Question

Consolidation worksheet for gain on constructive retirement of subsidiarys debt with no AAPEquity method Assume that a Parent company acquires a 80% interest in its

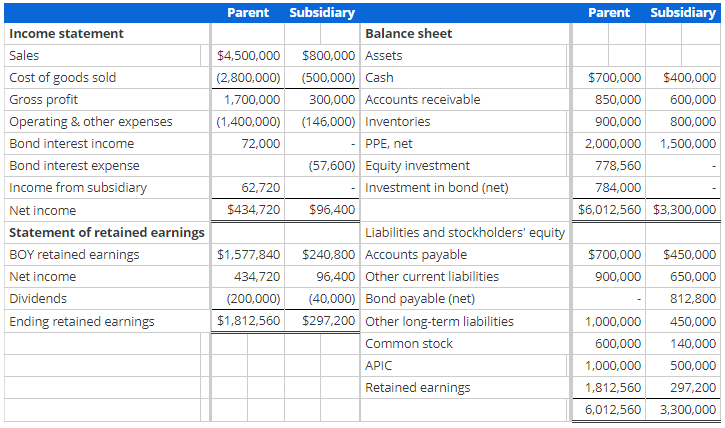

Consolidation worksheet for gain on constructive retirement of subsidiarys debt with no AAPEquity method Assume that a Parent company acquires a 80% interest in its Subsidiary on January 1, 2015. On the date of acquisition, the fair value of the 80 percent controlling interest was $640,000 and the fair value of the 20 percent noncontrolling interest was $160,000. On January 1, 2015, the book value of net assets equaled $800,000 and the fair value of the identifiable net assets equaled the book value of identifiable net assets (i.e., there was no AAP or Goodwill).

On December 31, 2016, the Subsidiary company issued $800,000 (face) 8 percent, five-year bonds to an unaffiliated company for $832,000. The bonds pay interest annually on December 31, and the bond premium is amortized using the straight-line method. This results in annual bond-payable premium amortization equal to $6,400 per year.

On December 31, 2018, the Parent paid $776,000 to purchase all of the outstanding Subsidiary company bonds. The bond discount is amortized using the straight-line method, which results in annual bond-investment discount amortization equal to $8,000 per year.

The Parent and the Subsidiary report the following financial statements for the year ended December 31, 2019:

Can you help me with the ones I got wrong?

Can you help me with the ones I got wrong?

What more do you need? This is the entire question copied and pasted...

