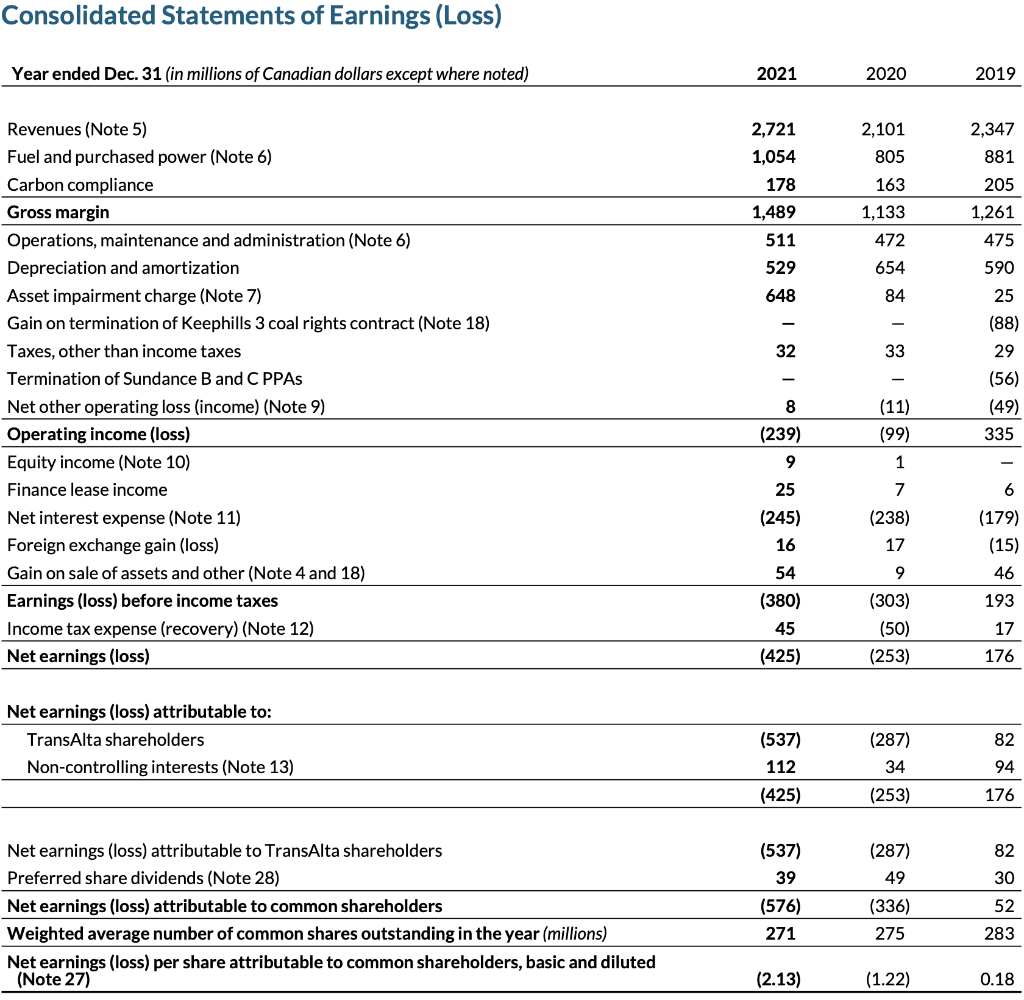

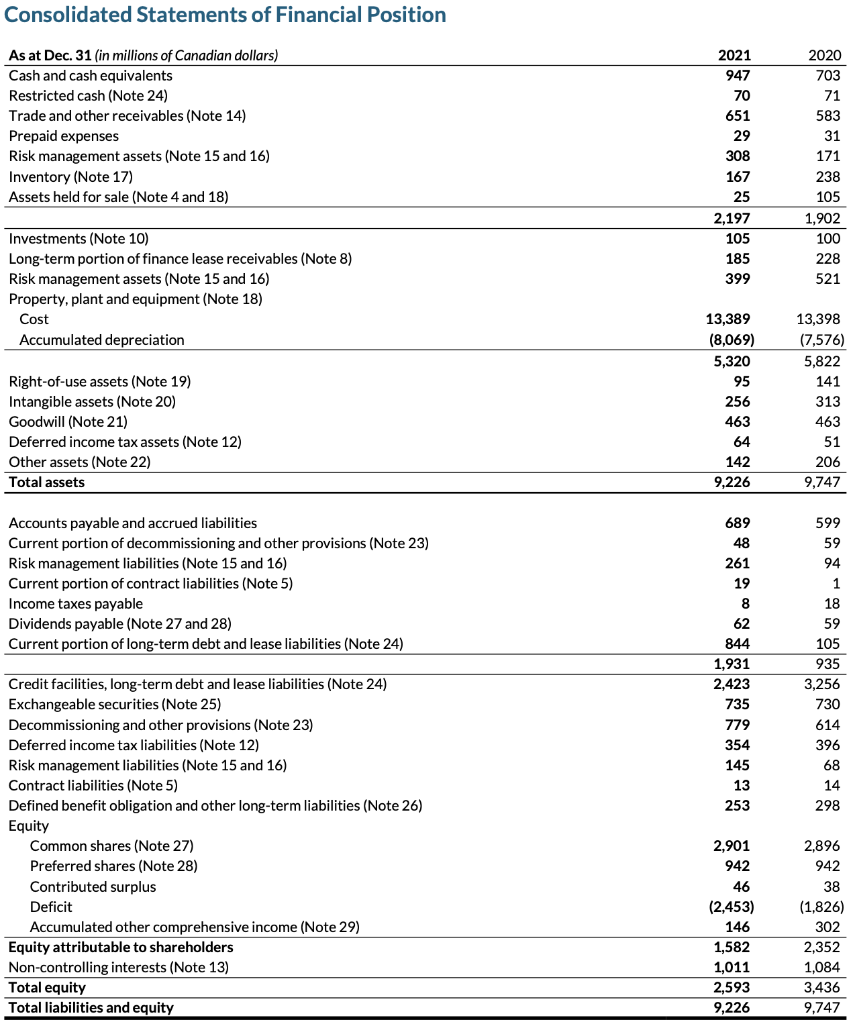

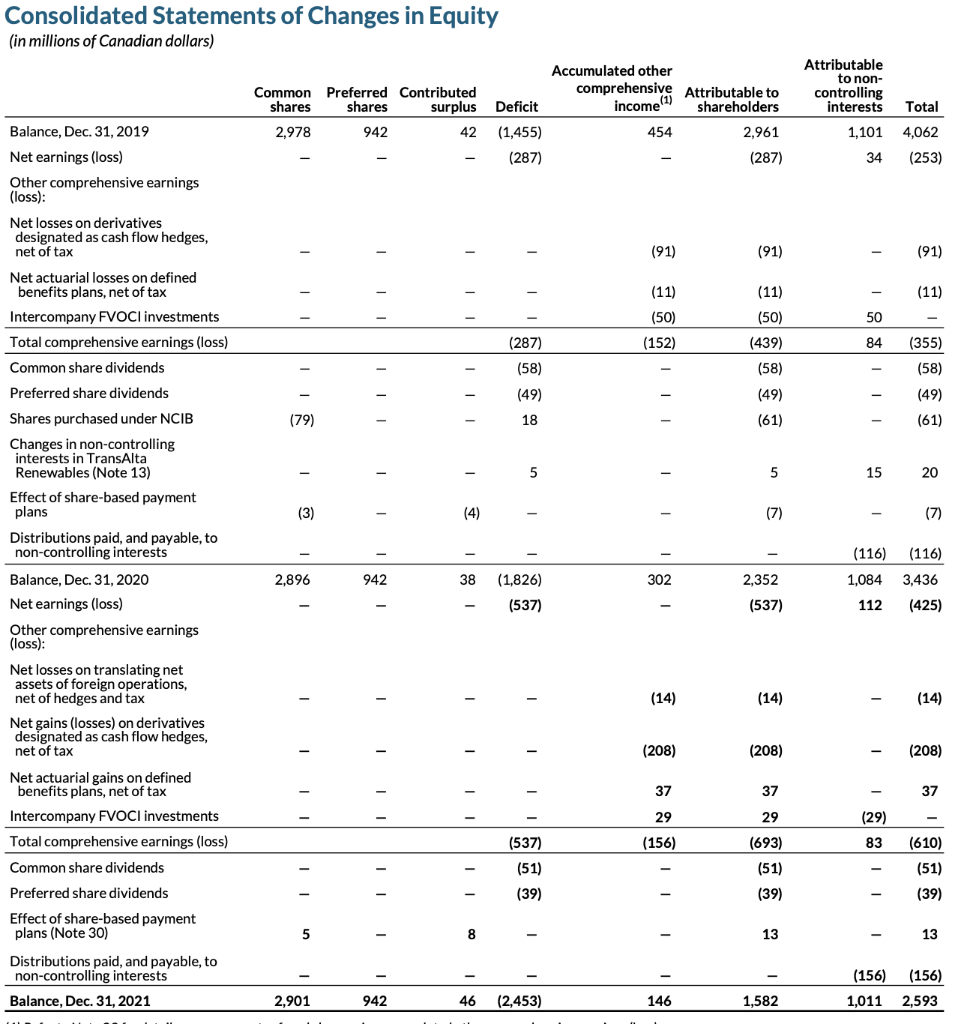

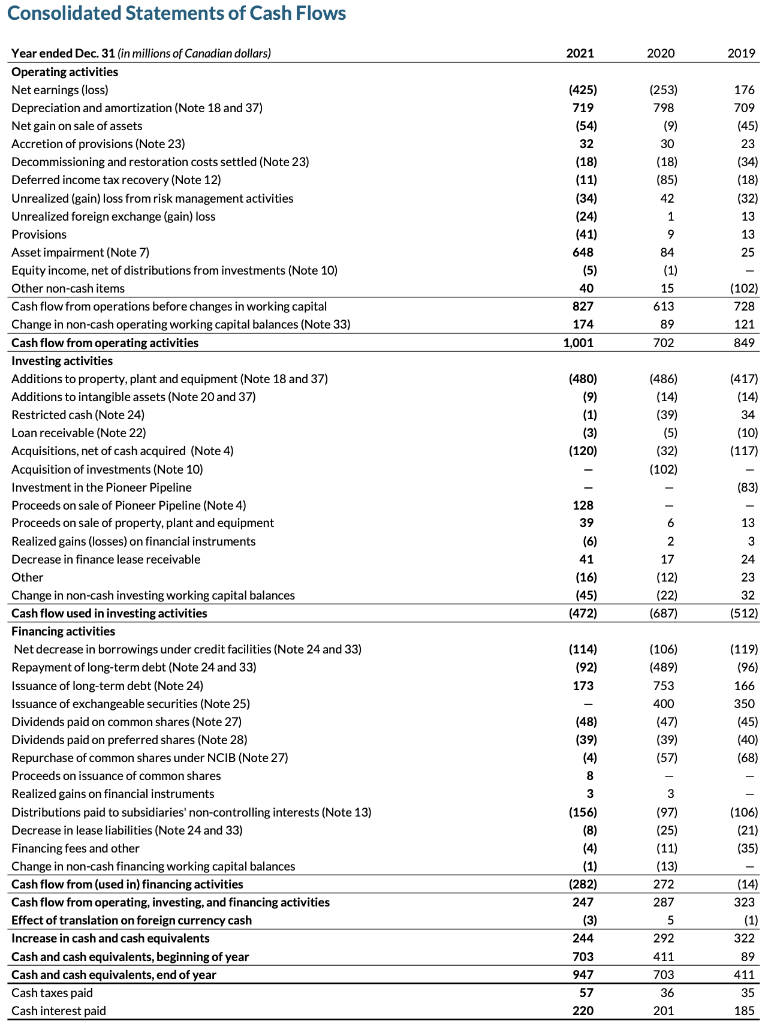

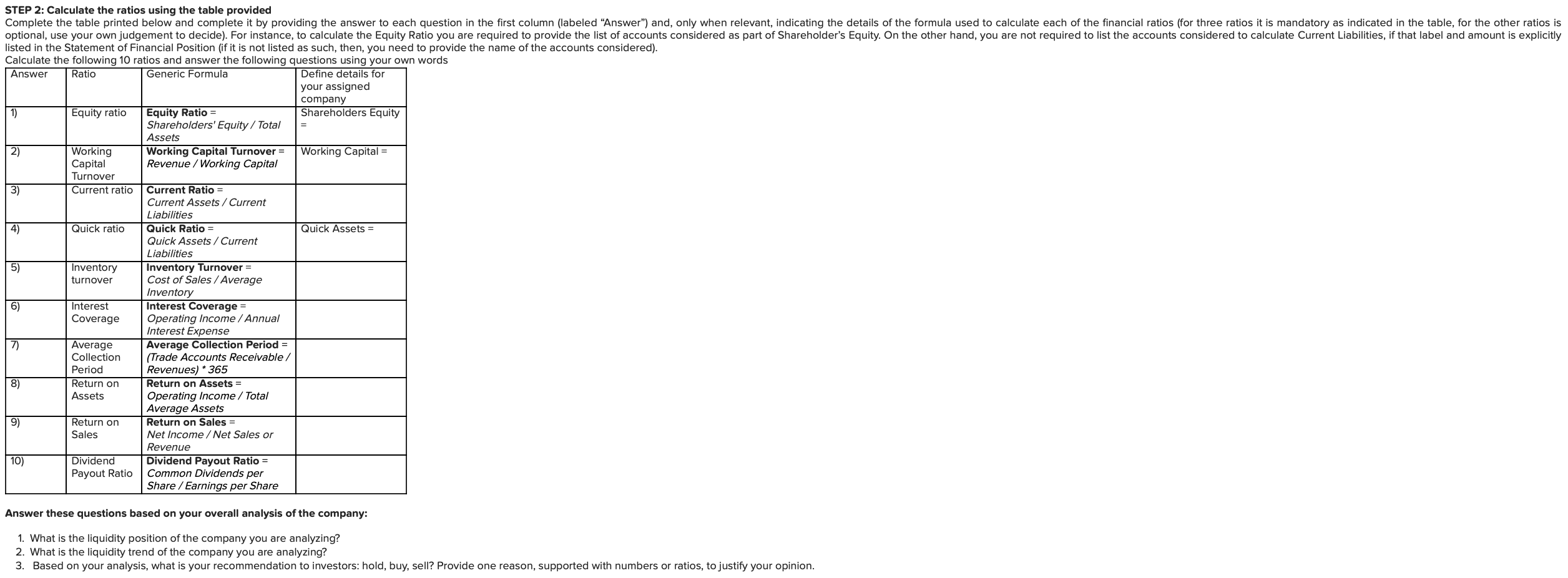

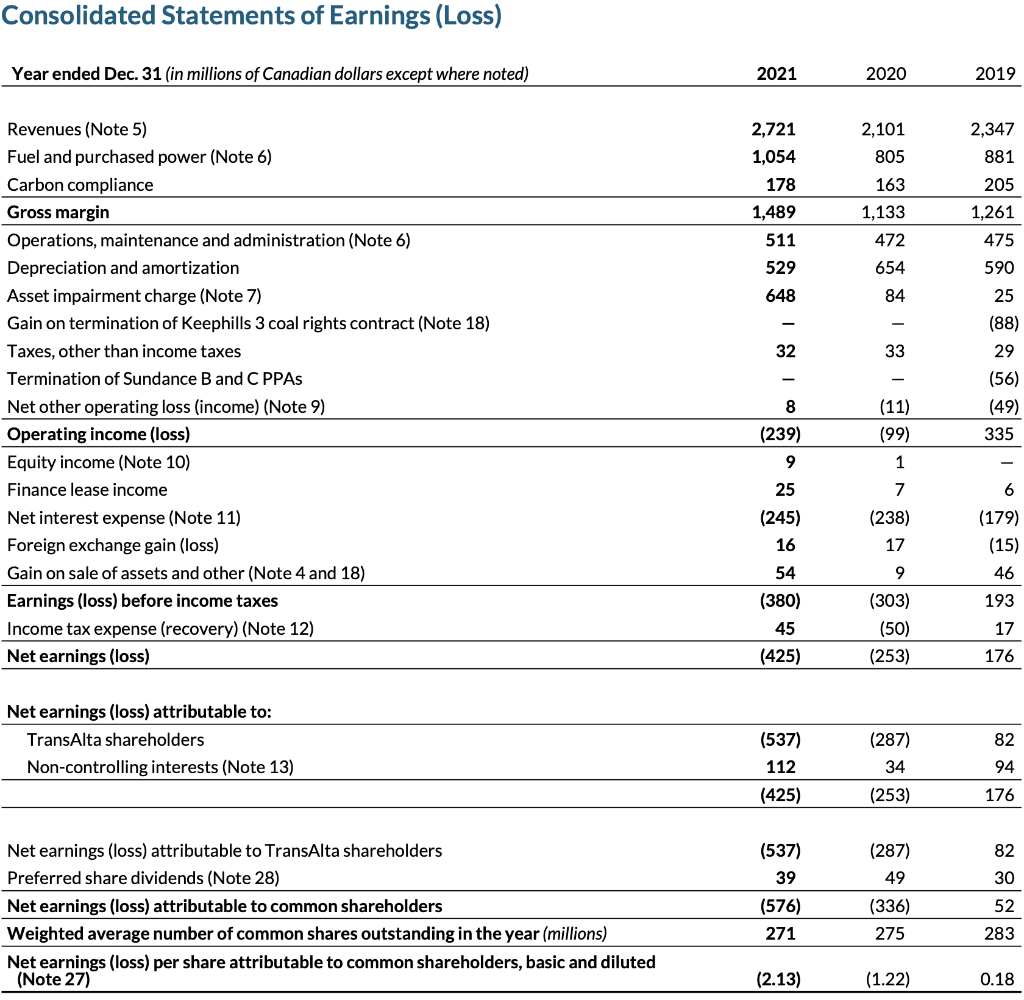

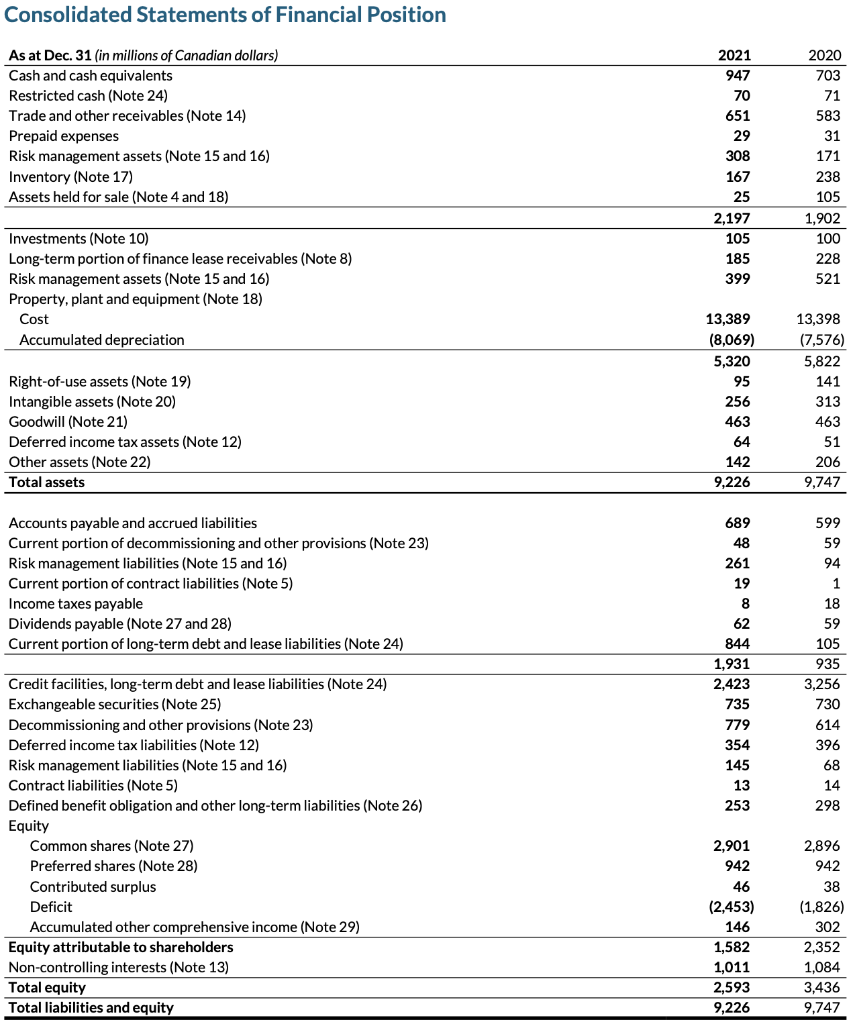

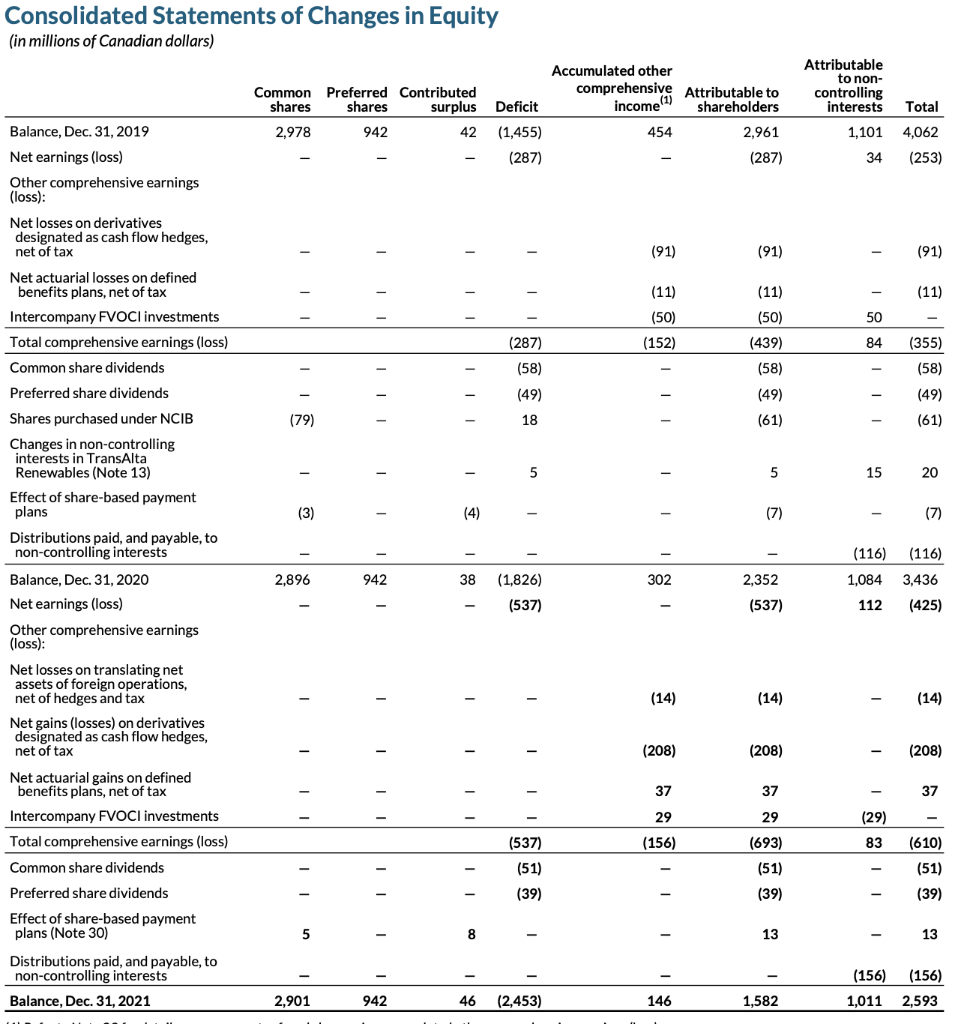

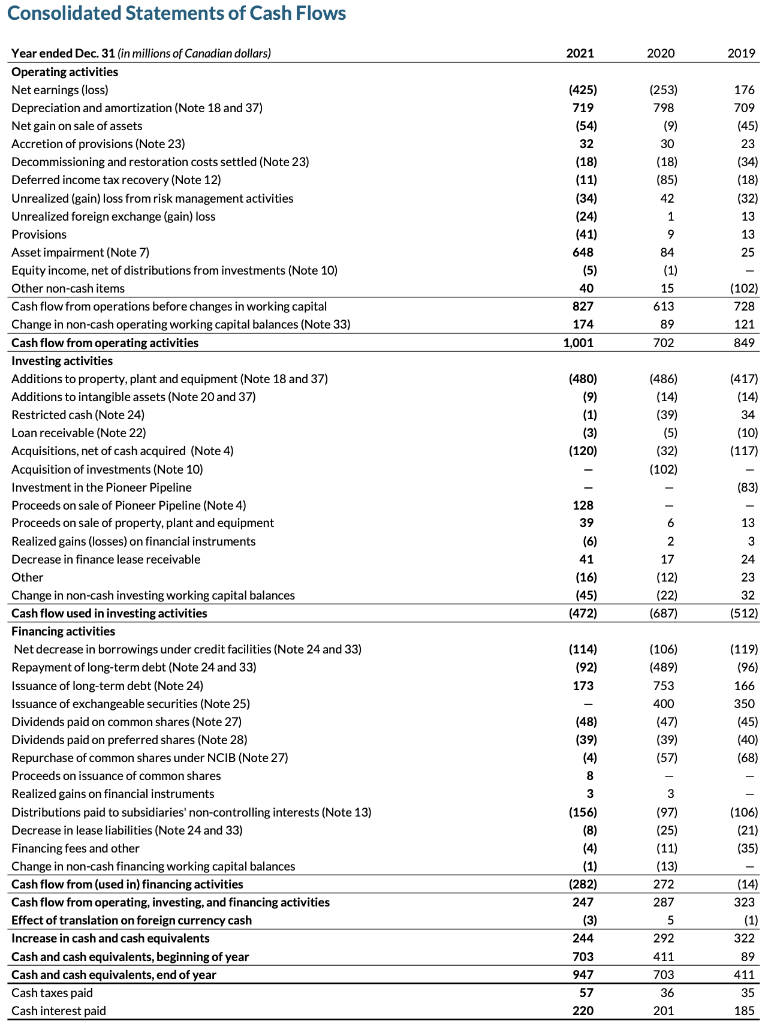

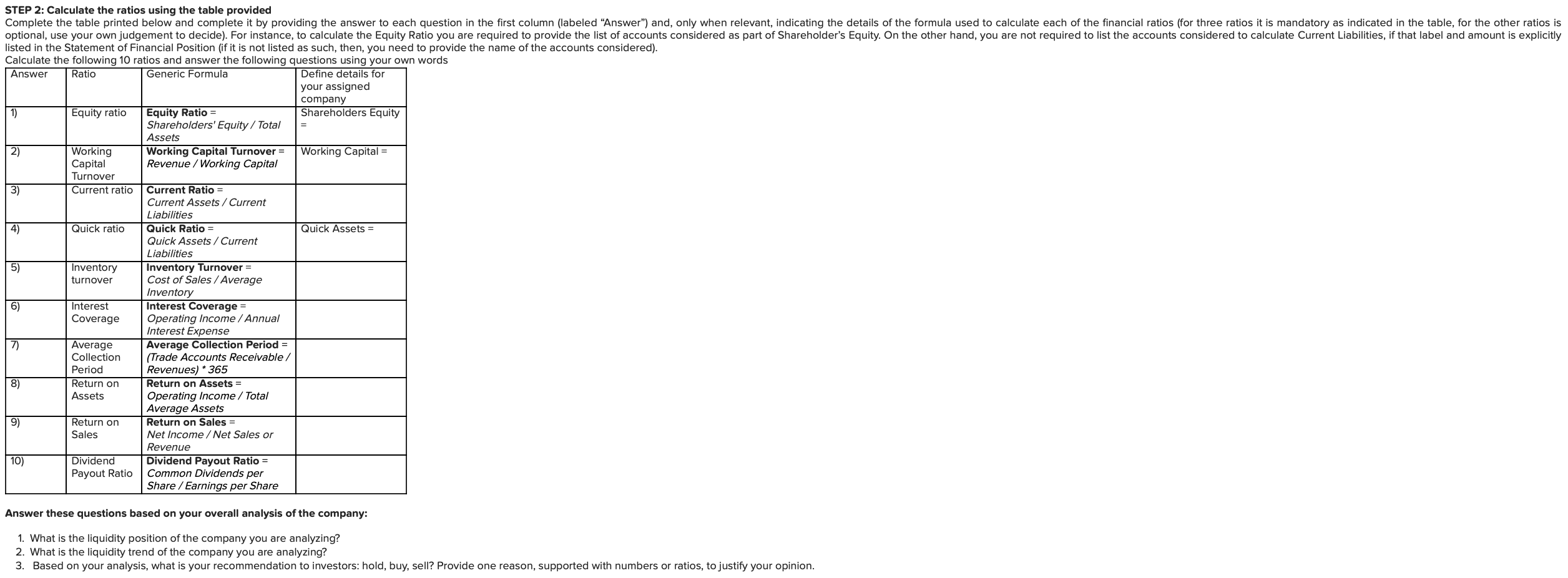

Consolidated Statements of Earnings (Loss) Year ended Dec. 31 (in millions of Canadian dollars except where noted) \begin{tabular}{lrl} 2021 & 2020 & 2019 \\ \hline \end{tabular} Revenues (Note 5) Fuel and purchased power (Note 6) 2,7211,0542,1018052,347881 Carbon compliance Gross margin Operations, maintenance and administration (Note 6) Depreciation and amortization Asset impairment charge (Note 7) Gain on termination of Keephills 3 coal rights contract (Note 18) Taxes, other than income taxes Termination of Sundance B and C PPAs Net other operating loss (income) (Note 9) Operating income (loss) Equity income (Note 10) Finance lease income Net interest expense (Note 11) Foreign exchange gain (loss) Gain on sale of assets and other (Note 4 and 18) Earnings (loss) before income taxes Income tax expense (recovery) (Note 12) Net earnings (loss) \begin{tabular}{rrr} 178 & 163 & 205 \\ \hline 1,489 & 1,133 & 1,261 \\ \hline 511 & 472 & 475 \\ 529 & 654 & 590 \\ 648 & 84 & 25 \end{tabular} Net earnings (loss) attributable to: \begin{tabular}{lrrr} \hline TransAlta shareholders & (537) & (287) & 82 \\ Non-controlling interests (Note 13) & 112 & 34 & (253) \\ \hline & (425) & 176 \\ \hline \end{tabular} Net earnings (loss) attributable to TransAlta shareholders Preferred share dividends (Note 28) Net earnings (loss) attributable to common shareholders Weighted average number of common shares outstanding in the year (millions) \begin{tabular}{rcr} \hline (537) & (287) & 82 \\ 39 & 49 & 30 \\ \hline (576) & (336) & 52 \\ \hline 271 & 275 & 283 \\ \hline \end{tabular} Net earnings (loss) per share attributable to common shareholders, basic and diluted (Note 27) (2.13) (1.22) 0.18 Consolidated Statements of Financial Position Accounts payable and accrued liabilities Current portion of decommissioning and other provisions (Note 23) Risk management liabilities (Note 15 and 16) Current portion of contract liabilities (Note 5) Income taxes payable Dividends payable (Note 27 and 28) Current portion of long-term debt and lease liabilities (Note 24) Credit facilities, long-term debt and lease liabilities (Note 24) Exchangeable securities (Note 25) Decommissioning and other provisions (Note 