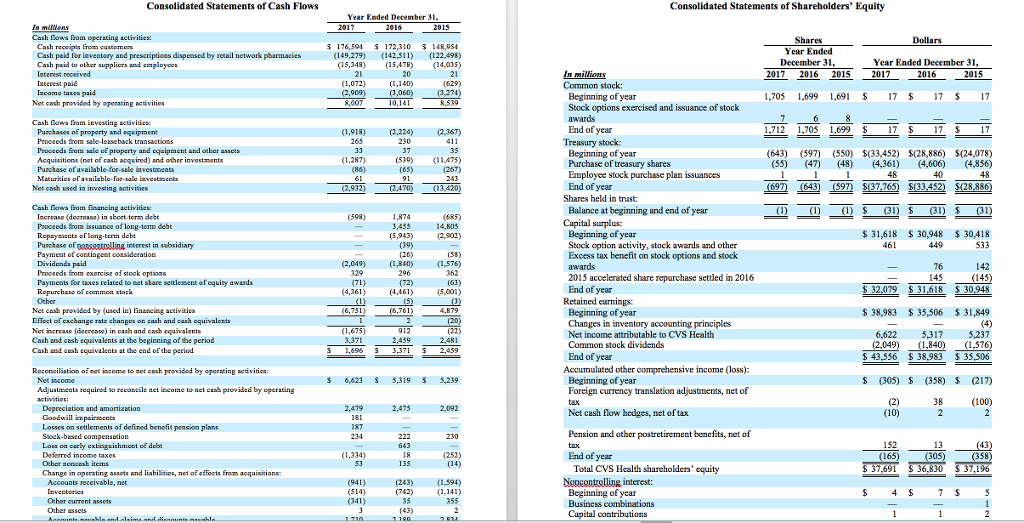

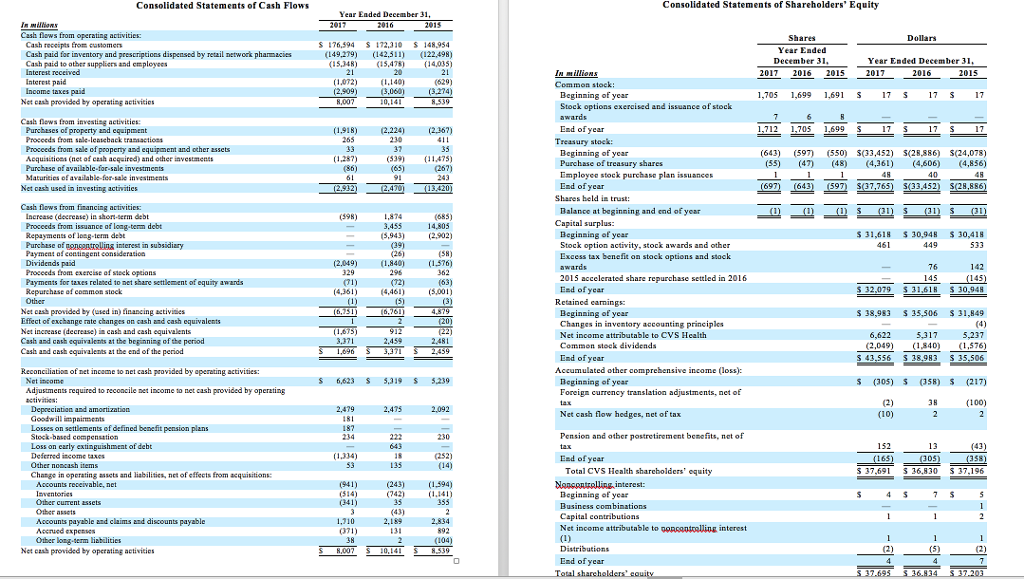

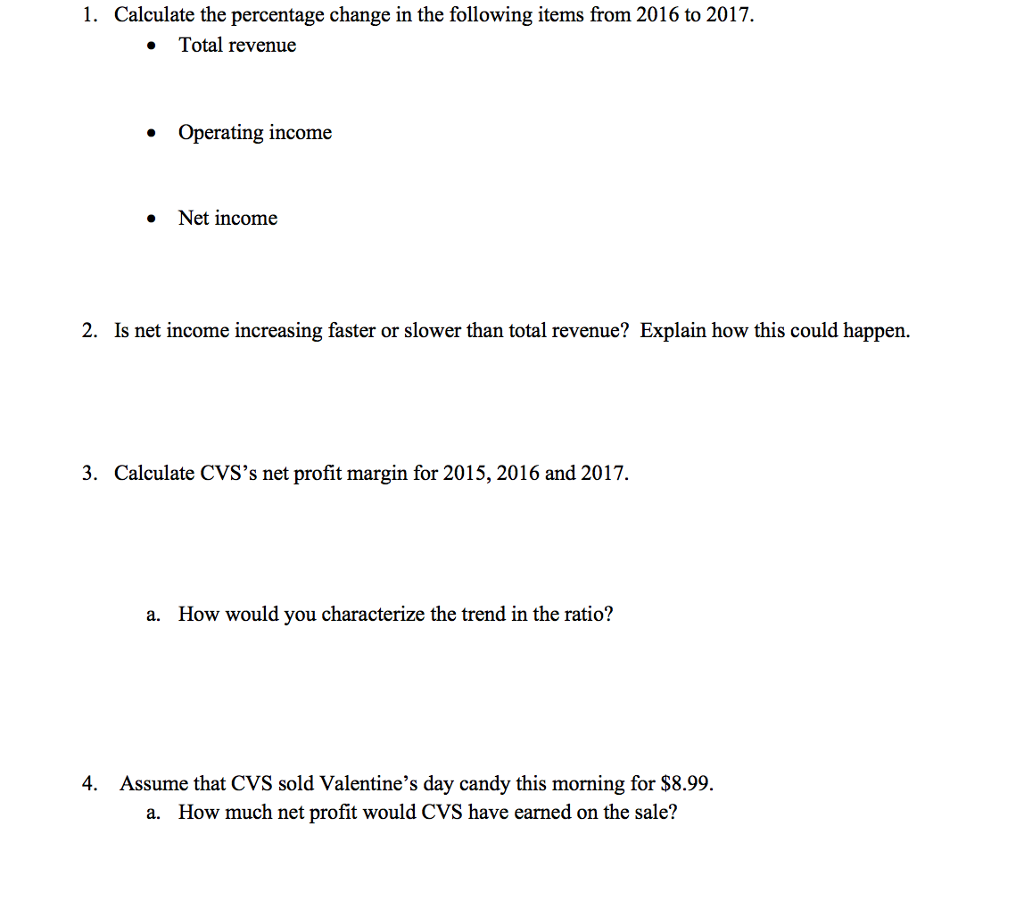

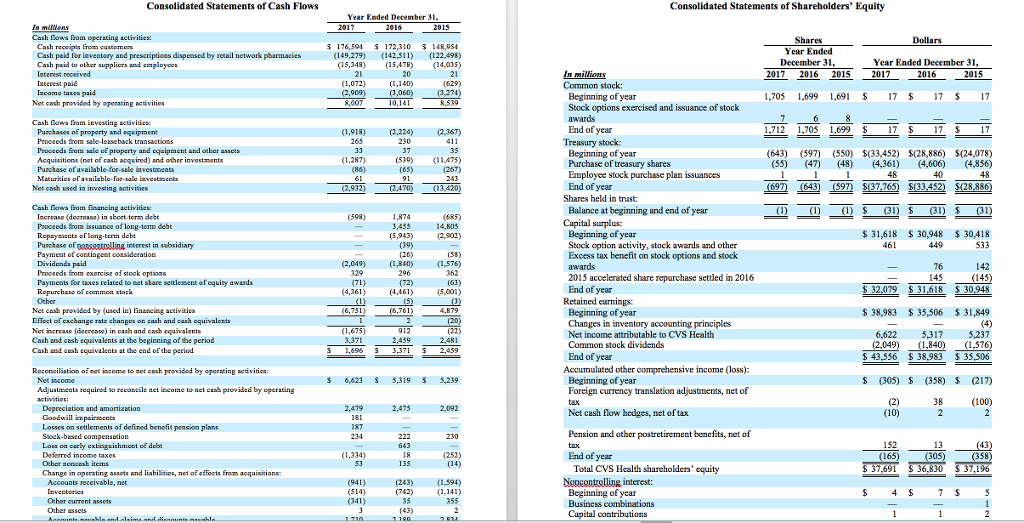

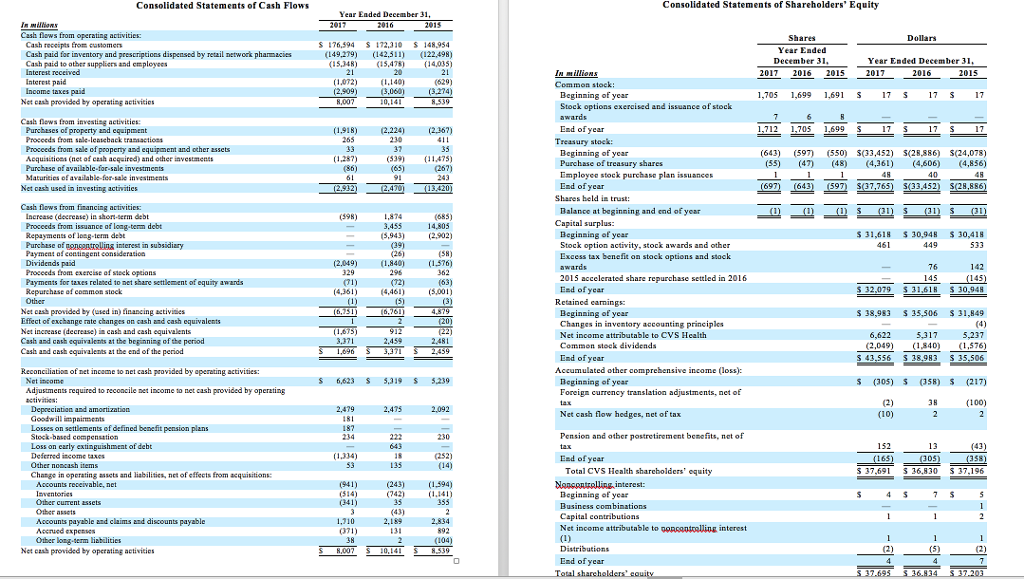

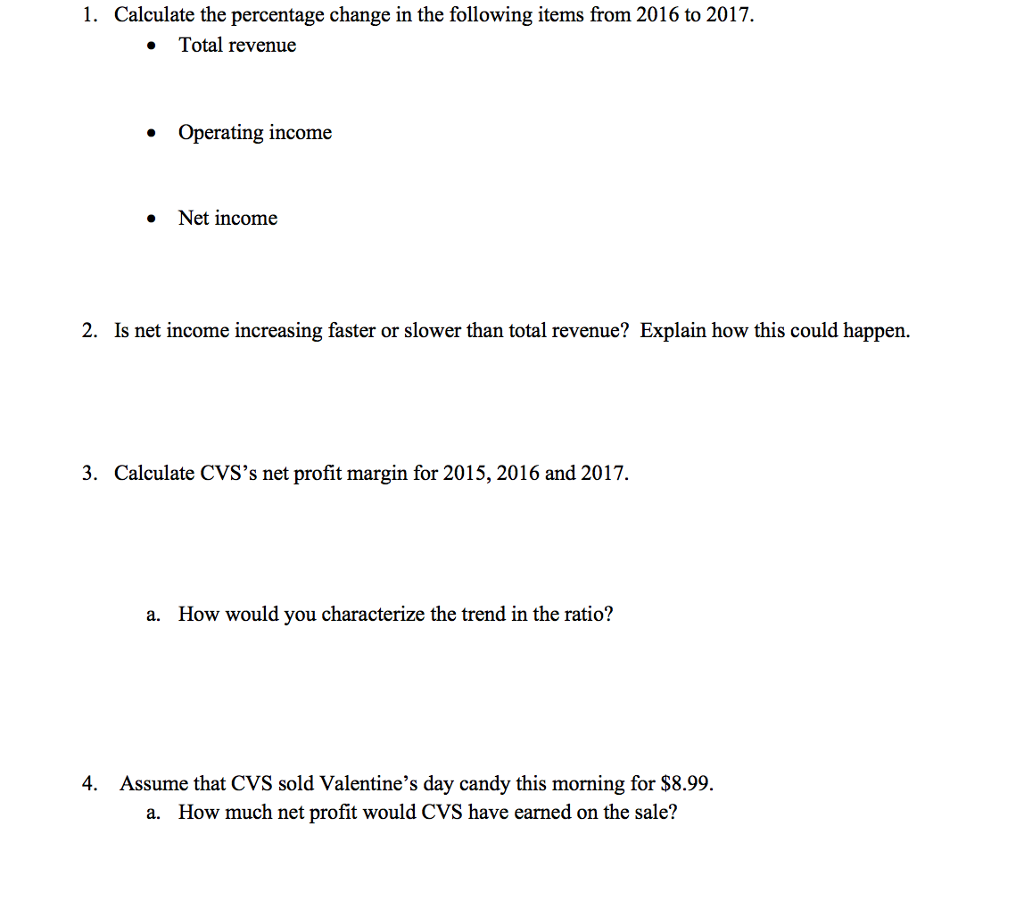

Consolidated Statements of Cash Flows Consolidated Statements of Shareholders' Equity Year Ended December 31 Cash Dows om operating aetivities Cash receipts Eroan customen Cash paid for iaventory and preseriptioas dispensed by retail network pharmacies Cash paid to other suppliers and employecs Interest received 5 176,591 172,310 4R,054 (149,279) (142,511) (122.498) 5,34 (5,47) (14,035) Year Ended December 31 2017 2016 2015 _2017 20162015 Common stock 3,060) 274) 1,705 1,699 1,691 S171717 Net cash provided by operating activities Stock options exercised and issuance of stock Cash Nows from inveating ectivities 1.712 1.705 1.699 $ Purchases of property and equipment Prooeeds from sale-leaseback transactions Proceods from sale of property and eq ipment and other assets Acquisitions (nat of cash aoquired) and odher investments Punchase of available-for-sele investmeats Treasury stock: (643) (597) (550) $(33,452) $(28,886) $(24,078) (519 (1.475) Purchase of treasury shares Employee stock purchase plan issuances End of year (55) (47) (48) (4,361) (4,606) (4,856) (697 (645) 5 7683.452 $28886 Net cash used in investing activities Shares held in trust: Cash Dowsa From financing activities: Balance at beginning and end of year (31) $ (31) $ (31) Iscrease (decreasa) in shoet term debt Proceeds from issuanoe of long-termn debt Repayments ofLong-term debt Purchase of parsenttolUing interest in subsidiary 14,805 $ 31,618 30,948 30,418 Stock option activity, stock awards and other Excess tax benefit on stock options and stock Dividends paid 2015 accelerated share repurchase settled in 2016 End of year Paymeats or taxes related to net share setulesent of equity awards 32,079 $3161830948 $ 38,983 35,506 31,849 6,622 5317 5237 43.556 $38,983 35.506 S (305) (358) (217) Net cash provided by (used in) inaneing aceivities EFoct of exchange rate changes on cash and cash oquivalests Net increase (dacea in cash andquivalants Cash and cash equivalents at the beginning of the period Cash and esb equivalents at dhe end of the pecied Changes in inventory accounting principles Net income attributable to CVS Health Common stock dividends End of year .696 3,371 2459 Roconcilistion of net income to set cash provied by opernting activities Accumulated other comprehensive income (loss): S 6,623 5,319 5,239 Adjustments required so reconeile aet ineome to net ca provided by eperating Foreign currency translation adjustments, net of Net cash flow hedges, net of tax Pension and other postretirement benefits, net of Losses on settlements of defined benefit peasion plans Loss on cary extingsishment oE debt Change in operating assets and liabitios, net of affeets from acquistions (1,334) (165) 305(358 Total CVS Health shareholders' equity Other current assets Consolidated Statements of Cash Flows Consolidated Statements of Shareholders' Equity Year Ended December 31 Cash flows from operating activities Cash receipts from eustomers Cash paid for inventory and prescriptions dispensed by retail netwock phamacits Cash paid to ather suppliers and employees 176,594 172,30 148.954 (149,279 (142,311) (122,498) December 31 Year Eaded December 31. (15,348) 2017 2016 2015 201S 0O 1.705 1,699 1,691 S 1717 S17 Net enh provided by operating activicie Stock options exeraised and issuance of stock Cash lews from investing activities 1,712 1,705 1,699 S Purchases of property and equipment Procceds from sale-leateback trasactions Proceeds from sale of property and equipanent and other assets Acquisitioes (net of cash acquired) and other investments (1918 (2,224) (2.367) (643) (597) (550) (33,452) S(28,886) S(24,078) (55) 47) (48) (4,36) (4,606) (4,856) Purchase of treasury shares tock purchase plan issuances Net czsh used in investing activities (597) S(37,765) 3(33.452) $(28,886 Shares