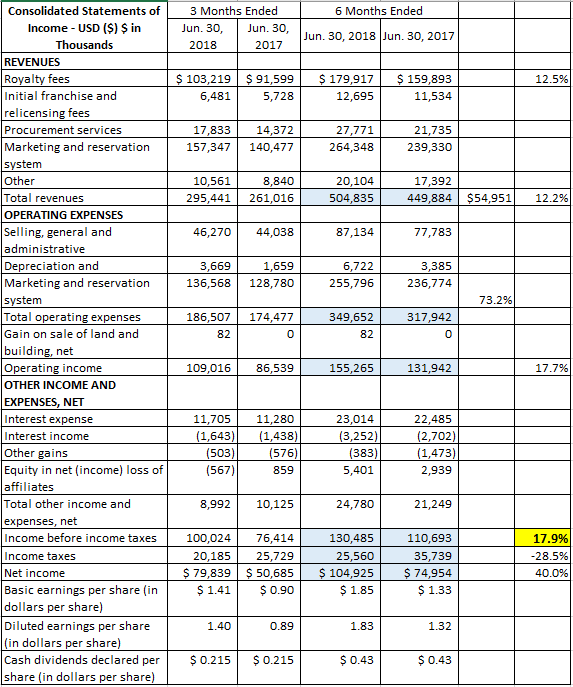

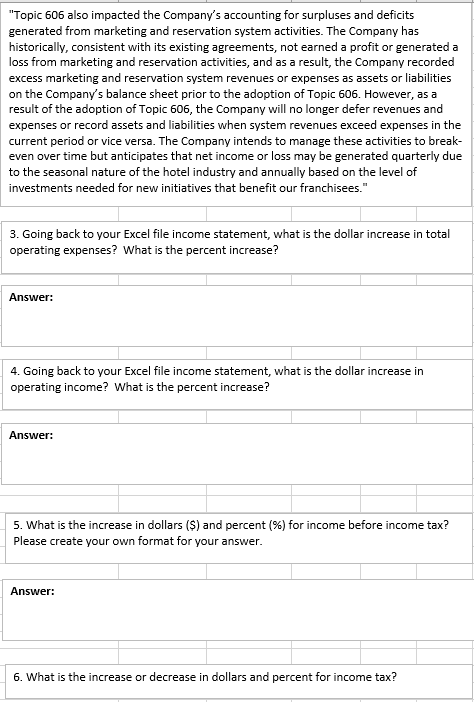

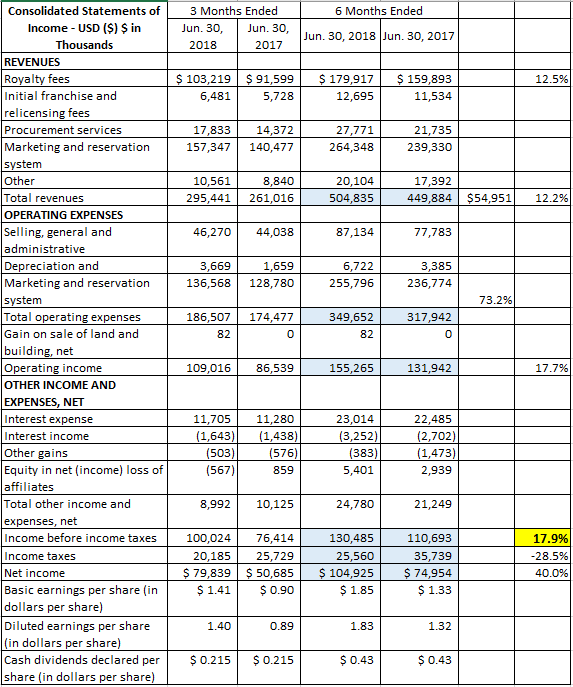

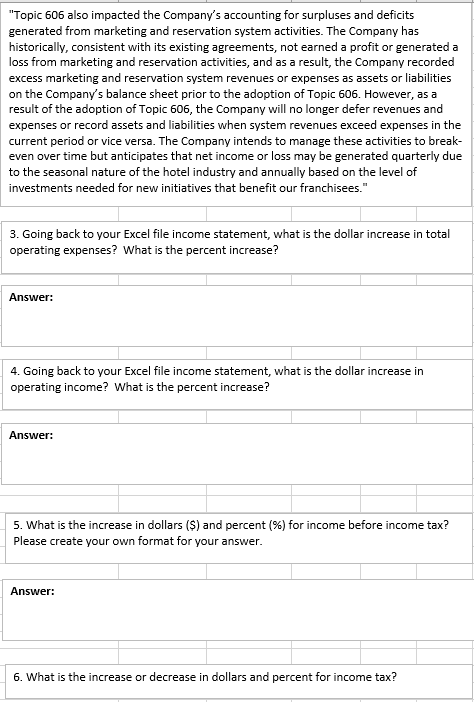

Consolidated Statements of Income- USD (S) $ in Thousands 3 Months Ended 6 Months Ended Jun. 30, 2018 Jun. 30, 2017 2018 2017 REVENUES 103,219 $ s $91,599 5,728 $159,893 11,534 ees 179,917 Initial franchise and relicensing fees Procurement services Marketing and reservation 6,481 12,695 17,833 14,372 157,347 140,477 27,771 21,735 239,330 264,348 10,561 20,104 17,392 Total revenues OPERATING EXPENSES Selling, general and administrative Depreciation and Marketing and reservation 295,441 261,016 46,270 44,038 1,659 504,835 87,134 6,722 449,884 $54,951 77,783 3,669 3,385 236,774 136,568 128,780 255,796 349,652 Total operating expenses Gain on sale of land and 186,507 174,477 317,942 0 0 86,539 155,265 Operating income OTHER INCOME AND EXPENSES, NET Interest expense Interest income Other gains Equity in net (income) loss of affiliates Total other incom expenses, net Income before income taxes 100,024 76,414 Income taxes Net income Basic earnings per share (irn dollars per share) Diluted earnings per share in dollars per share Cash dividends declared per0.215 $0.215 share (in dollars per share) 109,016 131,942 23,014 (3,252) (383) 5,401 11,705 11,280 (1,438) 22,485 2,702) (567) 859 8,992 10,125 24,780 e and 130,485 25,560 104,925 110,693 35,739 74,954 $1.33 17.9% 20,185 $ 79,839 25,729 0,685 $1.41 $0.90 40.0% 0.89 1.32 Topic 606 also impacted the Company's accounting for surpluses and deficits generated from marketing and reservation system activities. The Company has historically, consistent with its existing agreements, not earned a profit or generated a loss from marketing and reservation activities, and as a result, the Company recorded excess marketing and reservation system revenues or expenses as assets or liabilities on the Company's balance sheet prior to the adoption of Topic 606. However, as a result of the adoption of Topic 606, the Company will no longer defer revenues and expenses or record assets and liabilities when system revenues exceed expenses in the current period or vice versa. The Company intends to manage these activities to break even over time but anticipates that net income or loss may be generated quarterly due to the seasonal nature of the hotel industry and annually based on the level of investments needed for new initiatives that benefit our franchisees." 3. Going back to your Excel file income statement, what is the dollar increase in total operating expenses? What is the percent increase? Answer: 4. Going back to your Excel file income statement, what is the dollar increase in operating income? What is the percent increase? Answer: 5. what is the increase in dollars ($) and percent (%) for income before income tax? Please create your own format for your answer. Answer: 6. What is the increase or decrease in dollars and percent for income tax