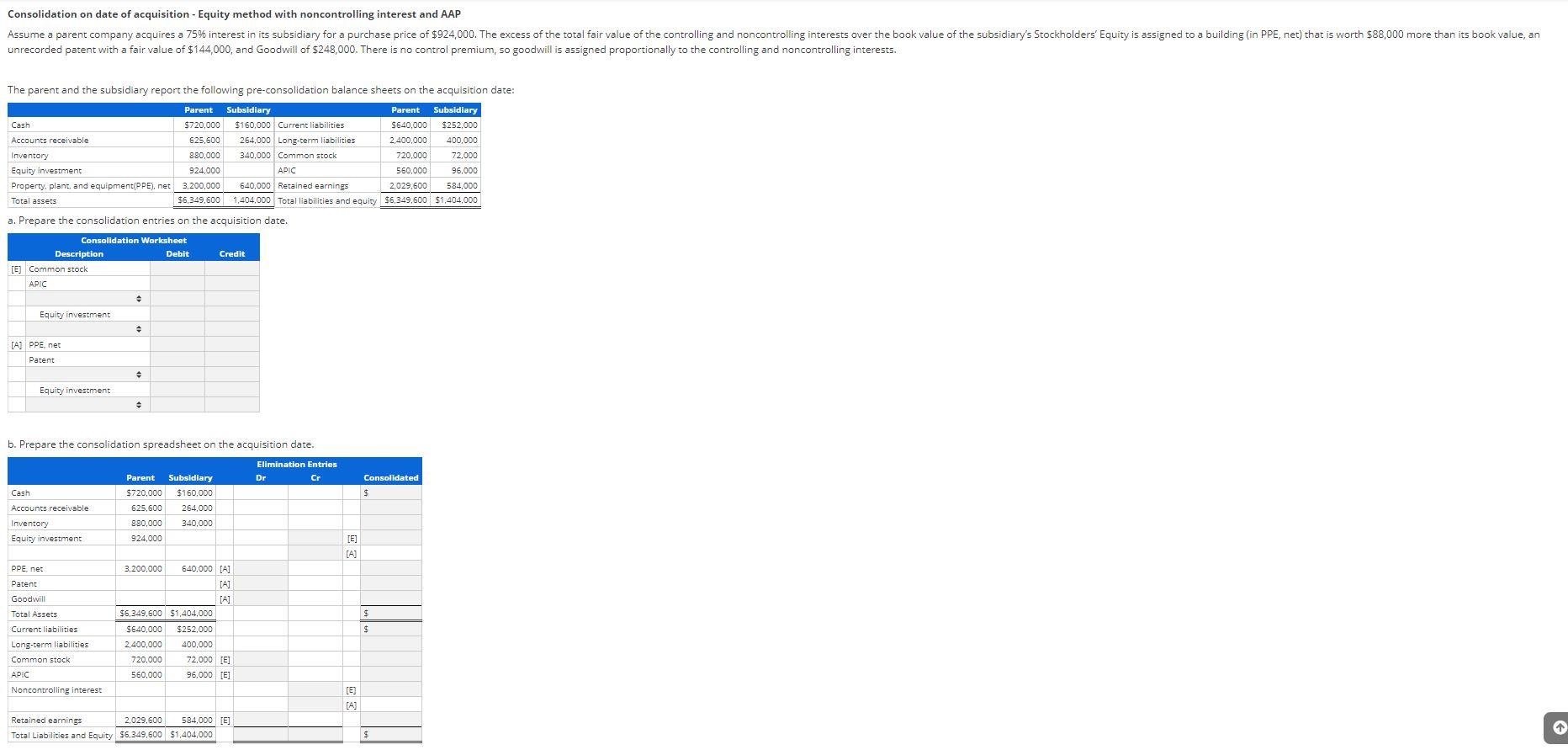

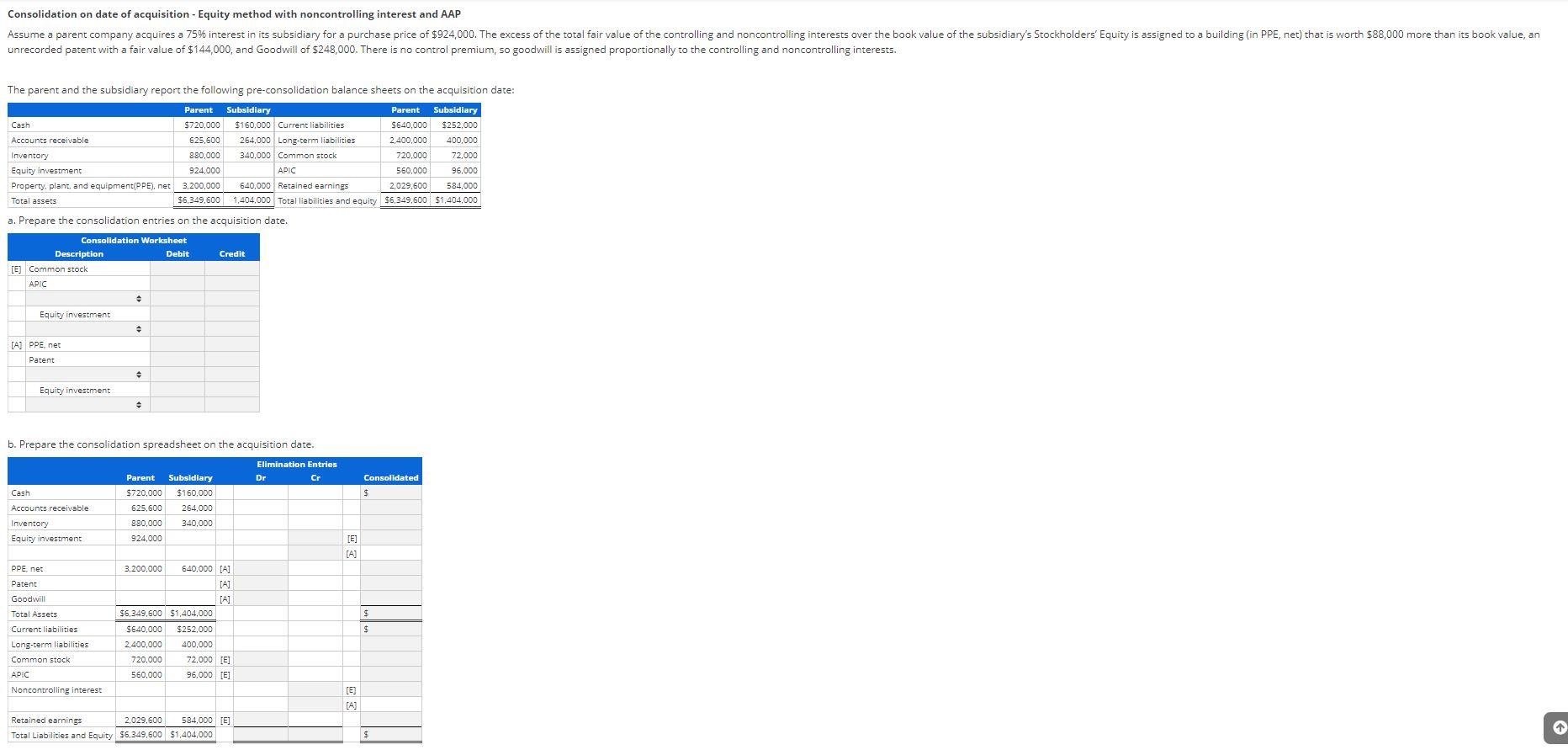

Consolidation on date of acquisition - Equity method with noncontrolling interest and AAP Assume a parent company acquires a 75% interest in its subsidiary for a purchase price of $924,000. The excess of the total fair value of the controlling and noncontrolling interests over the book value of the subsidiary's Stockholders' Equity is assigned to a building (in PPE, net) that is worth $88,000 more than its book value, an unrecorded patent with a fair value of $144,000, and Goodwill of $248,000. There is no control premium, so goodwill is assigned proportionally to the controlling and noncontrolling interests. The parent and the subsidiary report the following pre-consolidation balance sheets on the acquisition date: Parent Subsidiary Parent Subsidiary Cash $720,000 $160,000 Current liabilities $640,000 $ 252.000 Accounts receivable 625,600 264.000 Long-term liabilities 2,400,000 400,000 Inventory 880,000 340,000 Common stock 720,000 72,000 Equity investment 924.000 APIC 560,000 96,000 Property, plant, and equipment(PPE), net 3,200,000 640,000 Retained earnings 2,029,600 584.000 Total assets $6,349,600 1,404,000 Total liabilities and equity $6,349,600 $1,404,000 a. Prepare the consolidation entries on the acquisition date. Consolidation