23) Deferred income tax liabilities (Note 12) Risk management liabilities (Note 15 and 16) Contract liabilities (Note 5) Defined benefit obligation and other long-term liabilities (Note 26) Equity Common shares (Note 27) Preferred shares (Note 28) Contributed surplus Deficit Accumulated other comprehensive income (Note 29) Equity attributable to shareholders Non-controlling interests (Note 13) Total equity Total liabilities and equity 689482615995994 1989418 818 \begin{tabular}{rr} 62 & 59 \\ 844 & 105 \\ \hline 931 & 935 \\ \hline 423 & 3,256 \\ 735 & 730 \\ 779 & 614 \\ 354 & 396 \\ 145 & 68 \\ 13 & 14 \\ 253 & 298 \end{tabular} Conenlidatad Statamantenf Chanaac in Frulity Consolidated Statements of Cash Flows Answer these questions based on your overall analysis of the company: 1. What is the liquidity position of the company you are analyzing? 2. What is the liquidity trend of the company you are analyzing? 3. Based on your analysis, what is your recommendation to investors: hold, buy, sell? Provide one reason, supported with numbers or ratios, to justify your opinion. Consolidated Statements of Earnings (Loss) Year ended Dec. 31 (in millions of Canadian dollars except where noted) \begin{tabular}{lrl} 2021 & 2020 & 2019 \\ \hline \end{tabular} Revenues (Note 5) Fuel and purchased power (Note 6) 2,7211,0542,1018052,347881 Carbon compliance Gross margin Operations, maintenance and administration (Note 6) Depreciation and amortization Asset impairment charge (Note 7) Gain on termination of Keephills 3 coal rights contract (Note 18) Taxes, other than income taxes Termination of Sundance B and C PPAs Net other operating loss (income) (Note 9) Operating income (loss) Equity income (Note 10) Finance lease income Net interest