held is trust Cash flows from financing activities Balance at beginning and end of year lncrease (decrense) in shor-serm debt Proceeds from issuance of loag.term debt $31,618 S 30,948 30,418 Purchase oftlins interest in subsidizry Payment af centingent consideration Stock option activity, stock awards and other Excess tax benefit on stock aptions and stack (2.049 840(1576) Proceeds from exercise of steek Payments for taxes related to net share settlement of equity awards 2015 accelerated share repurchase settled in 2016 $ 32,079 31,618 S 30,948 Net cash prowided by (used in) tinancing activisies Effect of exchange rate changes on cash and cash equivalents Net increase (decrease) is cash and cash equivalents Cash and cash equivalents at the beginning of the period S 38,983 35,506 S31,849 Changes in inventory accounting prineiples Net income attributable to CVS Health Common stock dividends (2,049) 1840) (576) S 43.556 5 38,983 S 35.506 ash equivalents at the end of the period Reconcliatios of net incame to net cash provided by aperating activities: Accumulated other comprehensive income (loss) S 6,623 5,319 5.239 S (30s) S (358) S (217) Adjustments required to reconcile net income to net cash provided by opereting Net cash flow hedges, net of tax Losses on settlements of defined benefit pension plans Pension and other postretirement bemefits, net of Loss on early extinguishment of debt Total CVS Health shareholders' oquity Change in operating assets and liabilitics, net of effeets from aequisitions: Beginaing of year Accounts payable and claims and discounts payable Net income attributable to interest Net cah provided by aperating activities 37.695 S 36.834 8 37.203 1. Calculate the percentage change in the following items from 2016 to 2017. Total revenue * Operating income Net income 2. Is net income increasing faster or slower than total revenue? Explain how this could happen. 3. Calculate CVS's net profit margin for 2015, 2016 and 2017 a. How would you characterize the trend in the ratio? 