Answered step by step

Verified Expert Solution

Question

1 Approved Answer

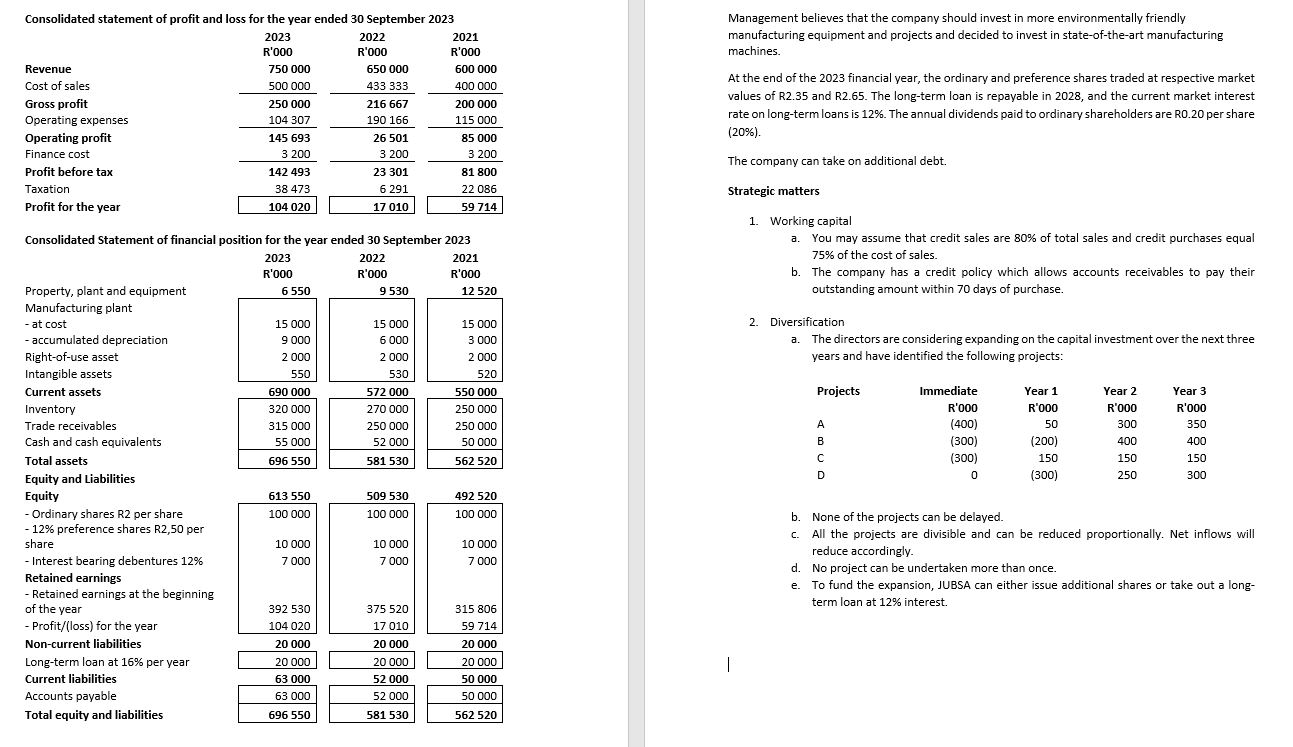

Consolidated statement of profit and loss for the year ended 30 September 2023 2023 R'000 2022 R'000 2021 R'000 Revenue 750 000 650 000

Consolidated statement of profit and loss for the year ended 30 September 2023 2023 R'000 2022 R'000 2021 R'000 Revenue 750 000 650 000 600 000 Cost of sales 500 000 433 333 400 000 Gross profit 250 000 216 667 200 000 Operating expenses 104 307 190 166 Operating profit 145 693 26 501 115 000 85 000 Finance cost 3 200 3 200 3 200 Profit before tax 142 493 23 301 81 800 Taxation 38 473 6 291 22 086 Profit for the year 104 020 17 010 59 714 15.000 3 000 2 000 Management believes that the company should invest in more environmentally friendly manufacturing equipment and projects and decided to invest in state-of-the-art manufacturing machines. At the end of the 2023 financial year, the ordinary and preference shares traded at respective market values of R2.35 and R2.65. The long-term loan is repayable in 2028, and the current market interest rate on long-term loans is 12%. The annual dividends paid to ordinary shareholders are RO.20 per share (20%). The company can take on additional debt. Strategic matters 1. Working capital a. You may assume that credit sales are 80% of total sales and credit purchases equal 75% of the cost of sales. b. The company has a credit policy which allows accounts receivables to pay their outstanding amount within 70 days of purchase. 2. Diversification a. The directors are considering expanding on the capital investment over the next three years and have identified the following projects: Manufacturing plant Consolidated Statement of financial position for the year ended 30 September 2023 Property, plant and equipment - at cost 2023 2022 R'000 R'000 2021 R'000 6550 9 530 12 520 15 000 15 000 - accumulated depreciation 9 000 6 000 Right-of-use asset 2 000 2 000 Intangible assets 550 530 520 Current assets 690 000 572 000 550 000 Inventory 320 000 270 000 Trade receivables 315 000 250 000 250 000 250 000 Cash and cash equivalents 55 000 52 000 Total assets 696 550 581 530 50 000 562 520 Equity and Liabilities Equity 613 550 509 530 492 520 -Ordinary shares R2 per share 100 000 100 000 100 000 - 12% preference shares R2,50 per share 10 000 10 000 10 000 - Interest bearing debentures 12% Retained earnings 7 000 7 000 - Retained earnings at the beginning of the year 392 530 375 520 315 806 - Profit/(loss) for the year 104 020 17 010 59 714 Non-current liabilities 20 000 20 000 20 000 Long-term loan at 16% per year 20.000 20 000 20 000 Current liabilities 63 000 52 000 50 000 Accounts payable 63 000 52 000 50 000 Total equity and liabilities 696 550 581 530 562 520 Projects Immediate Year 1 Year 2 Year 3 R'000 R'000 R'000 R'000 A (400) 50 300 350 B (300) (200) 400 400 C (300) 150 150 150 D 0 (300) 250 300 7 000 b. None of the projects can be delayed. c. All the projects are divisible and can be reduced proportionally. Net inflows will reduce accordingly. d. No project can be undertaken more than once. e. To fund the expansion, JUBSA can either issue additional shares or take out a long- term loan at 12% interest.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started