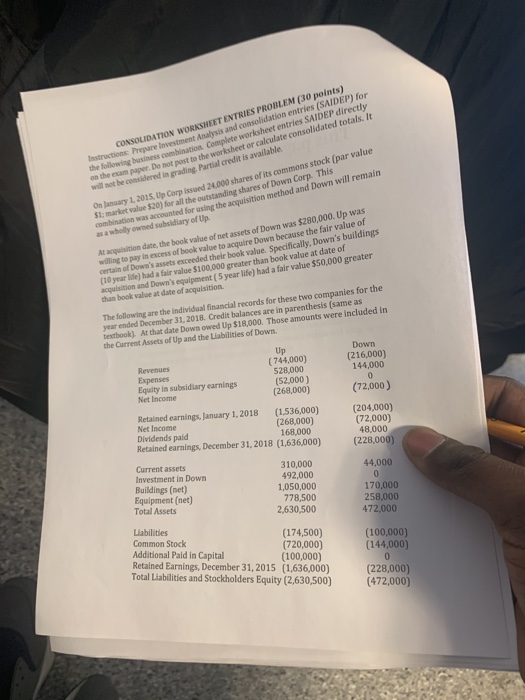

CONSOLIDATION WORKSHEET ENTRIES PROBLEM (30 points) the surare Investment Analysis and consolidation entries (SAIDEP) for combination Complete worksheet entries SAIDEP directly not post to the worksheet or calculate consolidated totals. It in grading, Partial credit is available On January 1, 2015, Up Corp issued 24,000 shares of its commons stock (par value SI: market value $20) for all the outstanding shares of Down Corp This on the esam paper. L will not be conbknacion was aounted for using the acquisition method and Down will remain t acquisition date, the book value of net assets of Down was $280,000. Up was as a wholly owned subsidiary of Up. willing to pay in excess of book value to acquire Down because the fair value of certain of Down' (1o year life) had a fair value acquisition and Down's equipment ( 5 year life) had a than book value at date of acquisition s assets exceeded their book value. Specifically, Down's buildings $100,000 greater than book value at date of fair value $50.000 greater The following are the individual financial records for these two companies for the year ended December 31, 2018. Credit balances are in parenthesis (same as textbook). At that date Down owed Up $18,000. Those amounts were included in the Current Assets of Up and the Liabilities of Down Up Down Revenues Expenses Equity in subsidiary earnings (744,000) 528,000 (52,000) (268,000) (216,000) 144,000 Net Income (72,000) Retained earnings, January 1, 2018 (1,536,000) Net Income Dividends paid Retained earnings, December 31, 2018 (1,636,000) (204,000) (72,000) 48,000 (228,00 (268,000) 168,000 Current assets Investment in Down Buildings (net) 310,000 492,000 1,050,000 778,500 2,630,500 44,000 170,000 472,000 (100,000) Equipment (net) Total Assets Liabilities Common Stock Additional Paid in Capital Retained Earnings, December 31,2015 (174,500) (720,000) (144,000) Total Liablities and Stockholders Equity (2,630,500) (472,000) (100,000) (1,636,000) (228,000) CONSOLIDATION WORKSHEET ENTRIES PROBLEM (30 points) the surare Investment Analysis and consolidation entries (SAIDEP) for combination Complete worksheet entries SAIDEP directly not post to the worksheet or calculate consolidated totals. It in grading, Partial credit is available On January 1, 2015, Up Corp issued 24,000 shares of its commons stock (par value SI: market value $20) for all the outstanding shares of Down Corp This on the esam paper. L will not be conbknacion was aounted for using the acquisition method and Down will remain t acquisition date, the book value of net assets of Down was $280,000. Up was as a wholly owned subsidiary of Up. willing to pay in excess of book value to acquire Down because the fair value of certain of Down' (1o year life) had a fair value acquisition and Down's equipment ( 5 year life) had a than book value at date of acquisition s assets exceeded their book value. Specifically, Down's buildings $100,000 greater than book value at date of fair value $50.000 greater The following are the individual financial records for these two companies for the year ended December 31, 2018. Credit balances are in parenthesis (same as textbook). At that date Down owed Up $18,000. Those amounts were included in the Current Assets of Up and the Liabilities of Down Up Down Revenues Expenses Equity in subsidiary earnings (744,000) 528,000 (52,000) (268,000) (216,000) 144,000 Net Income (72,000) Retained earnings, January 1, 2018 (1,536,000) Net Income Dividends paid Retained earnings, December 31, 2018 (1,636,000) (204,000) (72,000) 48,000 (228,00 (268,000) 168,000 Current assets Investment in Down Buildings (net) 310,000 492,000 1,050,000 778,500 2,630,500 44,000 170,000 472,000 (100,000) Equipment (net) Total Assets Liabilities Common Stock Additional Paid in Capital Retained Earnings, December 31,2015 (174,500) (720,000) (144,000) Total Liablities and Stockholders Equity (2,630,500) (472,000) (100,000) (1,636,000) (228,000)