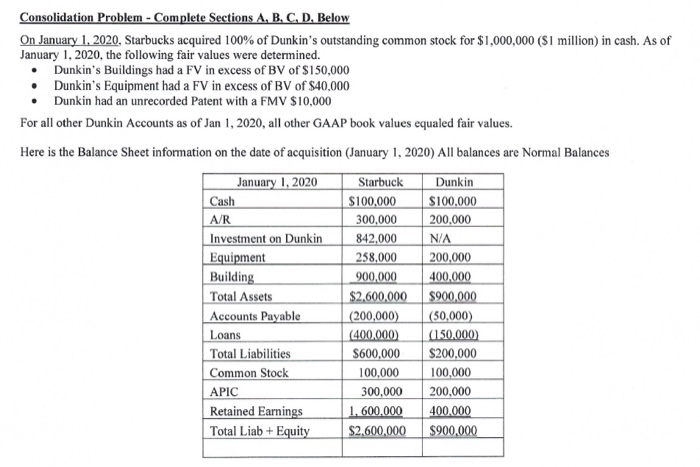

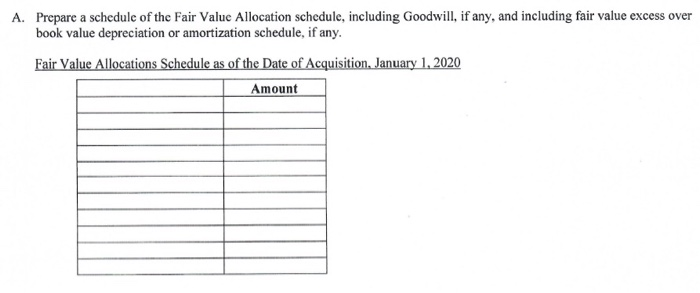

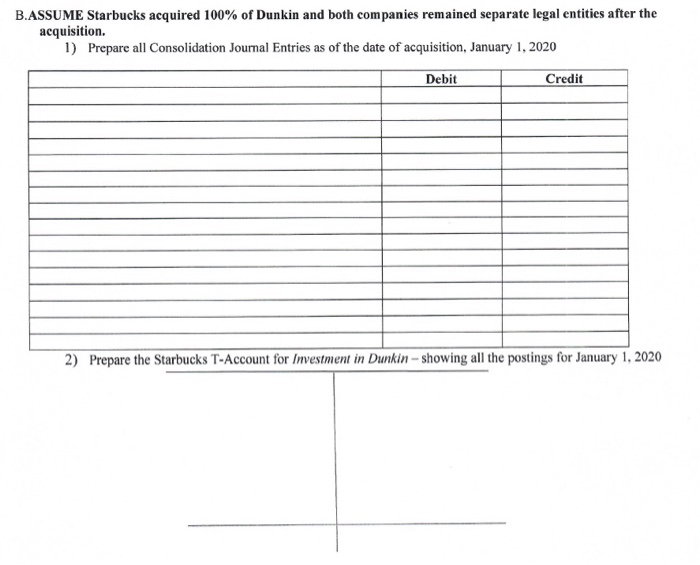

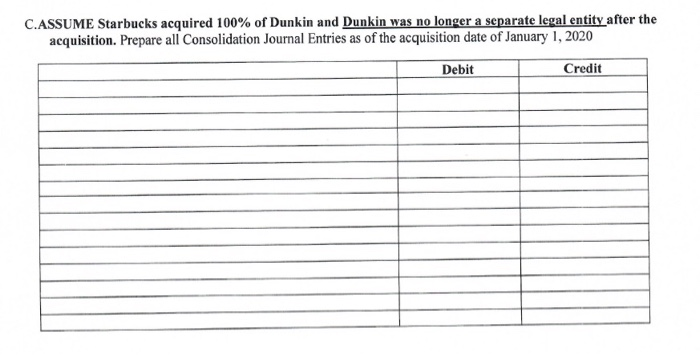

Consolidation Problem - Complete Sections A, B, C, D, Below On January 1, 2020, Starbucks acquired 100% of Dunkin's outstanding common stock for $1,000,000 ($1 million) in cash. As of January 1, 2020, the following fair values were determined. Dunkin's Buildings had a FV in excess of BV of $150,000 Dunkin's Equipment had a FV in excess of BV of $40,000 Dunkin had an unrecorded Patent with a FMV $10,000 For all other Dunkin Accounts as of Jan 1, 2020, all other GAAP book values equaled fair values. Here is the Balance Sheet information on the date of acquisition (January 1, 2020) All balances are Normal Balances January 1, 2020 Starbuck Dunkin Cash $100,000 $100,000 A/R 300,000 200.000 Investment on Dunkin 842,000 NA Equipment 258,000 200,000 Building 900,000 400.000 Total Assets $2,600,000 $900,000 Accounts Payable (200,000) (50,000) (400,000) (150.000) Total Liabilities $600,000 $200,000 Common Stock 100,000 100,000 APIC 300,000 200,000 Retained Earnings 1.600.000 400.000 Total Liab + Equity $2,600,000 $900.000 Loans A. Prepare a schedule of the Fair Value Allocation schedule, including Goodwill, if any, and including fair value excess over book value depreciation or amortization schedule, if any. Fair Value Allocations Schedule as of the Date of Acquisition. January 1, 2020 Amount B.ASSUME Starbucks acquired 100% of Dunkin and both companies remained separate legal entities after the acquisition. 1) Prepare all Consolidation Journal Entries as of the date of acquisition, January 1, 2020 Debit Credit 2) Prepare the Starbucks T-Account for Investment in Dunkin-showing all the postings for January 1, 2020 C.ASSUME Starbucks acquired 100% of Dunkin and Dunkin was no longer a separate legal entity after the acquisition. Prepare all