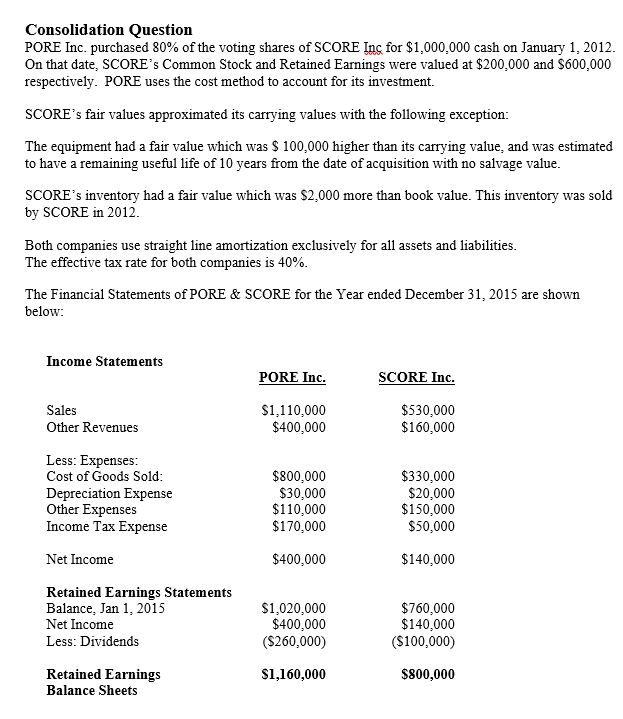

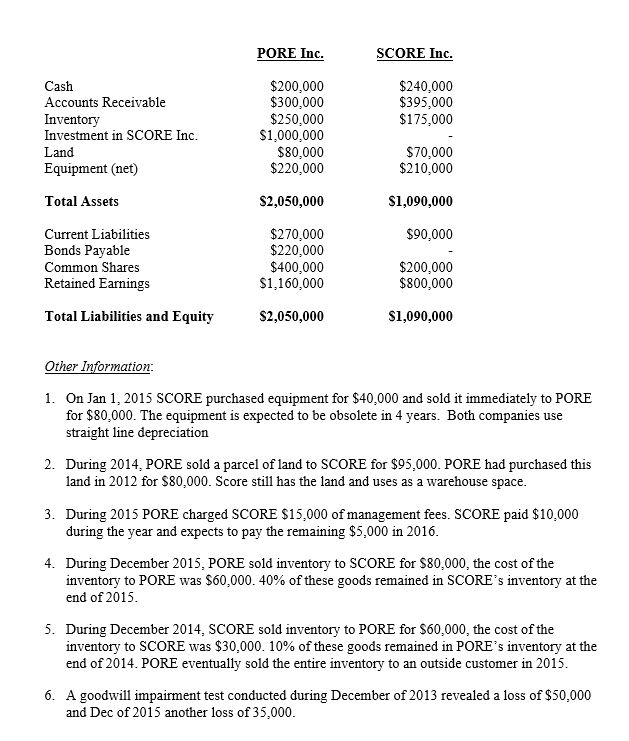

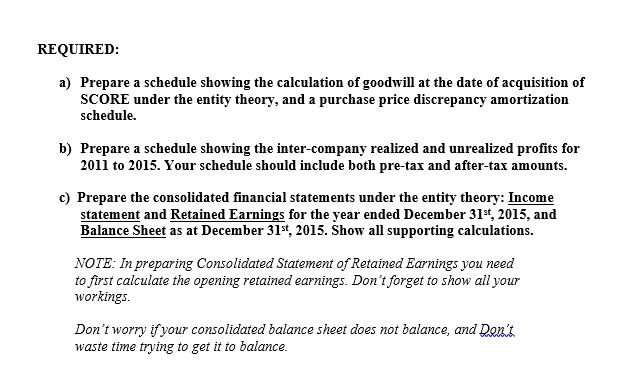

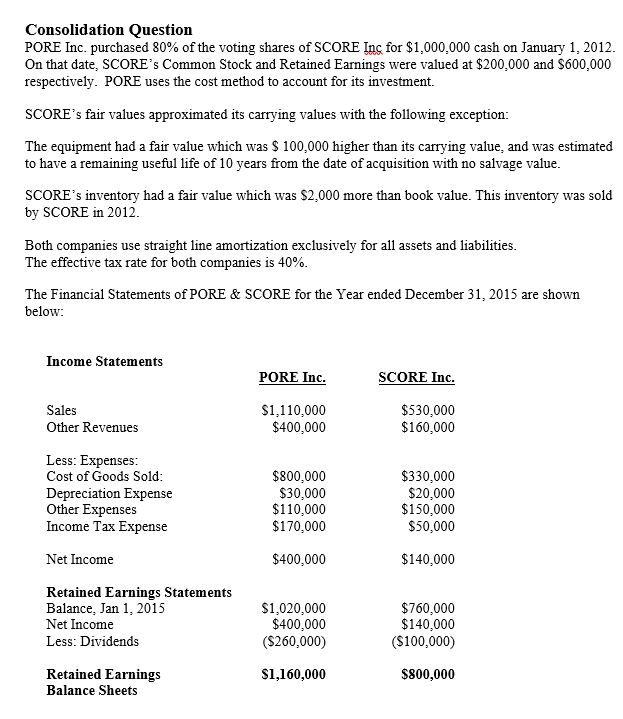

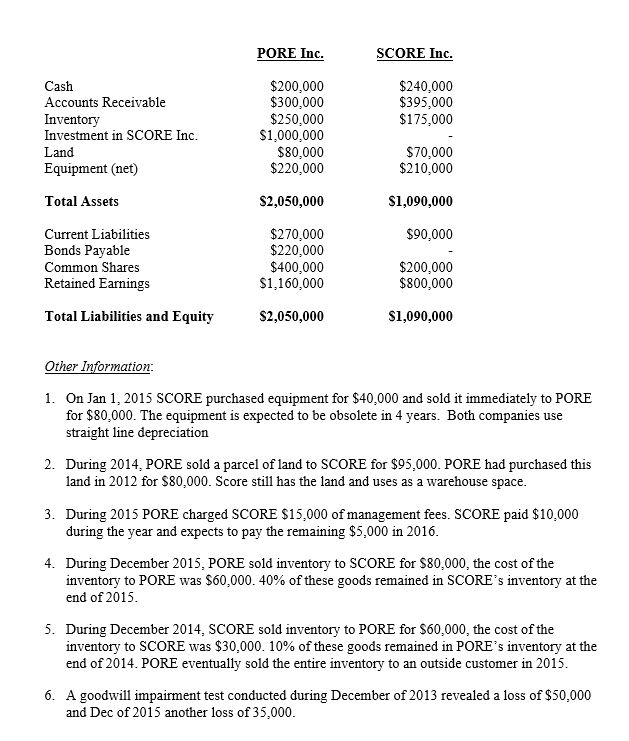

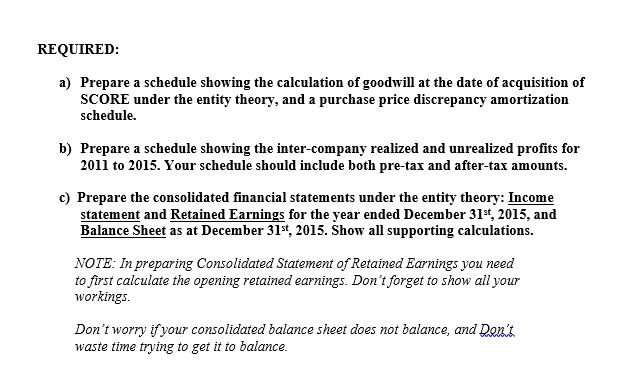

Consolidation Question PORE Inc. purchased 80% of the voting shares of SCORE Ink for $1,000,000 cash on January 1, 2012. On that date, SCORE's Common Stock and Retained Earnings were valued at $200,000 and S600,000 respectively. PORE uses the cost method to account for its investment. SCORE's fair values approximated its carrying values with the following exception The equipment had a fair value which was S 100,000 higher than its carrying value, and was estimated to have a remaining useful life of 10 years from the date of acquisition with no salvage value SCORE's inventory had a fair value which was S2,000 more than book value. This inventory was sold by SCORE in 2012 Both companies use straight line amortization exclusively for all assets and liabilities The effective tax rate for both companies is 40% The Financial Statements of PORE & SCORE for the Year ended December 31,2015 are showin below: Income Statements PORE Inc SCORE Inc Sales Other Revenues S1,110,000 $400,000 $530,000 $160,000 ses ess Cost of Goods Sold Depreciation Expense Other Expenses Income Tax Expense $800,000 S30,000 $110,000 $170,000 $330,000 $20,000 $150,000 $50,000 Net Income $400,000 $140,000 Retained Earnings Statements Balance, Jan 1, 2015 Net Income