Answered step by step

Verified Expert Solution

Question

1 Approved Answer

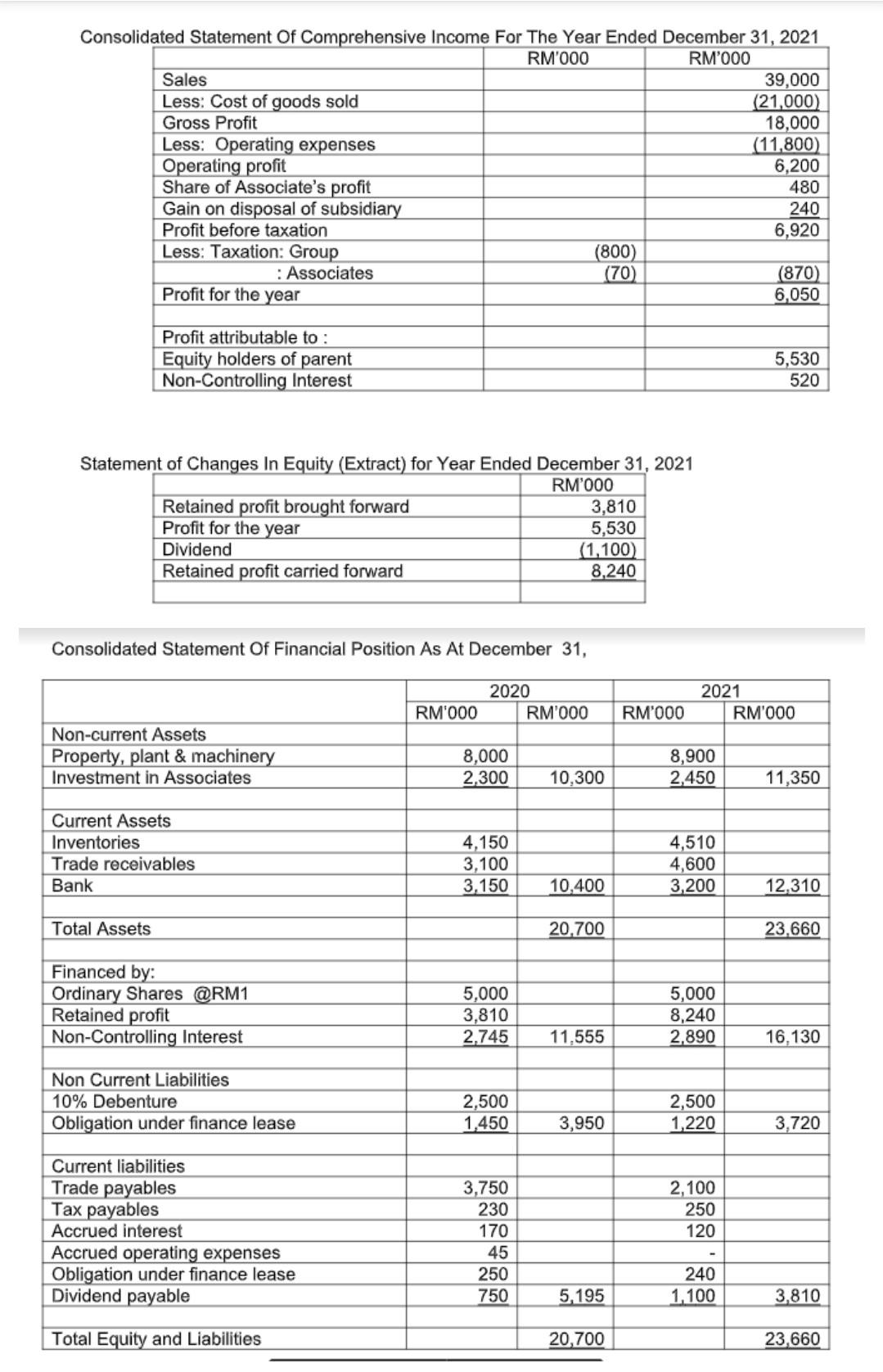

Consolidated Statement of Comprehensive Income For The Year Ended December 31, 2021 RM'000 RM'000 Sales 39,000 Less: Cost of goods sold (21,000) Gross Profit 18,000

