Question

Consolidation Working Paper, Date of Acquisition On July 1, 2020, Petra Foods acquired 75 percent of the common stock of Schmidt Confections. The $1.2 billion

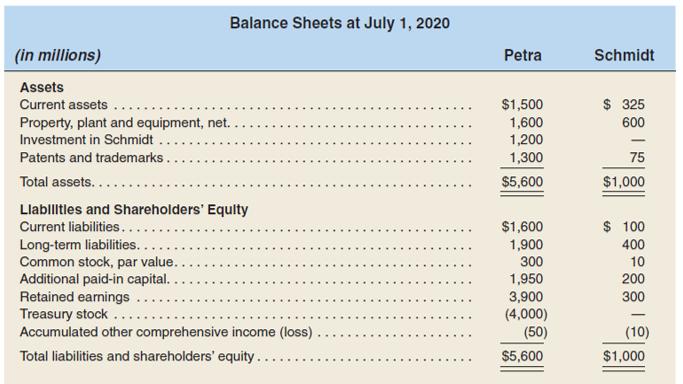

Consolidation Working Paper, Date of Acquisition On July 1, 2020, Petra Foods acquired 75 percent of the common stock of Schmidt Confections. The $1.2 billion purchase price was paid in cash. The acquisition entry is reflected below in the two companies' balance sheets just after the acquisition.

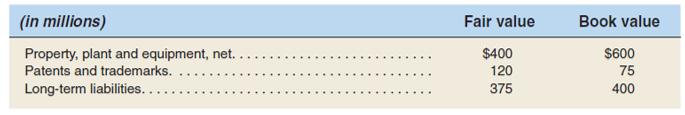

Independent appraisals produced the following fair value estimates for certain of Schmidt's previously recorded assets and liabilities. In addition, previously unreported customer-related intangibles have an estimated fair value of $30 million. Schmidt's noncontrolling interest has an estimated fair value of $375 million.

Required

a. Prepare a schedule to compute the total goodwill and its allocation to the controlling and noncontrolling interest.

b. Prepare a working paper to consolidate the balance sheets of Petra and Schmidt at July 1, 2020.

c. Prepare a formal consolidated balance sheet for Petra and Schmidt at July 1, 2020.

Balance Sheets at July 1, 2020 (in millions) Petra Schmidt Assets Current assets $ 325 $1,500 1,600 1,200 1,300 Property, plant and equipment, net. 600 Investment in Schmidt Patents and trademarks.. Total assets.... 75 $5,600 $1,000 Llablitles and Shareholders' Equity Current liabilities.. Long-term liabilities.. Common stock, par value. Additional paid-in capital. Retained earnings Treasury stock ... Accumulated other comprehensive income (loss) $ 100 $1,600 1,900 300 400 10 200 1,950 3,900 (4,000) (50) 300 (10) Total liabilities and shareholders' equity... $5,600 $1,000

Step by Step Solution

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a in millions Acquisition Cost 1200 Fair Value of noncontrolling interest 375 Total Fair Value 1575 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started