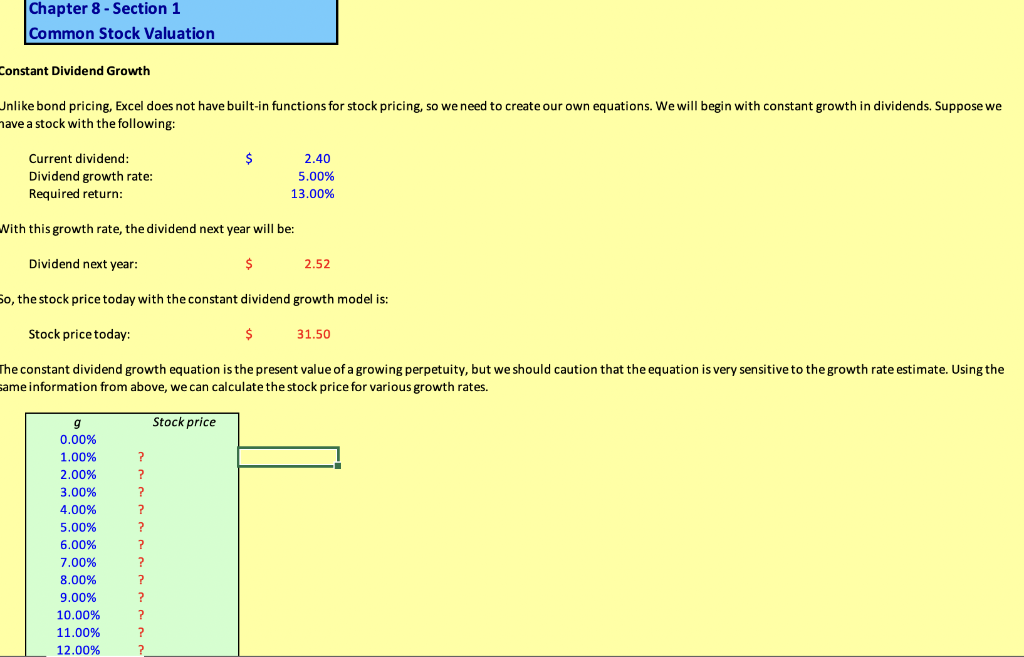

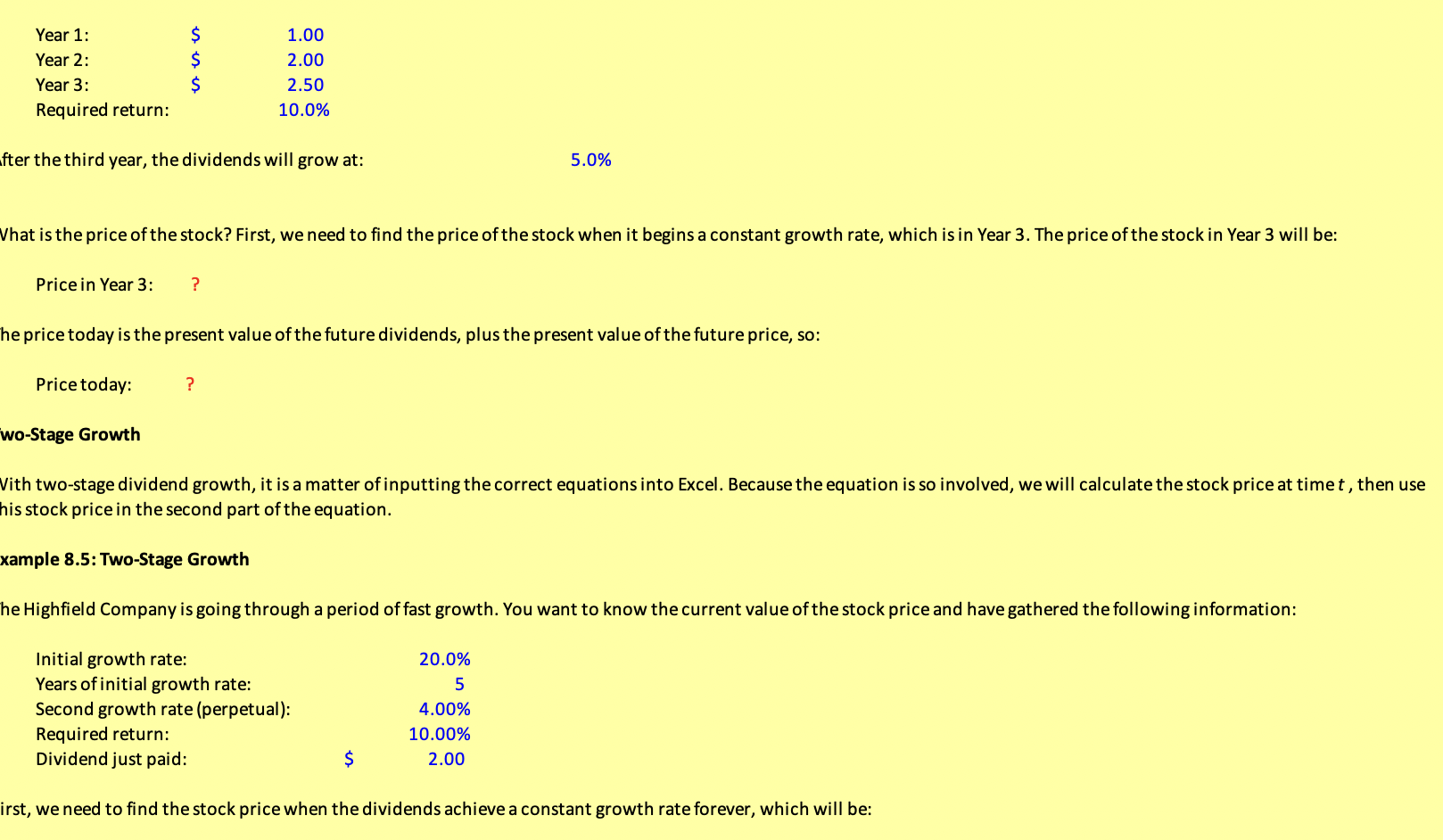

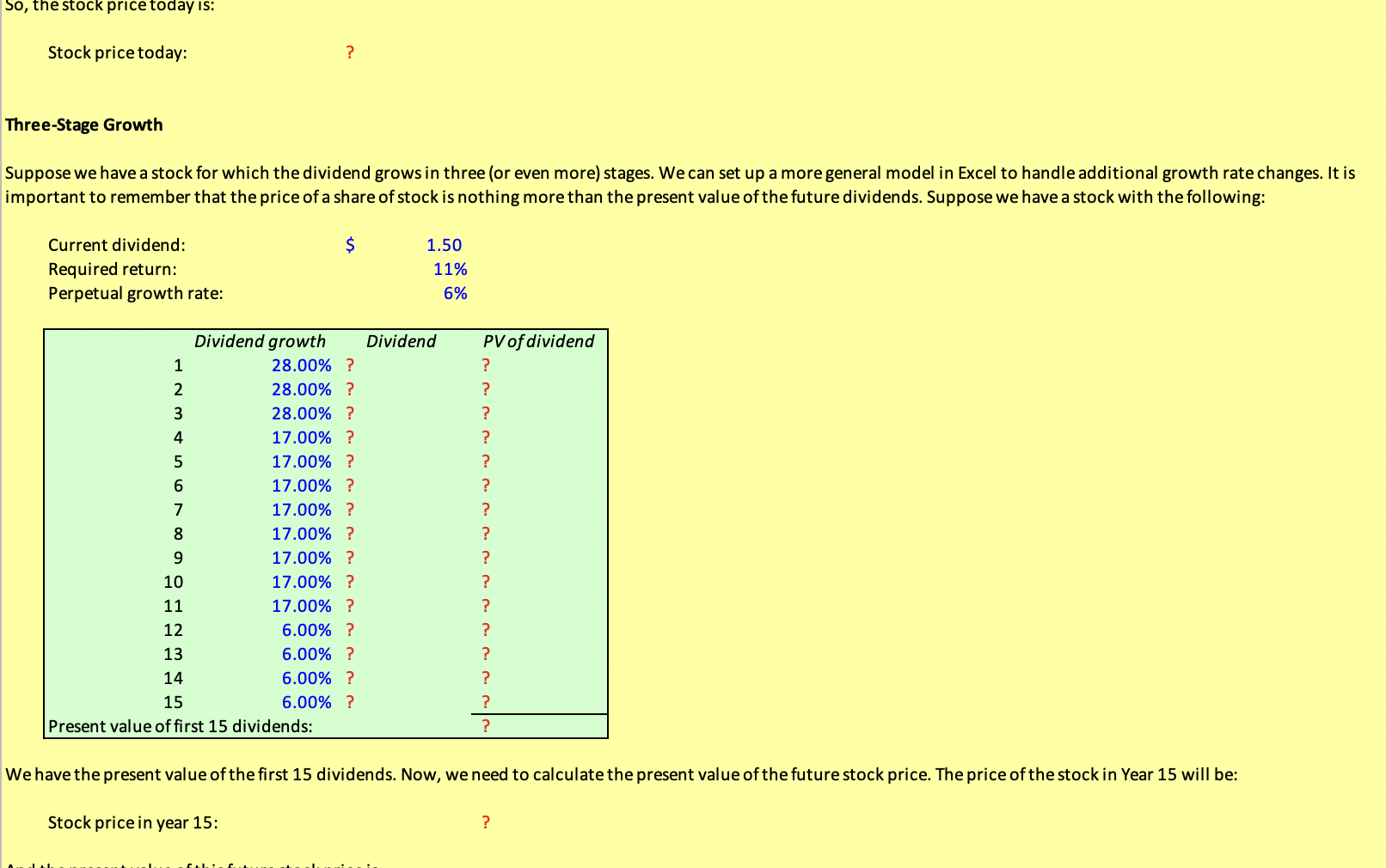

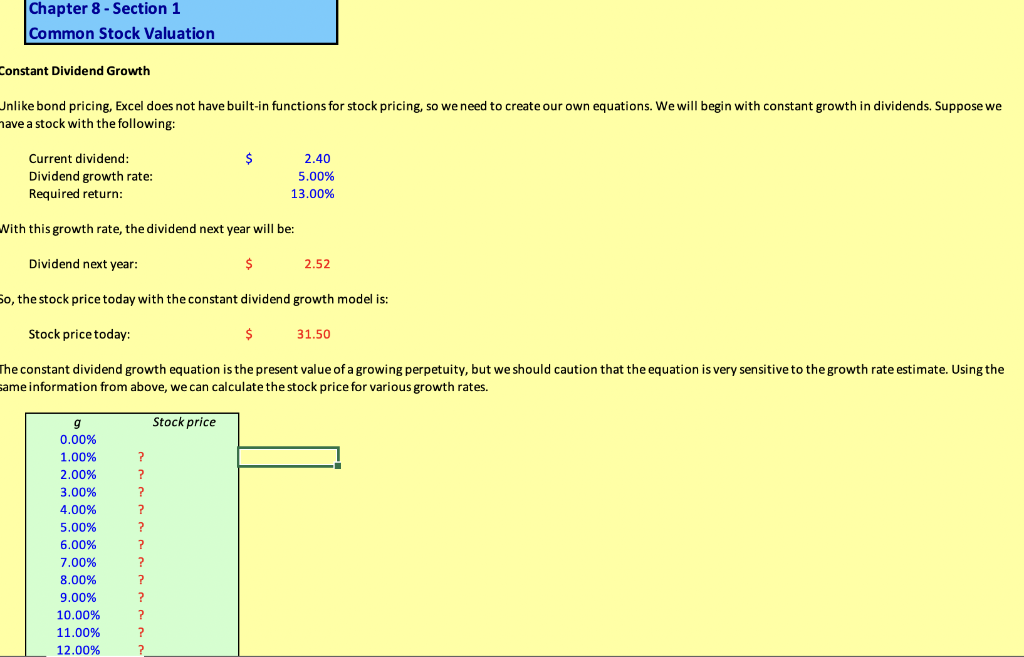

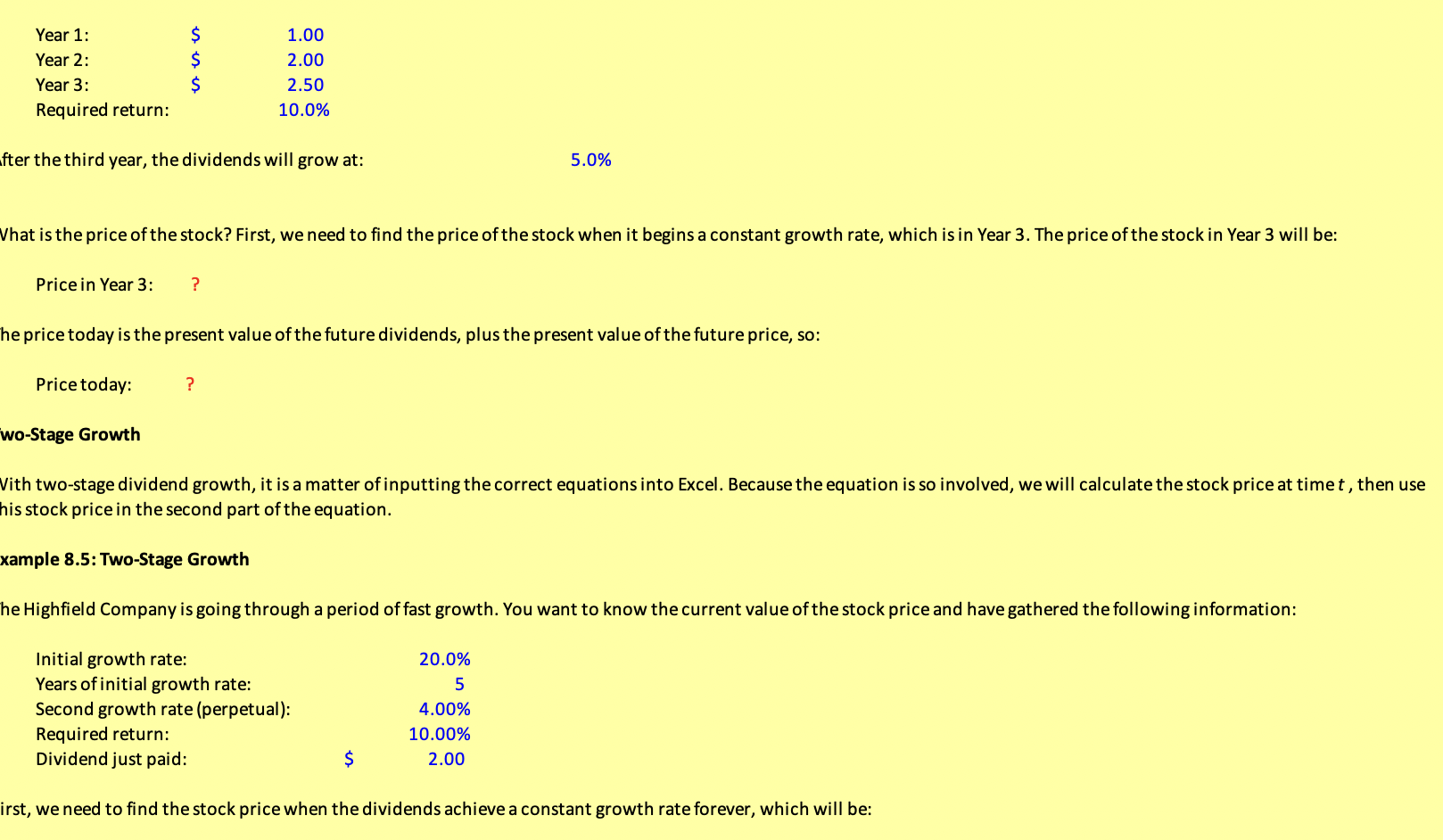

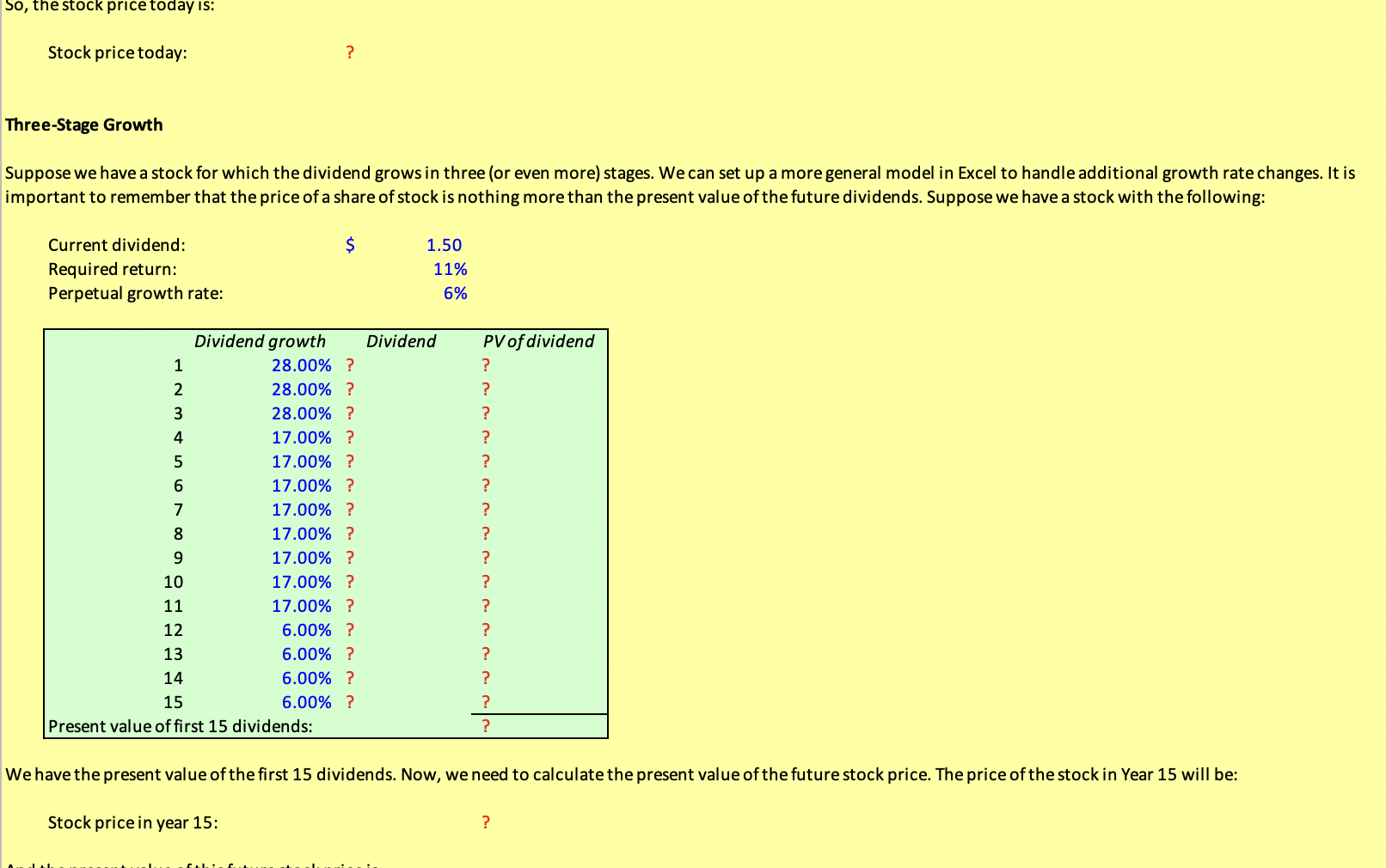

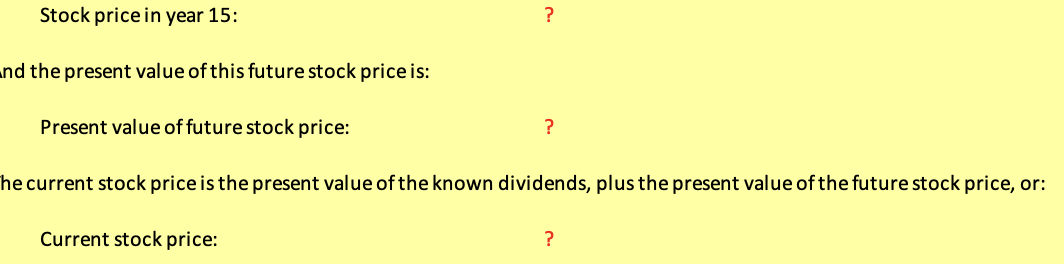

Constant Dividend Growth Jnlike bond pricing, Excel does not have built-in functions for stock pricing, so we need to create our own equations. We will begin with constant growth in dividends. Suppose we nave a stock with the following: Nith this growth rate, the dividend next year will be: Dividend next year: $2.52 So, the stock price today with the constant dividend growth model is: Stock price today: $31.50 The constant dividend growth equation is the present value of a growing perpetuity, but we should caution that the equation is very sensitive to