Worksheet Description Debit Credit [E] Common stock APIC Equity investment [A] PPE.net Patent Equity investment b. Prepare the consolidation spreadsheet on the acquisition date. Elimination Entries Dr Cr Consolidated Cash Subsidiary $160.000 264,000 340,000 Parent $720,000 625,600 880,000 924,000 Accounts receivable Inventory Equity investment [E] [A] 3.200.000 640.000 [A] $ PPE, net Patent Goodwill Total Assets Current liabilities Long-term liabilities Common stock APIC Noncontrolling interest [A] [Al $6,349,600 $1,404,000 $640,000 $252,000 2,400.000 400.000 720,000 72.000 [E] 560,000 96,000 LEI S [A] Retained earnings 2.029.600 584.000 IE) Total Liabilities and Equity 56,349,600 $1,404,000 Consolidation on date of acquisition - Equity method with noncontrolling interest and AAP Assume a parent company acquires a 75% interest in its subsidiary for a purchase price of $924,000. The excess of the total fair value of the controlling and noncontrolling interests over the book value of the subsidiary's Stockholders' Equity is assigned to a building (in PPE, net) that is worth $88,000 more than its book value, an unrecorded patent with a fair value of $144,000, and Goodwill of $248,000. There is no control premium, so goodwill is assigned proportionally to the controlling and noncontrolling interests. The