Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Constant Flows ^ Non-constant flows ^ I. Policy/Management Scenario The managers of Smithgall Woods-Dukes Creek Conservation Area have determined that they want Smithgall Woods to

Constant Flows ^

Non-constant flows ^

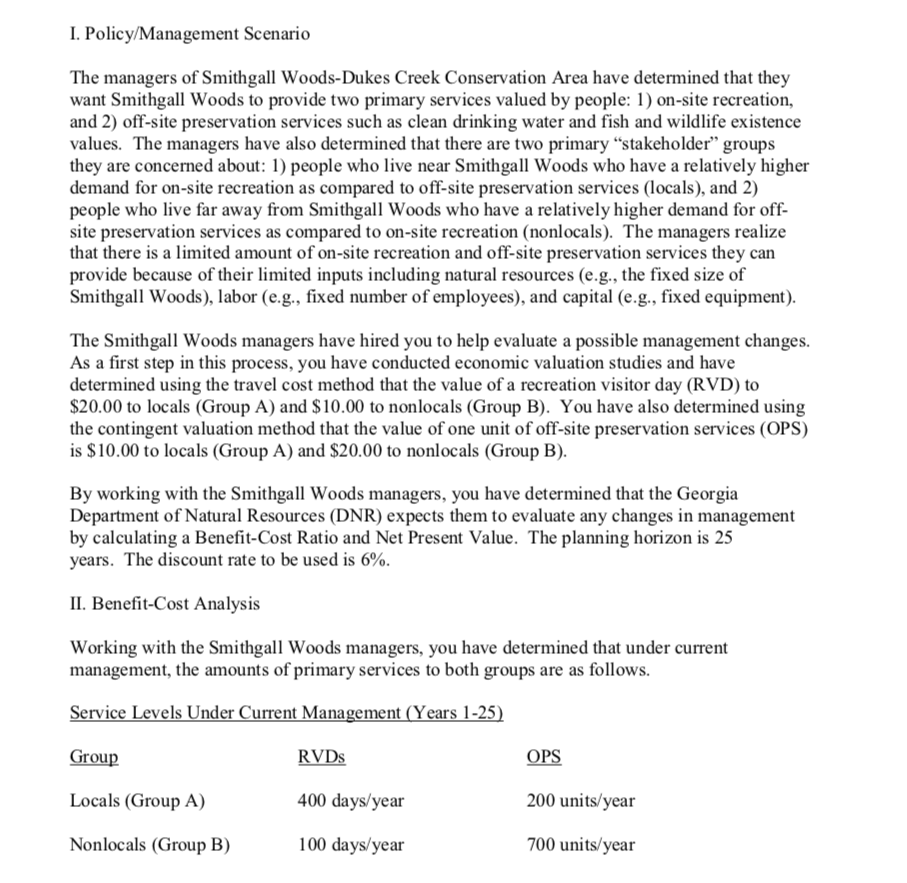

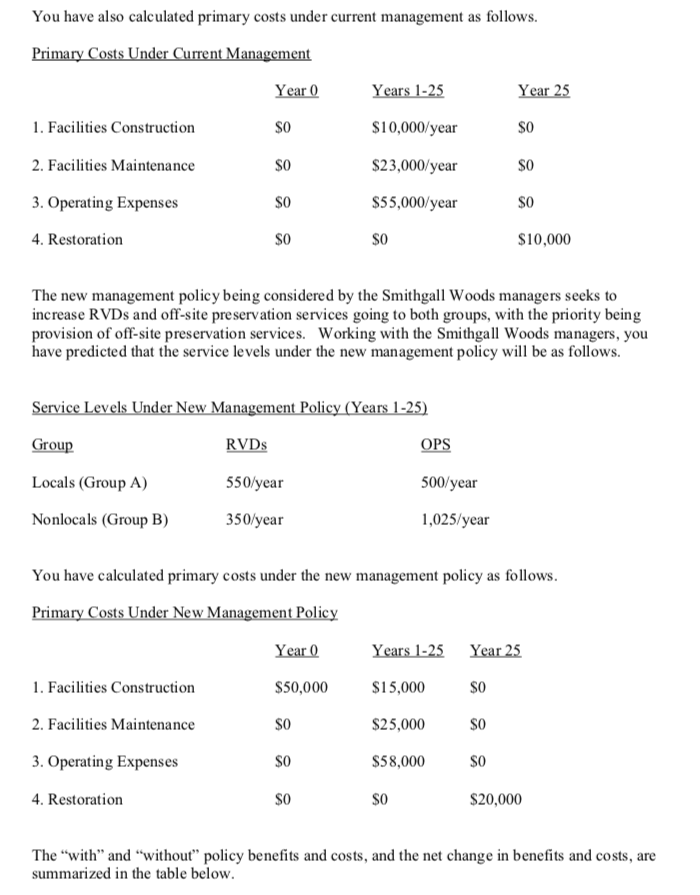

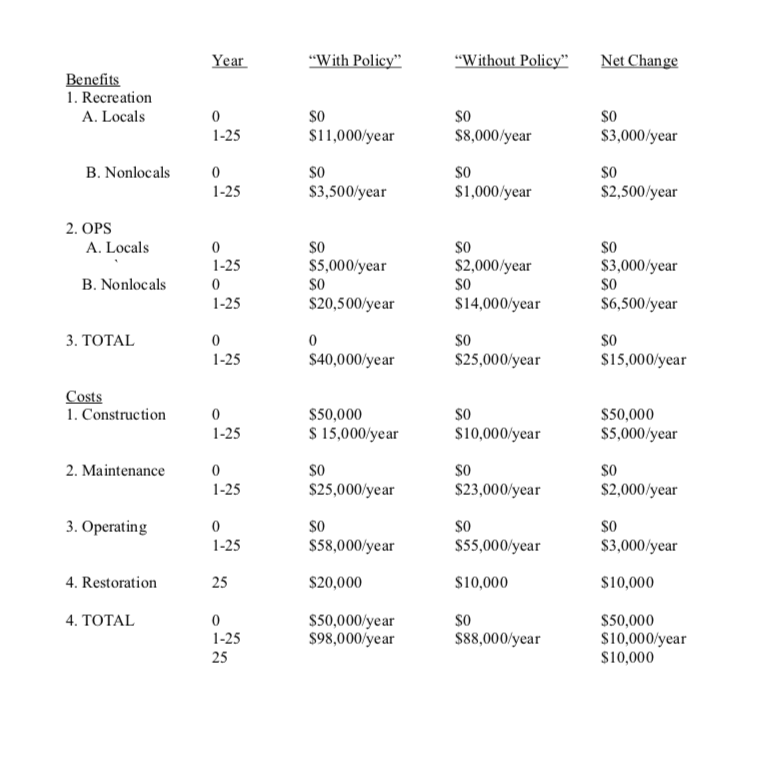

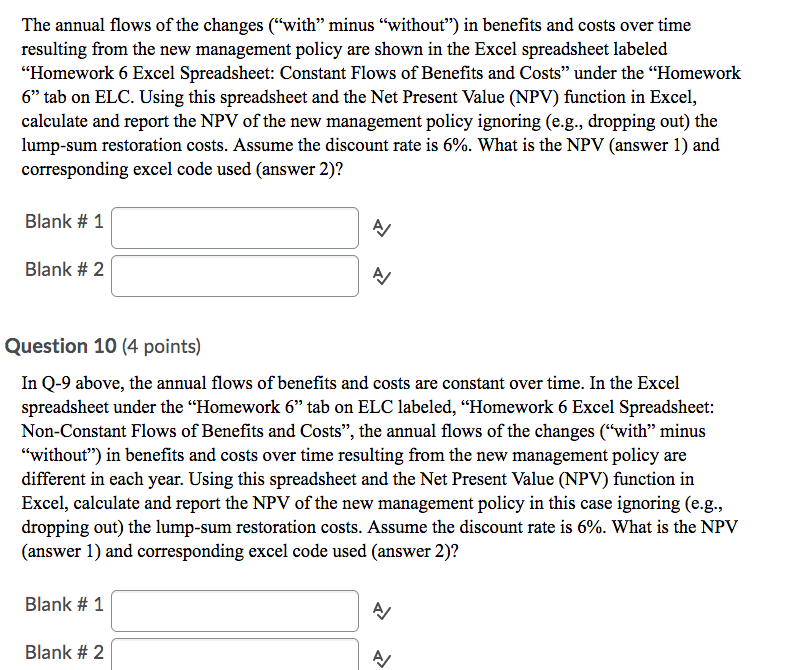

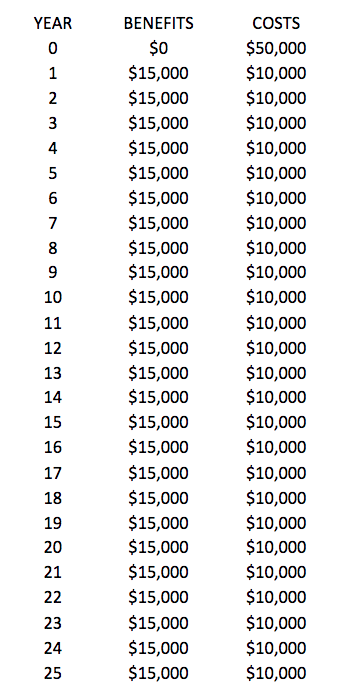

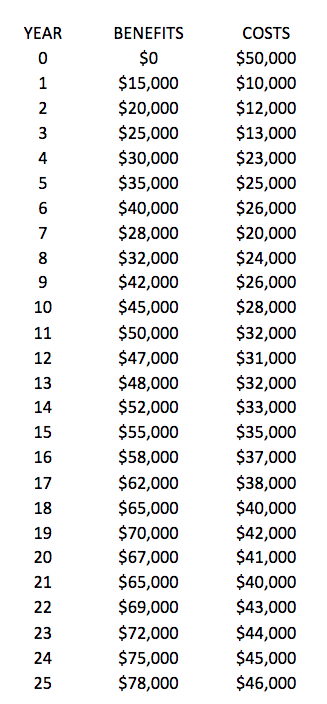

I. Policy/Management Scenario The managers of Smithgall Woods-Dukes Creek Conservation Area have determined that they want Smithgall Woods to provide two primary services valued by people: 1) on-site recreation, and 2) off-site preservation services such as clean drinking water and fish and wildlife existence values. The managers have also determined that there are two primary stakeholder" groups they are concerned about: 1) people who live near Smithgall Woods who have a relatively higher demand for on-site recreation as compared to off-site preservation services (locals), and 2) people who live far away from Smithgall Woods who have a relatively higher demand for off- site preservation services as compared to on-site recreation (nonlocals). The managers realize that there is a limited amount of on-site recreation and off-site preservation services they can provide because of their limited inputs including natural resources (e.g., the fixed size of Smithgall Woods), labor (e.g., fixed number of employees), and capital (e.g., fixed equipment). The Smithgall Woods managers have hired you to help evaluate a possible management changes. As a first step in this process, you