Consolidation Journal Entries as of the acquisition date of January 1, 2020 Debit Credit Consolidation Problem - Complete Sections A, B, C, D, Below On January 1, 2020, Starbucks acquired 100% of Dunkin's outstanding common stock for $1,000,000 ($1 million) in cash. As of January 1, 2020, the following fair values were determined. Dunkin's Buildings had a FV in excess of BV of $150,000 Dunkin's Equipment had a FV in excess of BV of $40,000 Dunkin had an unrecorded Patent with a FMV $10,000 For all other Dunkin Accounts as of Jan 1, 2020, all other GAAP book values equaled fair values. Here is the Balance Sheet information on the date of acquisition (January 1, 2020) All balances are Normal Balances January 1, 2020 Starbuck Dunkin Cash $100,000 $100,000 A/R 300,000 200.000 Investment on Dunkin 842,000 NA Equipment 258,000 200,000 Building 900,000 400.000 Total Assets $2,600,000 $900,000 Accounts Payable (200,000) (50,000) (400,000) (150.000) Total Liabilities $600,000 $200,000 Common Stock 100,000 100,000 APIC 300,000 200,000 Retained Earnings 1.600.000 400.000 Total Liab + Equity $2,600,000 $900.000 Loans A. Prepare a schedule of the Fair Value Allocation schedule, including Goodwill, if any, and including fair value excess over book value depreciation or amortization schedule, if any. Fair Value Allocations Schedule as of the Date of Acquisition. January 1, 2020 Amount B.ASSUME Starbucks acquired 100% of Dunkin and both companies remained separate legal entities after the acquisition. 1) Prepare all Consolidation Journal Entries as of the date of acquisition, January 1, 2020 Debit Credit 2) Prepare the Starbucks T-Account for Investment in Dunkin-showing all the postings for January 1, 2020 C.ASSUME Starbucks acquired 100% of Dunkin and Dunkin was no longer a separate legal entity after the acquisition. Prepare all Consolidation Journal Entries as of the acquisition date of January 1, 2020 Debit Credit