4. Assume that CVS sold Valentine's day candy this morning for $8.99. a. How much net profit would CVS have earned on the sale? Consolidated Statements of Cash Flows Consolidated Statements of Shareholders' Equity Year Ended December 31 Cash Dows om operating aetivities Cash receipts Eroan customen Cash paid for iaventory and preseriptioas dispensed by retail network pharmacies Cash paid to other suppliers and employecs Interest received 5 176,591 172,310 4R,054 (149,279) (142,511) (122.498) 5,34 (5,47) (14,035) Year Ended December 31 2017 2016 2015 _2017 20162015 Common stock 3,060) 274) 1,705 1,699 1,691 S171717 Net cash provided by operating activities Stock options exercised and issuance of stock Cash Nows from inveating ectivities 1.712 1.705 1.699 $ Purchases of property and equipment Prooeeds from sale-leaseback transactions Proceods from sale of property and eq ipment and other assets Acquisitions (nat of cash aoquired) and odher investments Punchase of available-for-sele investmeats Treasury stock: (643) (597) (550) $(33,452) $(28,886) $(24,078) (519 (1.475) Purchase of treasury shares Employee stock purchase plan issuances End of year (55) (47) (48) (4,361) (4,606) (4,856) (697 (645) 5 7683.452 $28886 Net cash used in investing activities Shares held in trust: Cash Dowsa From financing activities: Balance at beginning and end of year (31) $ (31) $ (31) Iscrease (decreasa) in shoet term debt Proceeds from issuanoe of long-termn debt Repayments ofLong-term debt Purchase of parsenttolUing interest in subsidiary 14,805 $ 31,618 30,948 30,418 Stock option activity, stock awards and other Excess tax benefit on stock options and stock Dividends paid 2015 accelerated share repurchase settled in 2016 End of year Paymeats or taxes related to net share setulesent of equity awards 32,079 $3161830948 $ 38,983 35,506 31,849 6,622 5317 5237 43.556 $38,983 35.506 S (305) (358) (217) Net cash provided by (used in) inaneing aceivities EFoct of exchange rate changes on cash and cash oquivalests Net