have conducted economic valuation studies and have determined using the travel cost method that the value of a recreation visitor day (RVD) to $20.00 to locals (Group A) and $10.00 to nonlocals (Group B). You have also determined using the contingent valuation method that the value of one unit of off-site preservation services (OPS) is $ 10.00 to locals (Group A) and $20.00 to nonlocals (Group B). By working with the Smithgall Woods managers, you have determined that the Georgia Department of Natural Resources (DNR) expects them to evaluate any changes in management by calculating a Benefit-Cost Ratio and Net Present Value. The planning horizon is 25 years. The discount rate to be used is 6%. II. Benefit-Cost Analysis Working with the Smithgall Woods managers, you have determined that under current management, the amounts of primary services to both groups are as follows. Service Levels Under Current Management (Years 1-25) Group RVDs OPS Locals (Group A) 400 days/year 200 units/year Nonlocals (Group B) 100 days/year 700 units/year You have also calculated primary costs under current management as follows. Primary Costs Under Current Management Year 0 Years 1-25 Year 25 1. Facilities Construction $0 $10,000/year $0 2. Facilities Maintenance $0 $23,000/year $0 3. Operating Expenses SO $55,000/year $0 4. Restoration $0 SO $10,000 The new management policy being considered by the Smithgall Woods managers seeks to increase RVDs and off-site preservation services going to both groups, with the priority being provision of off-site preservation services. Working with the Smithgall Woods managers, you have predicted that the service levels under the new management policy will be as