parent and the subsidiary report the following pre-consolidation balance sheets on the acquisition date: Parent Subsidiary Parent Subsidiary Cash $720,000 $160,000 Current liabilities $640,000 $ 252.000 Accounts receivable 625,600 264.000 Long-term liabilities 2,400,000 400,000 Inventory 880,000 340,000 Common stock 720,000 72,000 Equity investment 924.000 APIC 560,000 96,000 Property, plant, and equipment(PPE), net 3,200,000 640,000 Retained earnings 2,029,600 584.000 Total assets $6,349,600 1,404,000 Total liabilities and equity $6,349,600 $1,404,000 a. Prepare the consolidation entries on the acquisition date. Consolidation Worksheet Description Debit Credit [E] Common stock APIC Equity investment [A] PPE.net Patent Equity investment b. Prepare the consolidation spreadsheet on the acquisition date. Elimination Entries Dr Cr Consolidated Cash Subsidiary $160.000 264,000 340,000 Parent $720,000 625,600 880,000 924,000 Accounts receivable Inventory Equity investment [E] [A] 3.200.000 640.000 [A] $ PPE, net Patent Goodwill Total Assets Current liabilities Long-term liabilities Common stock APIC Noncontrolling interest [A] [Al $6,349,600 $1,404,000 $640,000 $252,000 2,400.000 400.000 720,000 72.000 [E] 560,000 96,000 LEI S [A] Retained earnings 2.029.600 584.000 IE) Total Liabilities and Equity 56,349,600 $1,404,000