increase (dacea in cash andquivalants Cash and cash equivalents at the beginning of the period Cash and esb equivalents at dhe end of the pecied Changes in inventory accounting principles Net income attributable to CVS Health Common stock dividends End of year .696 3,371 2459 Roconcilistion of net income to set cash provied by opernting activities Accumulated other comprehensive income (loss): S 6,623 5,319 5,239 Adjustments required so reconeile aet ineome to net ca provided by eperating Foreign currency translation adjustments, net of Net cash flow hedges, net of tax Pension and other postretirement benefits, net of Losses on settlements of defined benefit peasion plans Loss on cary extingsishment oE debt Change in operating assets and liabitios, net of affeets from acquistions (1,334) (165) 305(358 Total CVS Health shareholders' equity Other current assets Consolidated Statements of Cash Flows Consolidated Statements of Shareholders' Equity Year Ended December 31 Cash flows from operating activities Cash receipts from eustomers Cash paid for inventory and prescriptions dispensed by retail netwock phamacits Cash paid to ather suppliers and employees 176,594 172,30 148.954 (149,279 (142,311) (122,498) December 31 Year Eaded December 31. (15,348) 2017 2016 2015 201S 0O 1.705 1,699 1,691 S 1717 S17 Net enh provided by operating activicie Stock options exeraised and issuance of stock Cash lews from investing activities 1,712 1,705 1,699 S Purchases of property and equipment Procceds from sale-leateback trasactions Proceeds from sale of property and equipanent and other assets Acquisitioes (net of cash acquired) and other investments (1918 (2,224) (2.367) (643) (597) (550) (33,452) S(28,886) S(24,078) (55) 47) (48) (4,36) (4,606) (4,856) Purchase of treasury shares tock purchase plan issuances Net czsh used in investing activities (597) S(37,765) 3(33.452) $(28,886 Shares held is trust Cash flows from financing activities Balance at beginning and end of year lncrease (decrense) in shor-serm debt