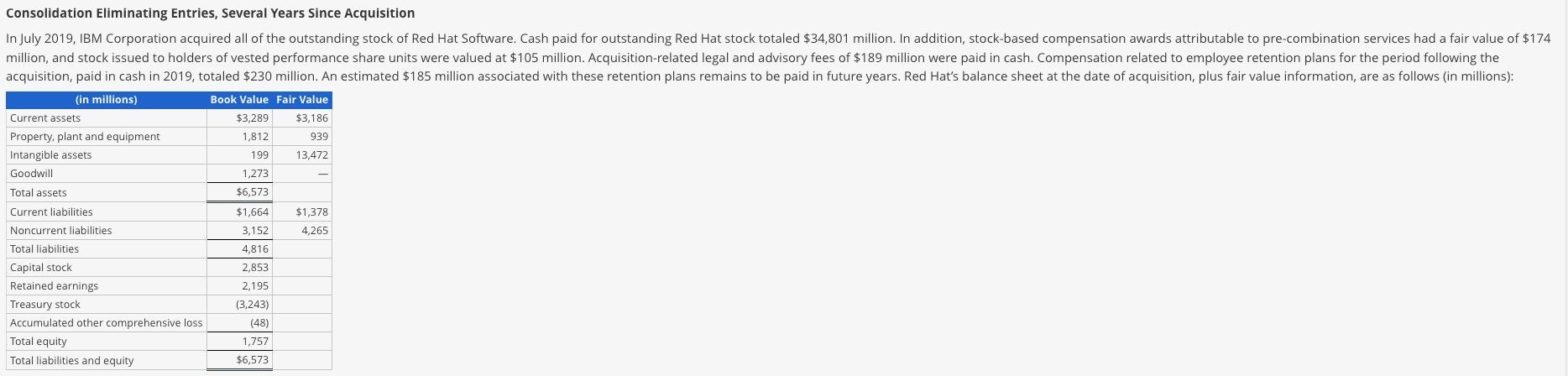

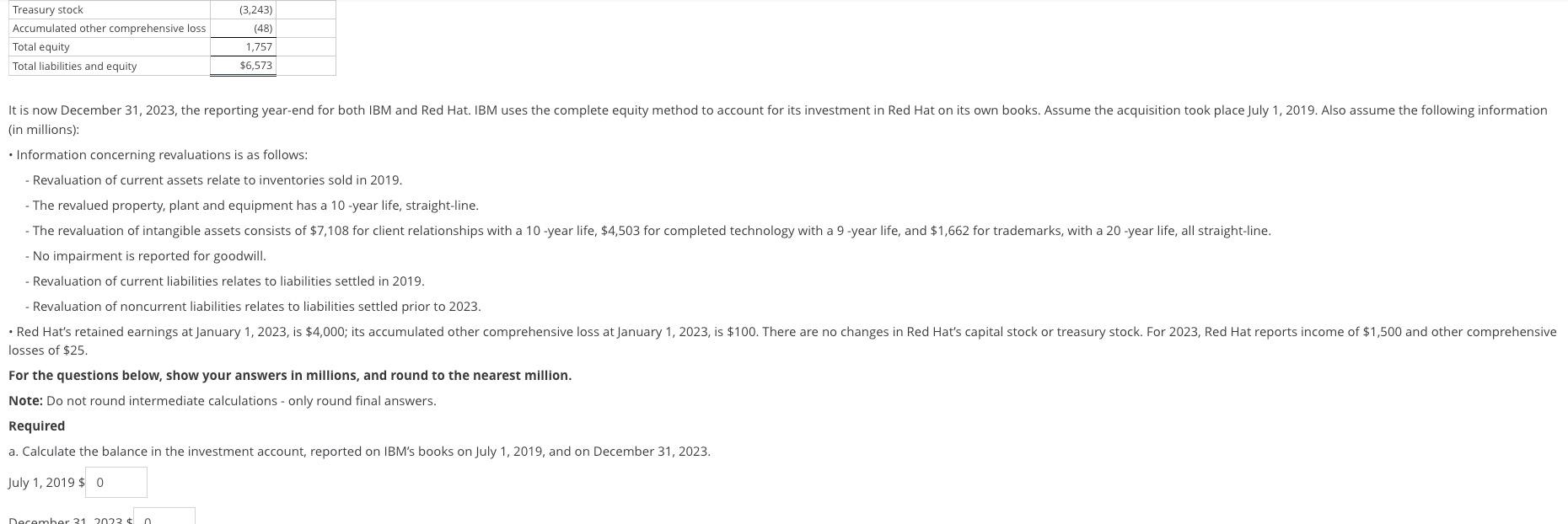

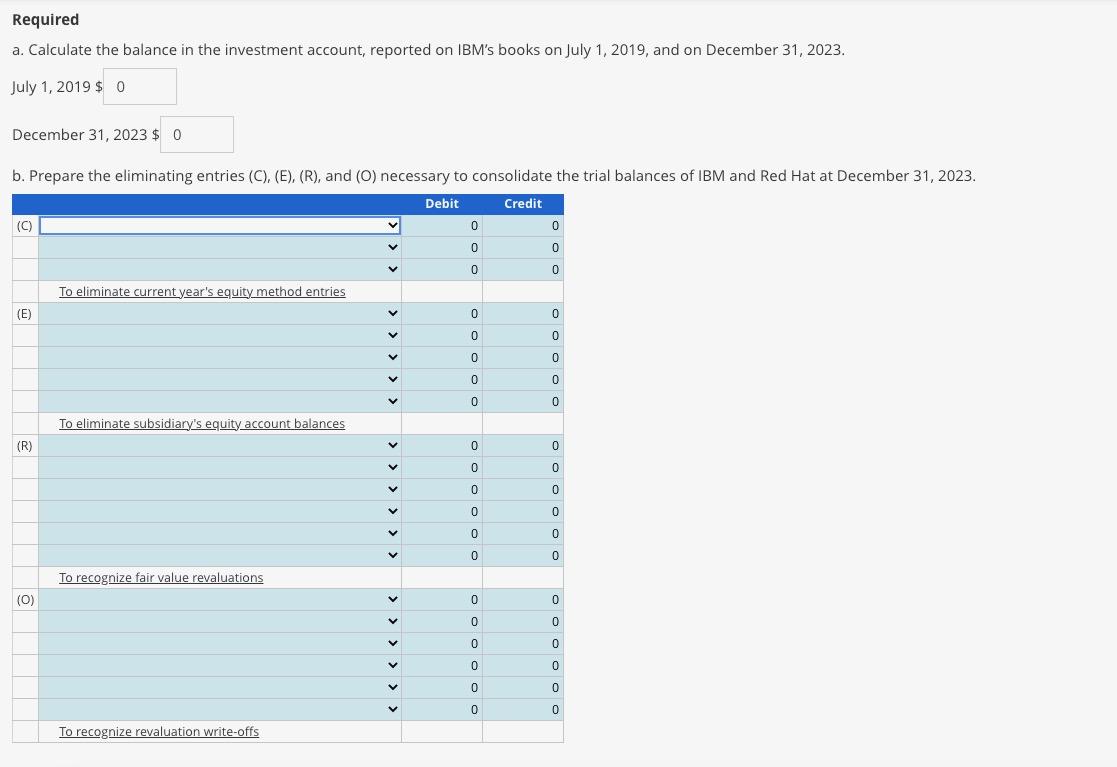

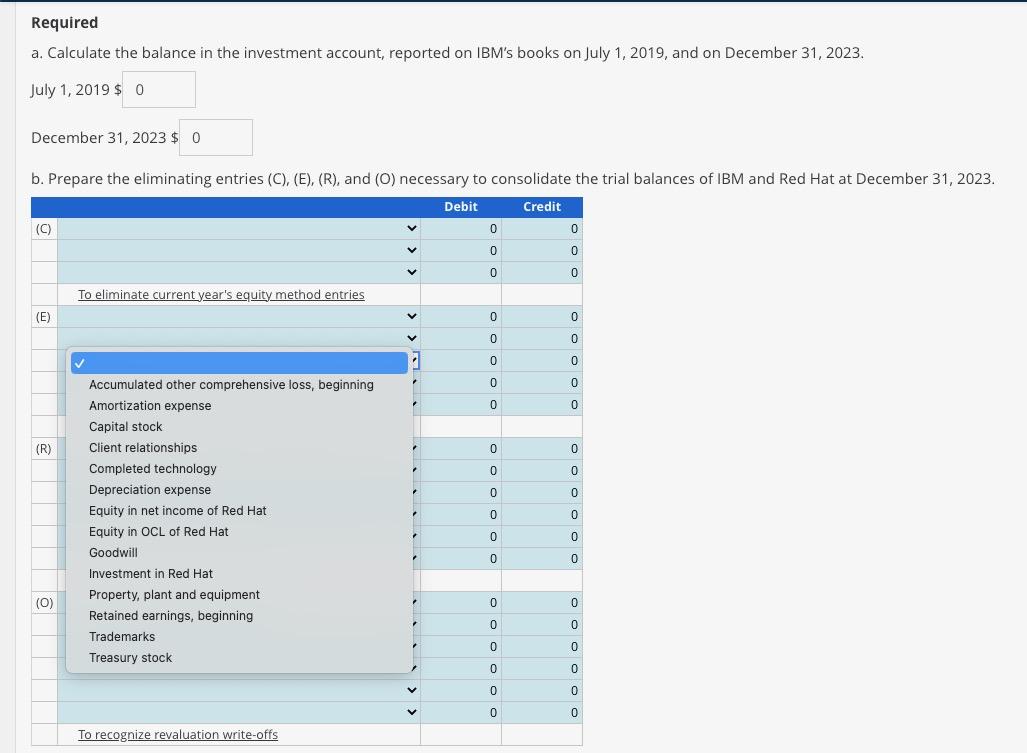

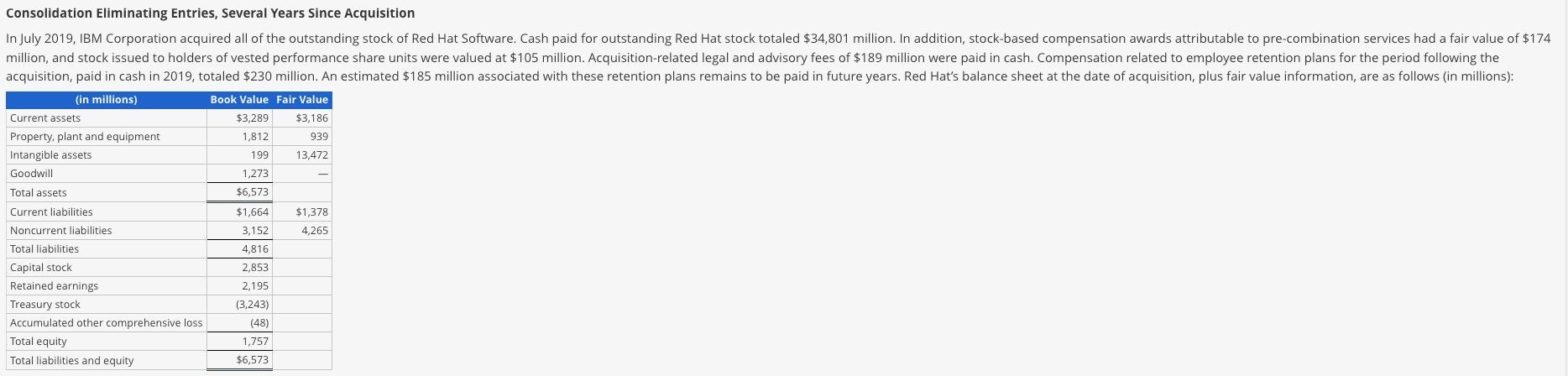

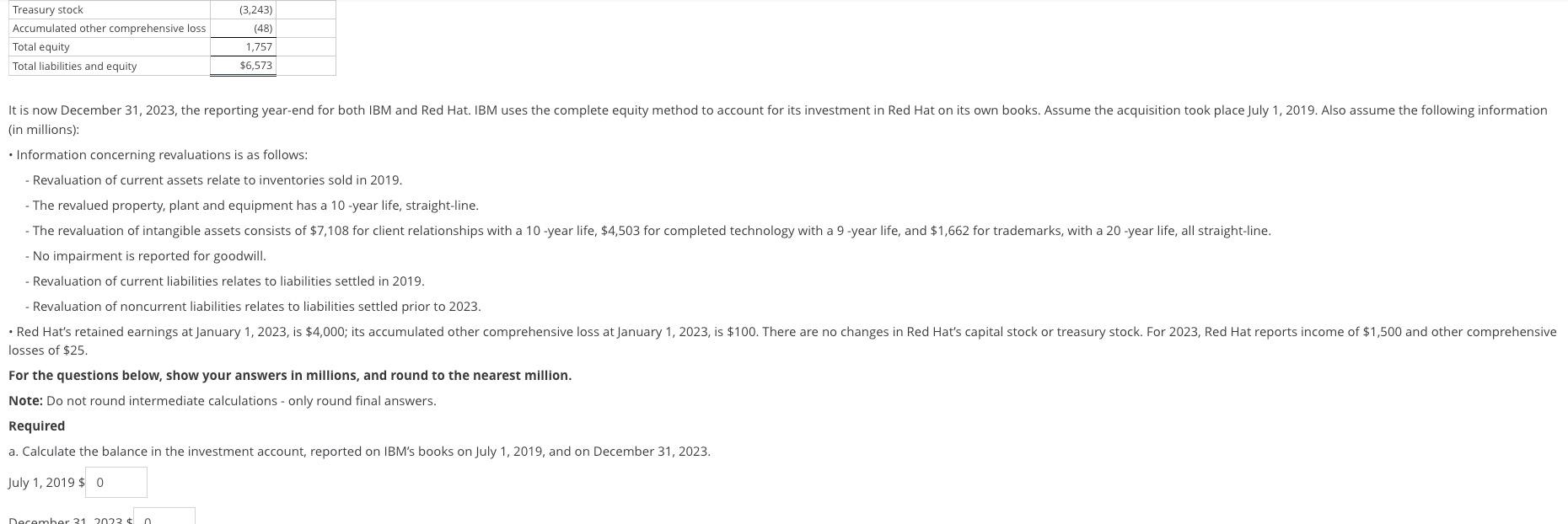

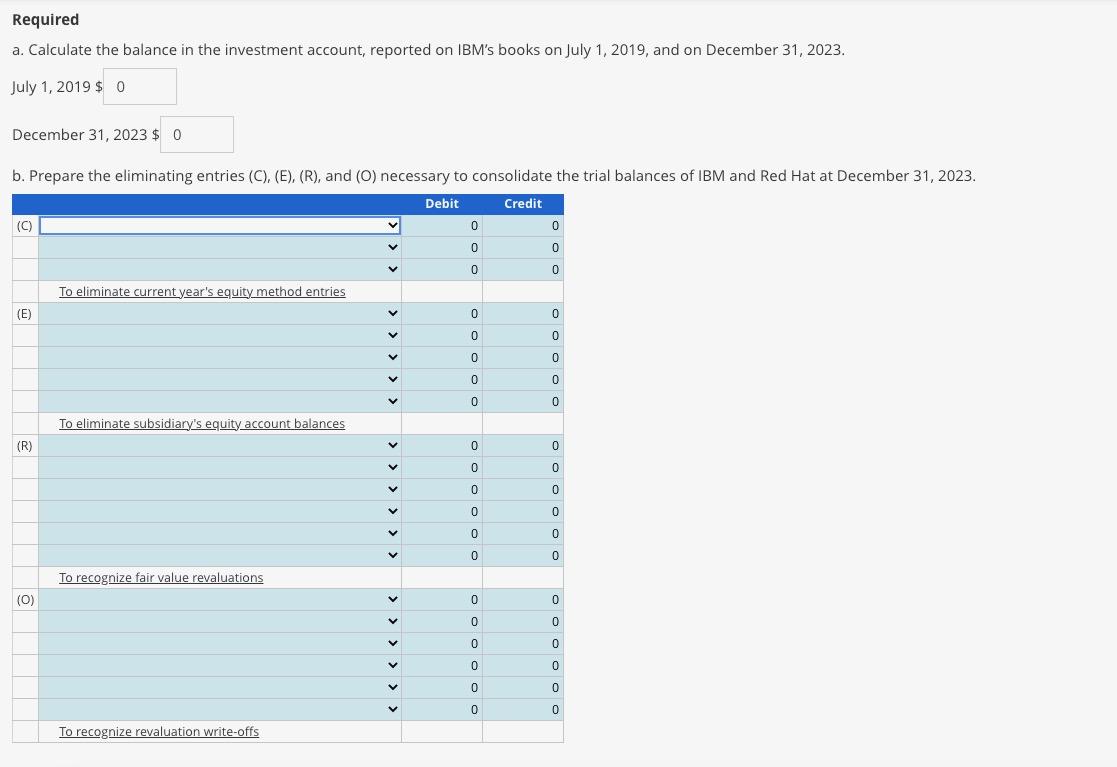

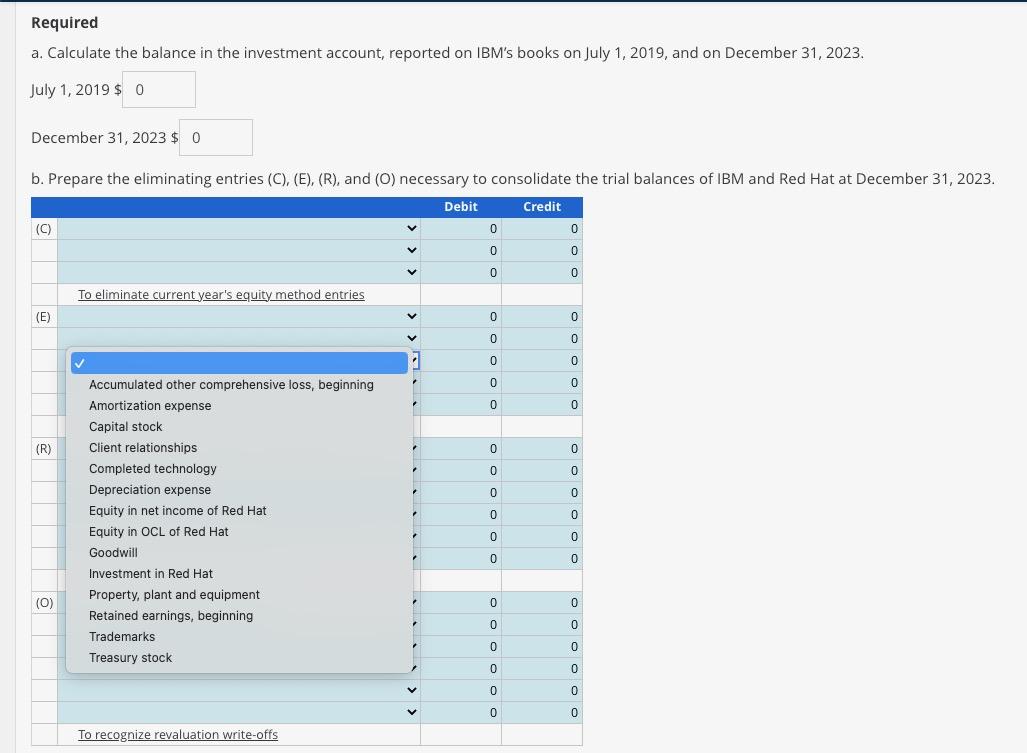

Consolidation Eliminating Entries, Several Years Since Acquisition (in millions): - Information concerning revaluations is as follows: - Revaluation of current assets relate to