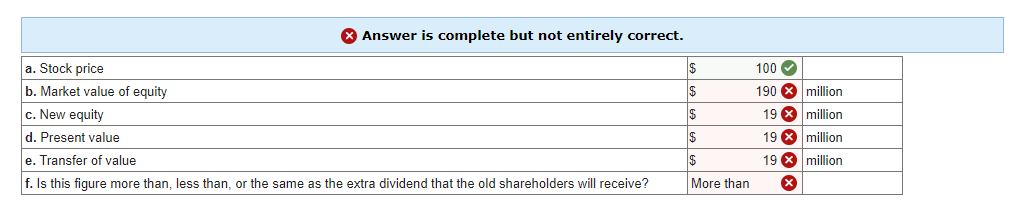

\begin{tabular}{|l|l|l|l|} \hline \multicolumn{1}{|c|}{X Answer is complete but not entirely correct. } \\ \hline a. Stock price & $ & 100 & \\ \hline b. Market value of equity & $170,000,000X & million \\ \hline c. New equity & $ & 17 & million \\ \hline d. Present value & $ & 118X & million \\ \hline e. Transfer of value & $1,888,890X & million \\ \hline f. Is this figure more than, less than, or the same as the extra dividend that the old shareholders will receive? & More than X & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Answer is complete but not entirely correct. } \\ \hline a. Stock price & 100 & \\ \hline b. Market value of equity & 190 & million \\ \hline c. New equity & 19 & million \\ \hline d. Present value & 19 & million \\ \hline e. Transfer of value & 19 & million \\ \hline f. Is this figure more than, less than, or the same as the extra dividend that the old shareholders will receive? & More than & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started