Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consolidation subsequent to date of acquisition- Equity method with noncontrolling interest, AAP, and gain on upstream intercompany equipment sale A parent company acquired its

![g. Complete the consolidating entries according to the C-E-A-D-I sequence. Consolidation Worksheet [C] [E]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/05/6288c8f0f1a62_1653131501559.png)

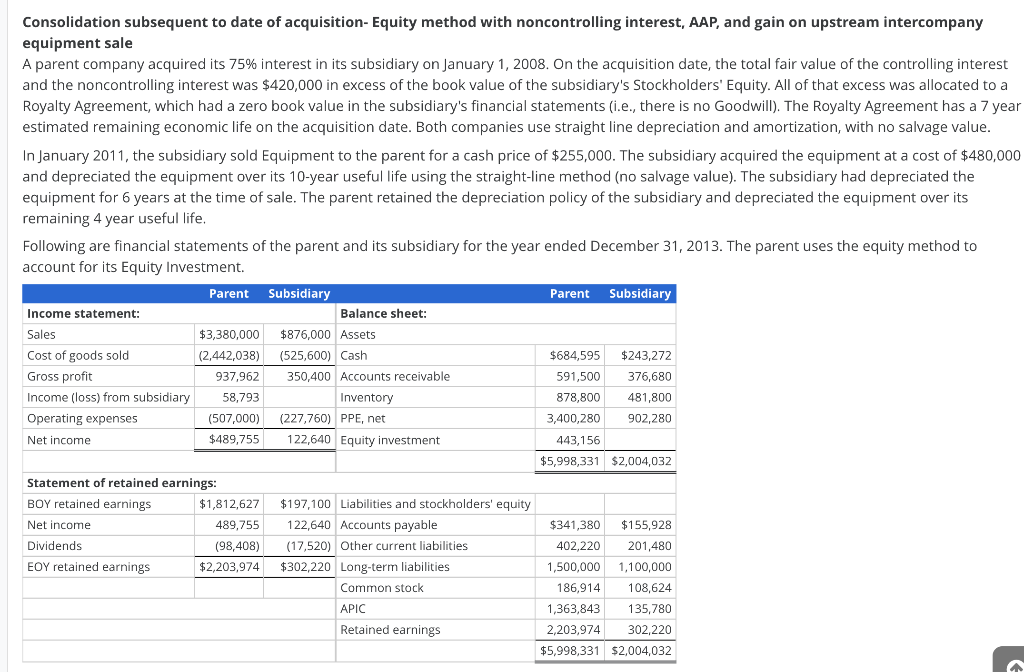

Consolidation subsequent to date of acquisition- Equity method with noncontrolling interest, AAP, and gain on upstream intercompany equipment sale A parent company acquired its 75% interest in its subsidiary on January 1, 2008. On the acquisition date, the total fair value of the controlling interest and the noncontrolling interest was $420,000 in excess of the book value of the subsidiary's Stockholders' Equity. All of that excess was allocated to a Royalty Agreement, which had a zero book value in the subsidiary's financial statements (i.e., there is no Goodwill). The Royalty Agreement has a 7 year estimated remaining economic life on the acquisition date. Both companies use straight line depreciation and amortization, with no salvage value. In January 2011, the subsidiary sold Equipment to the parent for a cash price of $255,000. The subsidiary acquired the equipment at a cost of $480,000 and depreciated the equipment over its 10-year useful life using the straight-line method (no salvage value). The subsidiary had depreciated the equipment for 6 years at the time of sale. The parent retained the depreciation policy of the subsidiary and depreciated the equipment over its remaining 4 year useful life. Following are financial statements of the parent and its subsidiary for the year ended December 31, 2013. The parent uses the equity method to account for its Equity Investment. Income statement: Sales Cost of goods sold Gross profit Income (loss) from subsidiary Operating expenses Net income Parent Dividends EOY retained earnings $3,380,000 (2,442,038) 937,962 58,793 (507,000) $489,755 Statement of retained earnings: BOY retained earnings Net income $1,812,627 489,755 (98,408) $2,203,974 Subsidiary Balance sheet: $876,000 Assets (525,600) Cash 350,400 Accounts receivable Inventory (227,760) PPE, net 122,640 Equity investment $197,100 Liabilities and stockholders' equity 122,640 Accounts payable (17,520) Other current liabilities $302,220 Long-term liabilities Common stock APIC Retained earnings Parent Subsidiary $684,595 $243,272 591,500 376,680 481,800 902,280 878,800 3,400,280 443,156 $5,998,331 $2,004,032 $341,380 402,220 1,500,000 1,100,000 186,914 108,624 1,363,843 135,780 2,203,974 302,220 $5,998,331 $2,004,032 $155,928 201,480 g. Complete the consolidating entries according to the C-E-A-D-I sequence. Consolidation Worksheet [C] [E] [A] [D] Income (loss) from subsidiary Consolidated net income attributable to noncontrolling interest Dividends Equity investment Noncontrolling interest Common stock APIC Retained earnings Equity investment Noncontrolling interest Royalty agreement Equity investment Noncontrolling interest Operating expenses Royalty agreement Description [Ilgain] Equity investment Noncontrolling interest PPE, net [Idep] PPE, net Depreciation expense " OO O O ( O O O Debit 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Credit 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To complete the consolidating entries according to the CEADI sequence well analyze each entry and determine the appropriate debit and credit amounts C ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started