follows. Service Levels Under New Management Policy (Years 1-25) Group RVDs OPS 550/year 500/year Locals (Group A) Nonlocals (Group B) 350/year 1,025/year You have calculated primary costs under the new management policy as follows. Primary Costs Under New Management Policy Year 0 Years 1-25 Year 25 1. Facilities Construction $50,000 $15,000 $0 2. Facilities Maintenance $0 $25,000 SO 3. Operating Expenses $0 $58,000 SO 4. Restoration $0 $0 $20,000 The "with" and "without policy benefits and costs, and the net change in benefits and costs, are summarized in the table below. Year "With Policy" Without Policy" Net Change Benefits 1. Recreation A. Locals 0 1-25 $0 $11,000/year $0 $8,000/year $0 $3,000/year B. Nonlocals $0 0 1-25 $3,500/year $0 $1,000/year $0 $2,500/year 2. OPS A. Locals SO SO B. Nonlocals 0 1-25 0 1-25 $5,000/year $0 $20,500/year $2,000/year $0 $14,000/year $0 $3,000/year $0 $6,500/year 3. TOTAL 0 1-25 0 $40,000/year $0 $25,000/year $0 $15,000/year Costs 1. Construction 0 1-25 $50,000 $ 15,000/year $0 $10,000/year $50,000 $5,000/year 2. Maintenance 0 1-25 $0 $25,000/year $0 $23,000/year $0 $2,000/year 3. Operating 0 1-25 $0 $58,000/year $0 $55,000/year $0 $3,000/year 4. Restoration 25 $20,000 $10,000 $10,000 4. TOTAL 0 1-25 25 $50,000/year $98,000/year $0 $88,000/year $50,000 $10,000/year $10,000 The annual flows of the changes ("with minus "without) in benefits and costs over time resulting from the new management policy are shown in the Excel spreadsheet labeled Homework 6 Excel Spreadsheet: Constant Flows of Benefits and Costs under the Homework 6 tab on ELC. Using this spreadsheet and the Net Present Value (NPV) function in Excel, calculate and report the NPV of the new management