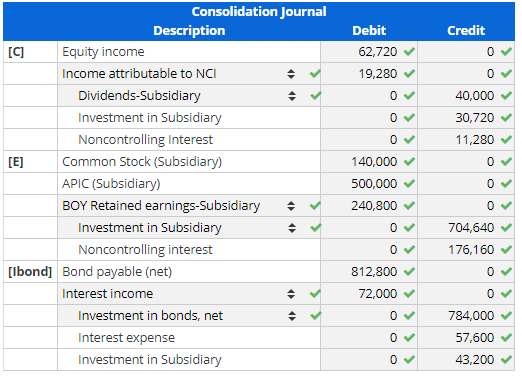

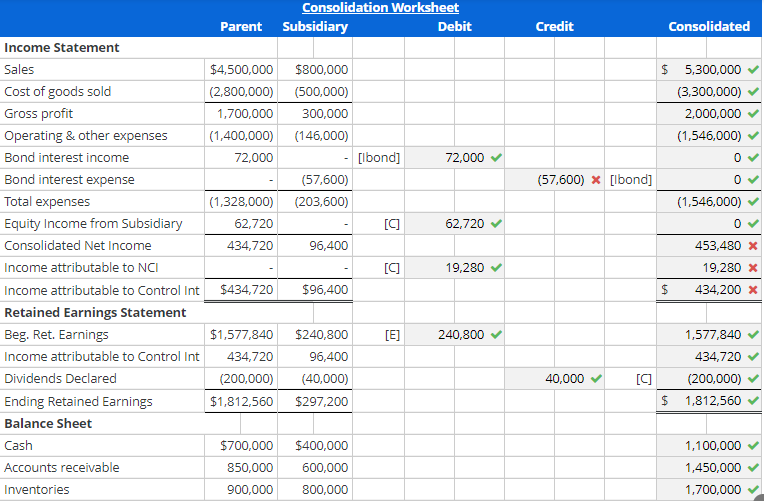

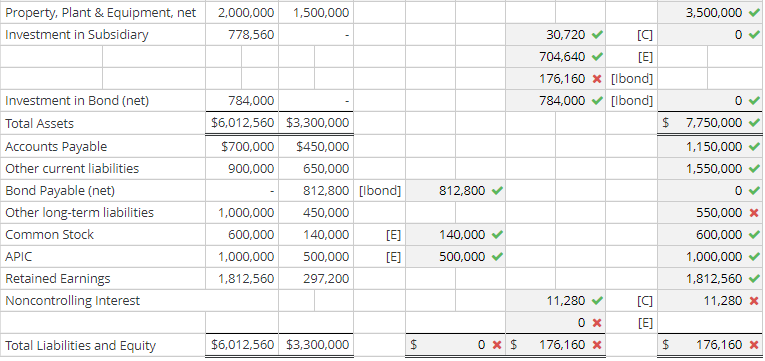

Parent Subsidiary Income statement Sales Cost of goods sold Gross profit Operating & other expenses Bond interest income Bond interest expense Income from subsidiary Net income Statement of retained earnings BOY retained earnings Net income Dividends Ending retained earnings Parent Subsidiary Balance sheet $4,500,000 $800,000 Assets (2.800,000) (500,000) Cash 1,700,000 300,000 Accounts receivable (1,400,000) (146,000) Inventories 72,000 PPE, net (57,600) Equity investment 62,720 Investment in bond (net) $434.720 $96,400 Liabilities and stockholders' equity $1,577,840 $240,800 Accounts payable 434,720 96,400 Other current liabilities (200,000) (40,000) Bond payable (net) $1,812,560 $297,200 Other long-term liabilities Common stock APIC Retained earnings $700,000 $400,000 850,000 600,000 900,000 800,000 2,000,000 1,500,000 778,560 784,000 $6,012,560 $3,300,000 $700,000 900,000 1,000,000 600,000 1,000,000 1,812,560 6,012,560 $450,000 650,000 812,800 450,000 140,000 500,000 297,200 3,300,000 Debit 62,720 Credit 0 19,280 0 0 0 40,000 30,720 11,280 0 0 Consolidation Journal Description [C] Equity income Income attributable to NCI Dividends-Subsidiary Investment in Subsidiary Noncontrolling Interest [E] Common Stock (Subsidiary) APIC (Subsidiary) BOY Retained earnings-Subsidiary Investment in Subsidiary Noncontrolling interest [lbond] Bond payable (net) Interest income Investment in bonds, net Interest expense Investment in Subsidiary 0 140,000 500,000 240,800 0 0 704,640 176,160 0 812,800 72,000 0 784,000 57,600 43,200 Consolidation Worksheet Subsidiary Debit Parent Credit Consolidated $ $4,500,000 (2,800,000) 1,700,000 (1,400,000) 72,000 $800,000 (500,000) 300,000 (146,000) 5,300,000 (3,300,000) 2,000,000 (1,546,000) [lbond] 72,000 (57,600) * [lbond] (57,600) (203,600) (1,328,000) (1,546,000) 62,720 [C 62,720 0 434,720 96,400 Income Statement Sales Cost of goods sold Gross profit Operating & other expenses Bond interest income Bond interest expense Total expenses Equity Income from Subsidiary Consolidated Net Income Income attributable to NCI Income attributable to control Int Retained Earnings Statement Beg. Ret. Earnings Income attributable to Control Int Dividends Declared Ending Retained Earnings Balance Sheet Cash Accounts receivable Inventories [C] 19,280 453,480 X 19,280 x 434,200 x $434,720 $96,400 $ E] 240,800 $1,577,840 434,720 (200,000) $1,812,560 $240,800 96,400 (40,000) $297,200 1,577,840 434,720 (200,000) 1,812,560 40,000 [C] $ $700,000 850,000 900,000 $400,000 600,000 800,000 1,100,000 1,450,000 1,700,000 1,500,000 3,500,000 Property, Plant & Equipment, net Investment in Subsidiary 2,000,000 778,560 0 30,720 [C] 704,640 [E] 176,160 x [lbond] 784,000 [lbond] Investment in Bond (net) Total Assets Accounts Payable Other current liabilities Bond Payable (net) Other long-term liabilities Common Stock APIC Retained Earnings Noncontrolling Interest 784,000 $6,012,560 $3,300,000 $700,000 $450,000 900,000 650,000 812,800 [bond] 1,000,000 450,000 600,000 140,000 [E] 1,000,000 500,000 [E] 1,812,560 297,200 812,800 $ 7,750,000 1,150,000 1,550,000 0 550,000 x 600,000 1,000,000 1,812,560 11,280 x 140,000 500,000 11,280 [C] OX [E] Total Liabilities and Equity $6,012,560 $3,300,000 $ 0x $ 176,160 x $ 176,160 xStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started