Less: Dividends $1,020,000 $400,000 (S260,000) $760,000 $140,000 (S100,000) Retained Earnings Balance Sheets S1,160,000 $800,000 Consolidation Question PORE Inc. purchased 80% of the voting shares of SCORE Ink for $1,000,000 cash on January 1, 2012. On that date, SCORE's Common Stock and Retained Earnings were valued at $200,000 and S600,000 respectively. PORE uses the cost method to account for its investment. SCORE's fair values approximated its carrying values with the following exception The equipment had a fair value which was S 100,000 higher than its carrying value, and was estimated to have a remaining useful life of 10 years from the date of acquisition with no salvage value SCORE's inventory had a fair value which was S2,000 more than book value. This inventory was sold by SCORE in 2012 Both companies use straight line amortization exclusively for all assets and liabilities The effective tax rate for both companies is 40% The Financial Statements of PORE & SCORE for the Year ended December 31,2015 are showin below: Income Statements PORE Inc SCORE Inc Sales Other Revenues S1,110,000 $400,000 $530,000 $160,000 ses ess Cost of Goods Sold Depreciation Expense Other Expenses Income Tax Expense $800,000 S30,000 $110,000 $170,000 $330,000 $20,000 $150,000 $50,000 Net Income $400,000 $140,000 Retained Earnings Statements Balance, Jan 1, 2015 Net Income Less: Dividends $1,020,000 $400,000 (S260,000) $760,000 $140,000 (S100,000) Retained Earnings Balance Sheets S1,160,000 $800,000