expense (Note 11) Foreign exchange gain (loss) Gain on sale of assets and other (Note 4 and 18) Earnings (loss) before income taxes Income tax expense (recovery) (Note 12) Net earnings (loss) \begin{tabular}{rrr} 178 & 163 & 205 \\ \hline 1,489 & 1,133 & 1,261 \\ \hline 511 & 472 & 475 \\ 529 & 654 & 590 \\ 648 & 84 & 25 \end{tabular} Net earnings (loss) attributable to: \begin{tabular}{lrrr} \hline TransAlta shareholders & (537) & (287) & 82 \\ Non-controlling interests (Note 13) & 112 & 34 & (253) \\ \hline & (425) & 176 \\ \hline \end{tabular} Net earnings (loss) attributable to TransAlta shareholders Preferred share dividends (Note 28) Net earnings (loss) attributable to common shareholders Weighted average number of common shares outstanding in the year (millions) \begin{tabular}{rcr} \hline (537) & (287) & 82 \\ 39 & 49 & 30 \\ \hline (576) & (336) & 52 \\ \hline 271 & 275 & 283 \\ \hline \end{tabular} Net earnings (loss) per share attributable to common shareholders, basic and diluted (Note 27) (2.13) (1.22) 0.18 Consolidated Statements of Financial Position Accounts payable and accrued liabilities Current portion of decommissioning and other provisions (Note 23) Risk management liabilities (Note 15 and 16) Current portion of contract liabilities (Note 5) Income taxes payable Dividends payable (Note 27 and 28) Current portion of long-term debt and lease liabilities (Note 24) Credit facilities, long-term debt and lease liabilities (Note 24) Exchangeable securities (Note 25) Decommissioning and other provisions (Note 23) Deferred income tax liabilities (Note 12) Risk management liabilities (Note 15 and 16) Contract liabilities (Note 5) Defined benefit obligation and other long-term liabilities (Note 26) Equity Common shares (Note 27) Preferred shares (Note 28) Contributed surplus Deficit Accumulated other comprehensive income (Note 29) Equity attributable to shareholders Non-controlling interests (Note 13) Total equity Total liabilities and equity 689482615995994 1989418 818 \begin{tabular}{rr} 62 & 59 \\ 844 & 105 \\ \hline 931 & 935 \\ \hline 423 & 3,256 \\ 735 & 730 \\ 779 & 614 \\ 354 & 396 \\ 145 & 68 \\ 13 & 14 \\ 253 & 298 \end{tabular} Conenlidatad Statamantenf Chanaac in Frulity Consolidated Statements of Cash Flows Answer these questions based on your overall analysis of the company: 1. What is the liquidity position of the company you are analyzing? 2. What is the liquidity trend of the company you are analyzing? 3. Based on your analysis, what is your recommendation to investors: hold, buy, sell? Provide one reason, supported with numbers or ratios, to justify your opinion