Question

Consolidation Question PAPA Inc. purchased 85% of the voting shares of SMALL Inc for $1,000,000 cash on January 1, 2023; in addition, the purchase agreement

Consolidation Question

PAPA Inc. purchased 85% of the voting shares of SMALL Inc for $1,000,000 cash on January 1, 2023; in addition, the purchase agreement also included a contingent consideration payable in cash on January 1, 2029. Assume that since the acquisition date management believes that $200,000 is the contingent consideration likely to become payable on January 1, 20X9 (ignore time value of money). PAPA uses the cost method to account for its investment. On that date, SMALLs Common Stock and Retained Earnings were valued at $300,000 and $500,000 respectively.

SMALLs fair values approximated its carrying values with the following exceptions:

- The equipment had a fair value which was $120,000 higher than its carrying value, and was estimated to have a remaining useful life of 10 years from the date of acquisition with no salvage value.

- SMALLs inventory had a fair value which was $15,000 less than book value. This inventory was sold by SMALL in 20X3.

- SMALLs skilled workforce had an exceptional reputation in the industry. Experts believed that the reputation of the work force should be valued at $225,000.

Both companies use straight line amortization exclusively for all assets and liabilities. The effective tax rate for both companies is 40%.

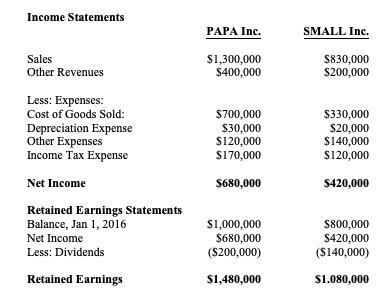

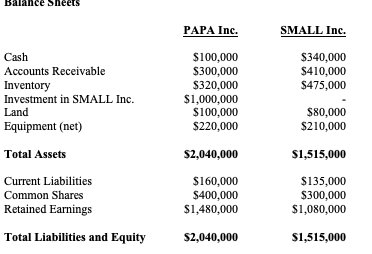

The Financial Statements of PAPA & SMALL for the Year ended December 31, 2026, are shown below:

Other Information:

- During 2026, SMALL sold a parcel of land to PAPA for $100,000 cash. SMALL had purchased this land in 2022 for $60,000. PAPA is currently using the land to hold excess inventory.

- During 2026 PAPA charged SMALL $45,000 of rental fees. SMALL did NOT pay this amount in 2026 but expects to pay the full $45,000 sometime in 20X7.

- During December 20X6, SMALL sold inventory to PAPA for $100,000 cash, the cost of the inventory to SMALL was $70,000. 50% of these goods remained in PAPAs inventory at the end of 2026.

- During December 2025, PAPA sold inventory to SMALL for $60,000 cash, the cost of the inventory to PAPA was $40,000. 40% of these goods remained in SMALLs inventory at the end of 2025. SMALL eventually sold the entire inventory to an outside customer in 2026.

- Year 2024 there was impairment in GW of $35,000.

- The effective tax rate for both companies is 40%.

- PAPA has recorded the investment in SMALL at Cost.

- For Consolidation PAPA uses the Fair Value Enterprise (FVE) method.

Required

- Calculate the amount of Goodwill arising from this combination.

- Prepare Amortization schedule of acquisition differential

- Prepare Schedule of Realized/Unrealized Profits

- Calculate Consolidated Net Income AND show Net Income attributable to PAPA shareholders and NCI shareholders.

- Prepare Consolidated financial statements (Income Statement, Balance Sheet, Statement of Retained Earnings) in excel and show all supporting calculations.

- One sheet should be for supporting calculations

- One sheet for the consolidated statements. Link all consolidation adjustments to supporting schedule in excel.

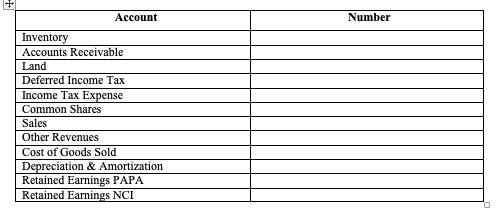

- One sheet for summary values below in excel. What are the values for the following accounts on PAPA consolidated financial statements for 2026.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started