the growth rate estimate. Using the same information from above, we can calculate the stock price for various growth rates. fter the third year, the dividends will grow at: 5.0% Vhat is the price of the stock? First, we need to find the price of the stock when it begins a constant growth rate, which is in Year 3 . The price of the stock in Year 3 will be: Price in Year 3: ? he price today is the present value of the future dividends, plus the present value of the future price, so: Price today: ? wo-Stage Growth Vith two-stage dividend growth, it is a matter of inputting the correct equations into Excel. Because the equation is so involved, we will calculate the stock price at time t, then us his stock price in the second part of the equation. xample 8.5: Two-Stage Growth he Highfield Company is going through a period of fast growth. You want to know the current value of the stock price and have gathered the following information: irst, we need to find the stock price when the dividends achieve a constant growth rate forever, which will be: Suppose we have a stock for which the dividend grows in three (or even more) stages. We can set up a more general model in Excel to handle additional growth rate changes. It is mportant to remember that the price of a share of stock is nothing more than the present value of the future dividends. Suppose we have a stock with the following: Ne have the present value of the first 15 dividends. Now, we need to calculate the present value of the future stock price. The price of the stock in Year 15 will be: Stock price in year 15 : ? Stock price in year 15: ? d the present value of this future stock price is: Present value of future stock price: ? he current stock price is the present value of the known dividends, plus the present value of the future stock price, or: Current stock price: ? Constant Dividend Growth Jnlike bond pricing, Excel does not have built-in functions for stock pricing, so we need to create our own equations. We will begin with constant growth in dividends. Suppose we nave a stock with the following: Nith this growth rate, the dividend next year will be: Dividend next year: $2.52 So, the stock price today with the constant dividend growth model is: Stock price today: $31.50 The constant dividend growth equation is the present value of a growing perpetuity, but we should caution that the equation is very sensitive to the growth rate estimate. Using the same information from above, we can calculate the stock price for various growth rates. fter the third year, the dividends will grow at: 5.0% Vhat is the price of the stock? First, we need to find the price of the stock when it begins a constant growth rate, which is in Year 3 . The price of the stock in Year 3 will be: Price in Year 3: ? he price today is the present value of the future dividends, plus the present value of the future price, so: Price today: ? wo-Stage Growth Vith two-stage dividend growth, it is a matter of inputting the correct equations into Excel. Because the equation is so involved, we will calculate the stock price at time t, then us his stock price in the second part of the equation. xample 8.5: Two-Stage Growth he Highfield Company is going through a period of fast growth. You want to know the current value of the stock price and have gathered the following information: irst, we need to find the stock price when the dividends achieve a constant growth rate forever, which will be: Suppose we have a stock for which the dividend grows in three (or even more) stages. We can set up a more general model in Excel to handle additional growth rate changes. It is mportant to remember that the price of a share of stock is nothing more than the present value of the future dividends. Suppose we have a stock with the following: Ne have the present value of the first 15 dividends. Now, we need to calculate the present value of the future stock price. The price of the stock in Year 15 will be: Stock price in year 15 : ? Stock price in year 15: ? d the present value of this future stock price is: Present value of future stock price: ? he current stock price is the present value of the known dividends, plus the present value of the future stock price, or: Current stock price