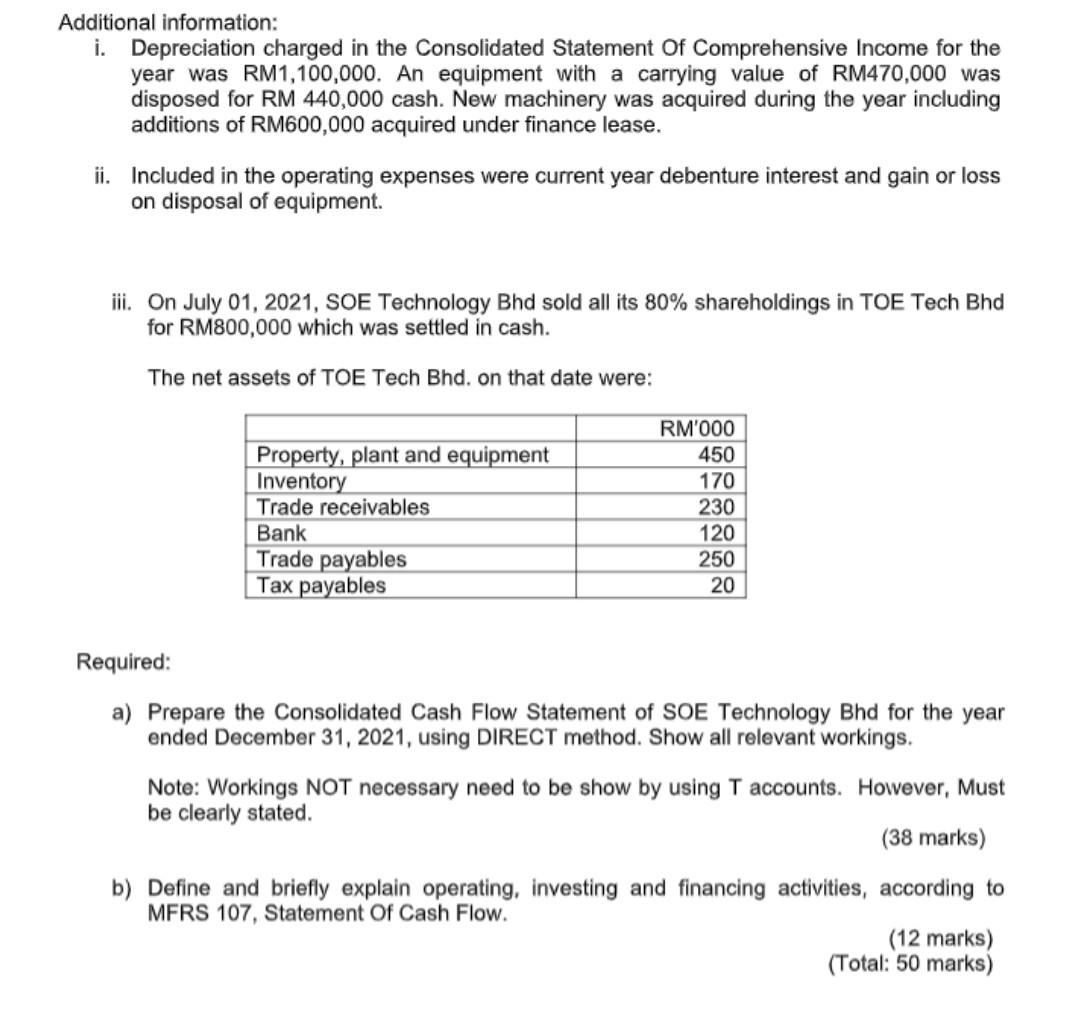

Consolidated Statement of Comprehensive Income For The Year Ended December 31, 2021 RM'000 RM'000 Sales 39,000 Less: Cost of goods sold (21,000) Gross Profit 18,000 Less: Operating expenses (11,800) Operating profit 6,200 Share of Associate's profit 480 Gain on disposal of subsidiary 240 Profit before taxation 6,920 Less: Taxation: Group (800) : Associates (70) (870) Profit for the year 6,050 Profit attributable to: Equity holders of parent Non-Controlling Interest 5,530 520 Statement of Changes In Equity (Extract) for Year Ended December 31, 2021 RM'000 Retained profit brought forward 3,810 Profit for the year 5,530 Dividend (1,100) Retained profit carried forward 8,240 Consolidated Statement of Financial Position As At December 31, 2020 RM'000 RM'000 2021 RM'000 RM'000 Non-current Assets Property, plant & machinery Investment in Associates 8,000 2.300 8,900 2,450 10,300 11,350 Current Assets Inventories Trade receivables Bank 4,150 3,100 3,150 4,510 4,600 3,200 10,400 12,310 Total Assets 20.700 23,660 Financed by: Ordinary Shares @RM1 Retained profit Non-Controlling Interest 5,000 3,810 2,745 5,000 8,240 2.890 11.555 16,130 Non Current Liabilities 10% Debenture Obligation under finance lease 2,500 1,450 2,500 1,220 3,950 3,720 Current liabilities Trade payables Tax payables Accrued interest Accrued operating expenses Obligation under finance lease Dividend payable 2,100 250 120 3,750 230 170 45 250 750 240 1.100 5,195 3,810 Total Equity and Liabilities 20,700 23,660 Additional information: i. Depreciation charged in the Consolidated Statement of Comprehensive Income for the year was RM1,100,000. An equipment with a carrying value of RM470,000 was disposed for RM 440,000 cash. New machinery was acquired during the year including additions of RM600,000 acquired under finance lease. ii. Included in the operating expenses were current year debenture interest and gain or loss on disposal of equipment. iii. On July 01, 2021, SOE Technology Bhd sold all its 80% shareholdings in TOE Tech Bhd for RM800,000 which was settled in cash. The net assets of TOE Tech Bhd. on that date were: Property, plant and equipment Inventory Trade receivables Bank Trade payables Tax payables RM'000 450 170 230 120 250 20 Required: a) Prepare the Consolidated Cash Flow Statement of SOE Technology Bhd for the year ended December 31, 2021, using DIRECT method. Show all relevant workings. Note: Workings NOT necessary need to be show by using T accounts. However, Must be clearly stated. (38 marks) b) Define and briefly explain operating, investing and financing activities, according to MFRS 107, Statement of Cash Flow. (12 marks) (Total: 50 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started