inventories sold in 2019. - The revalued property, plant and equipment has a 10 -year life, straight-line. - No impairment is reported for goodwill. - Revaluation of current liabilities relates to liabilities settled in 2019. - Revaluation of noncurrent liabilities relates to liabilities settled prior to 2023. losses of $25. For the questions below, show your answers in millions, and round to the nearest million. Note: Do not round intermediate calculations - only round final answers. Required a. Calculate the balance in the investment account, reported on IBM's books on July 1, 2019, and on December 31,2023. July 1,2019$ Required a. Calculate the balance in the investment account, reported on IBM's books on July 1, 2019, and on December 31,2023. July 1,2019$ December 31,2023$ Required a. Calculate the balance in the investment account, reported on IBM's books on July 1, 2019, and on December 31,2023. July 1,2019$ December 31,2023$ Consolidation Eliminating Entries, Several Years Since Acquisition (in millions): - Information concerning revaluations is as follows: - Revaluation of current assets relate to inventories sold in 2019. - The revalued property, plant and equipment has a 10 -year life, straight-line. - No impairment is reported for goodwill. - Revaluation of current liabilities relates to liabilities settled in 2019. - Revaluation of noncurrent liabilities relates to liabilities settled prior to 2023. losses of $25. For the questions below, show your answers in millions, and round to the nearest million. Note: Do not round intermediate calculations - only round final answers. Required a. Calculate the balance in the investment account, reported on IBM's books on July 1, 2019, and on December 31,2023. July 1,2019$ Required a. Calculate the balance in the investment account, reported on IBM's books on July 1, 2019, and on December 31,2023. July 1,2019$ December 31,2023$ Required a. Calculate the balance in the investment account, reported on IBM's books on July 1, 2019, and on December 31,2023. July 1,2019$ December 31,2023$