Answered step by step

Verified Expert Solution

Question

1 Approved Answer

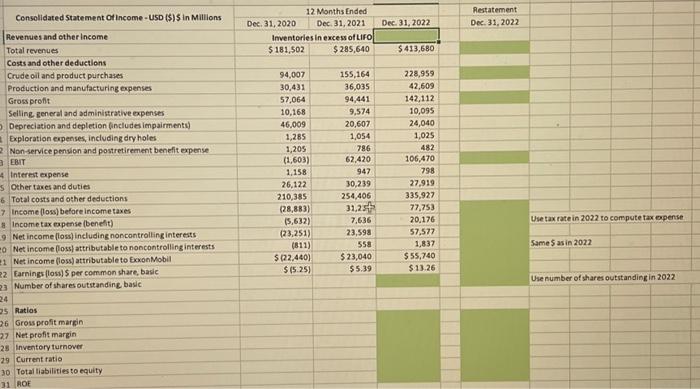

Consolidated Statement Of Income - USD ($) $ in Millions Revenues and other income Total revenues Costs and other deductions Crude oil and product purchases

Consolidated Statement Of Income - USD ($) $ in Millions Revenues and other income Total revenues Costs and other deductions Crude oil and product purchases Production and manufacturing expenses Gross profit Selling, general and administrative expenses O Depreciation and depletion (includes impairments) Exploration expenses, including dry holes 2 Non-service pension and postretirement benefit expense 3 EBIT 4 Interest expense Other taxes and duties 6 Total costs and other deductions 7 Income (loss) before income taxes 8 Income tax expense (benefit) 9 Net income (loss) including noncontrolling interests 20 Net income (loss) attributable to noncontrolling interests 21 Net income (loss) attributable to ExxonMobil 22 Earnings (loss) $ per common share, basic 23 Number of shares outstanding, basic 24 25 Ratios 26 Gross profit margin 27 Net profit margin 28 Inventory turnover 29 Current ratio 30 Total liabilities to equity 31 ROE 12 Months Ended Dec. 31, 2021 Inventories in excess of LIFO $ 181,502 $285,640 Dec. 31, 2020 94,007 30,431 57,064 10,168 46,009 1,285 1,205 (1,603) 1,158 26,122 210,385 (28,883) (5,632) (23,251) (811) $ (22,440) $(5.25) 155,164 36,035 94,441 9,574 20,607 1,054 786 62,420 947 30,239 254,406 31,2 7,636 23,598 558 $ 23,040 $5.39 Dec. 31, 2022 $ 413,680 228,959 42,609 142,112 10,095 24,040 1,025 482 106,470 798 27,919 335,927 77,753 20,176 57,577 1,837 $ 55,740 $ 13.26 Restatement Dec. 31, 2022 Use tax rate in 2022 to compute tax expense Same $ as in 2022 Use number of shares outstanding in 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started