Proceeds from issuance of loag.term debt $31,618 S 30,948 30,418 Purchase oftlins interest in subsidizry Payment af centingent consideration Stock option activity, stock awards and other Excess tax benefit on stock aptions and stack (2.049 840(1576) Proceeds from exercise of steek Payments for taxes related to net share settlement of equity awards 2015 accelerated share repurchase settled in 2016 $ 32,079 31,618 S 30,948 Net cash prowided by (used in) tinancing activisies Effect of exchange rate changes on cash and cash equivalents Net increase (decrease) is cash and cash equivalents Cash and cash equivalents at the beginning of the period S 38,983 35,506 S31,849 Changes in inventory accounting prineiples Net income attributable to CVS Health Common stock dividends (2,049) 1840) (576) S 43.556 5 38,983 S 35.506 ash equivalents at the end of the period Reconcliatios of net incame to net cash provided by aperating activities: Accumulated other comprehensive income (loss) S 6,623 5,319 5.239 S (30s) S (358) S (217) Adjustments required to reconcile net income to net cash provided by opereting Net cash flow hedges, net of tax Losses on settlements of defined benefit pension plans Pension and other postretirement bemefits, net of Loss on early extinguishment of debt Total CVS Health shareholders' oquity Change in operating assets and liabilitics, net of effeets from aequisitions: Beginaing of year Accounts payable and claims and discounts payable Net income attributable to interest Net cah provided by aperating activities 37.695 S 36.834 8 37.203 1. Calculate the percentage change in the following items from 2016 to 2017. Total revenue * Operating income Net income 2. Is net income increasing faster or slower than total revenue? Explain how this could happen. 3. Calculate CVS's net profit margin for 2015, 2016 and 2017 a. How would you characterize the trend in the ratio? 4. Assume that CVS sold Valentine's day candy this morning for $8.99. a. How much net profit would CVS have earned on the sale