Answered step by step

Verified Expert Solution

Question

1 Approved Answer

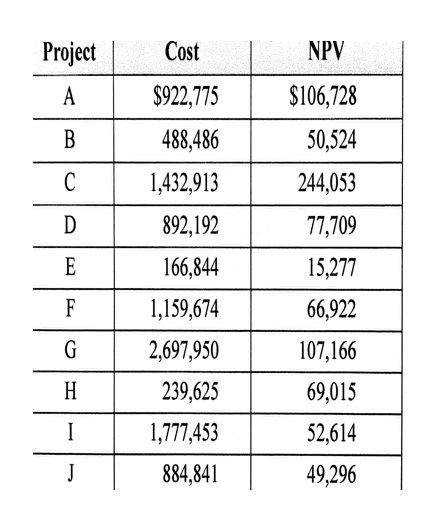

Constrained Optimization Using the input data provided below (page 2) , develop three solver models to answer 3 questions below. Which projects should we choose

Constrained Optimization

Using the input data provided below (page 2), develop three solver models to answer 3 questions below.

- Which projects should we choose to maximize shareholder wealth under the $5 million budget constraint?

- In addition to the above budget constraint, assume that projects A and B are mutually exclusive, but one of them must be selected. Change your Solver constraints to account for this new information and find the new solution.

- Ignore the constraints from part b. Lets say that Project I is of great strategic importance to the survival of the firm. It must be accepted. Now, which projects should be accepted to maximize the overall shareholder wealth?

Hint: To maximize shareholder wealth is equivalent to maximizing the total NPV of the selected projects. The objective (or target) cell and changing variables in the Solver are the same for the three parts, except the each constraint.

executive summary in your first worksheet 1 of the Excel file which describes the nature of the project including objectives, procedures of the analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started