policy ignoring (e.g., dropping out) the lump-sum restoration costs. Assume the discount rate is 6%. What is the NPV (answer 1) and corresponding excel code used (answer 2)? Blank #1 AJ Blank # 2 Question 10 (4 points) In Q-9 above, the annual flows of benefits and costs are constant over time. In the Excel spreadsheet under the Homework 6" tab on ELC labeled, Homework 6 Excel Spreadsheet: Non-Constant Flows of Benefits and Costs, the annual flows of the changes ("with minus "without) in benefits and costs over time resulting from the new management policy are different in each year. Using this spreadsheet and the Net Present Value (NPV) function in Excel, calculate and report the NPV of the new management policy in this case ignoring (e.g., dropping out) the lump-sum restoration costs. Assume the discount rate is 6%. What is the NPV (answer 1) and corresponding excel code used (answer 2)? Blank # 1 A Blank # 2 A YEAR 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 BENEFITS $0 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 COSTS $50,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 15 16 17 18 19 20 21 22 23 24 25 YEAR 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 BENEFITS $0 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $28,000 $32,000 $42,000 $45,000 $50,000 $47,000 $48,000 $52,000 $55,000 $58,000 $62,000 $ 65,000 $70,000 $67,000 $65,000 $69,000 $72,000 $75,000 $78,000 COSTS $50,000 $10,000 $12,000 $13,000 $23,000 $25,000 $26,000 $20,000 $24,000 $26,000 $28,000 $32,000 $31,000 $32,000 $33,000 $35,000 $37,000 $38,000 $40,000 $42,000 $41,000 $40,000 $43,000 $44,000 $45,000 $46,000 23 24 25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started