Answered step by step

Verified Expert Solution

Question

1 Approved Answer

consolidated workseet entry needs to be done on 30th june 2018 Consolidated workseet entry needs to be done on june 30th 2018 Case Study Sovereign

consolidated workseet entry needs to be done on 30th june 2018

Consolidated workseet entry needs to be done on june 30th 2018

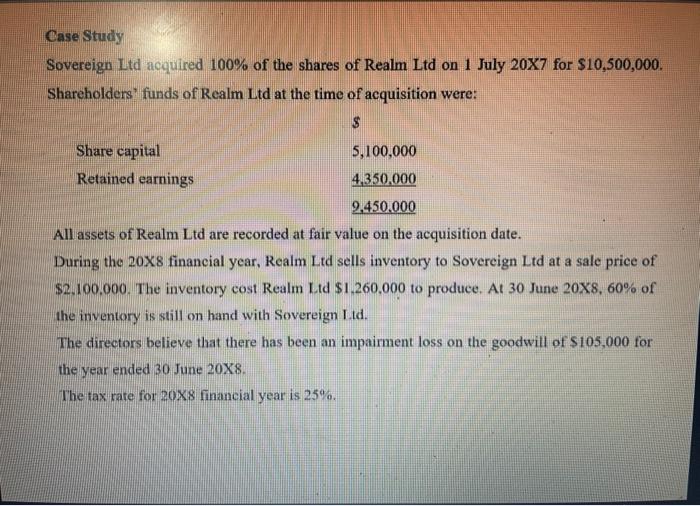

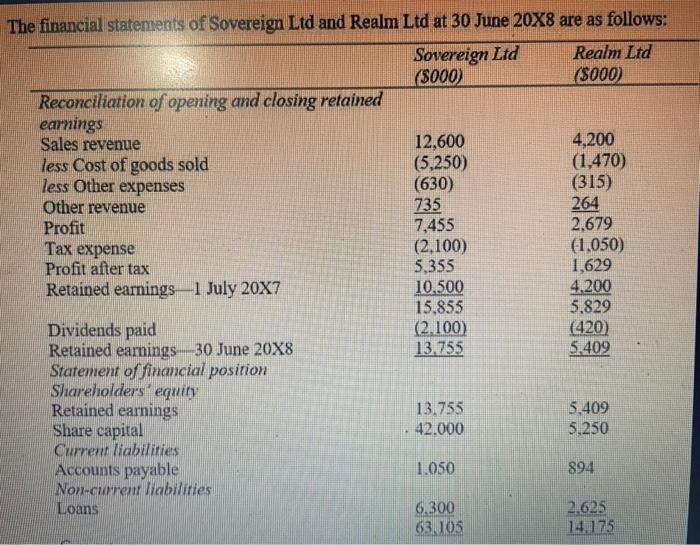

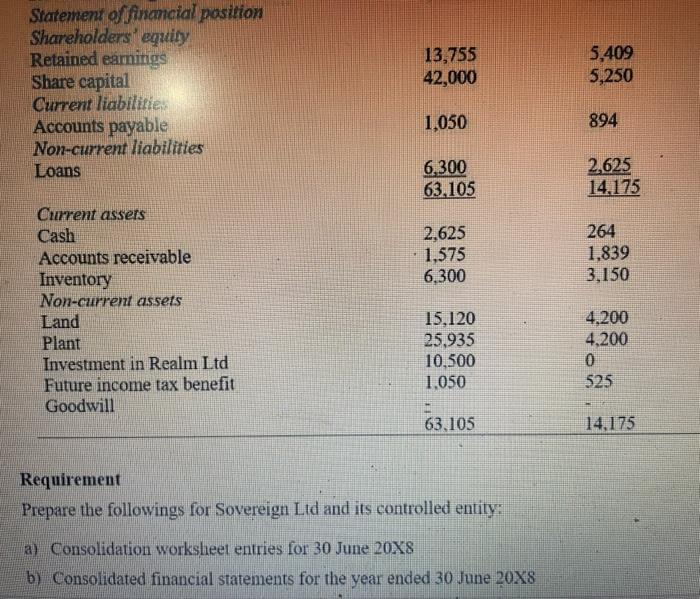

Case Study Sovereign Ltd acquired 100% of the shares of Realm Ltd on 1 July 20X7 for $10,500,000. Shareholders' funds of Realm Ltd at the time of acquisition were: All assets of Realm Ltd are recorded at fair value on the acquisition date. During the 20X8 financial year, Realm Ltd sells inventory to Sovereign Ltd at a sale price of $2,100,000. The inventory cost Realm L.td $1,260,000 to produce. At 30 June 208,60% of the inventory is still on hand with Sovereign I.td. The directors believe that there has been an impairment loss on the goodwill of $105,000 for the year ended 30 June 208. The tax rate for 208 financial year is 25% The financial statements of Sovereign Ltd and Realm Ltd at 30 June 20X8 are as follows: Requirement Prepare the followings for Sovereign Lid and its controlled entity: a) Consolidation worksheet entries for 30 June 20X8 b) Consolidated financial statements for the year ended 30 June 208 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started