Construct a 5-year pro forma statement

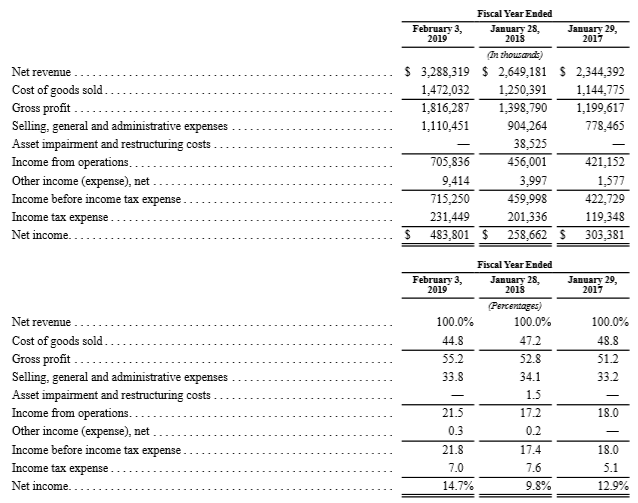

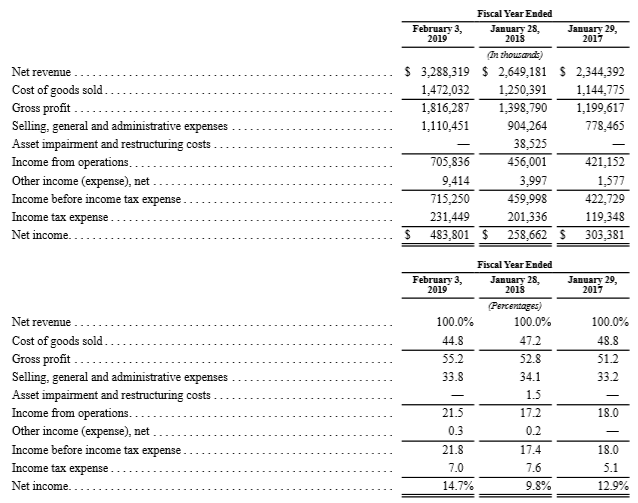

Income Statement 2019 2020 2021 2022 2023 2024 Sales Costs (64% of sales) EBIT Interest Taxes Net Income Dividends Additions to R/E Net revenue ... Cost of goods sold....... Gross profit............. ........... Selling, general and administrative expenses ...... Asset impairment and restructuring costs ............ Income from operations.......... Other income (expense), net...... Income before income tax expense......... Income tax expense............ Net income......... Fiscal Year Ended February 3, January 28, January 29, 2019 2018 2017 In showana) $ 3,288,319 $ 2,649,181 $ 2,344,392 1,472,032 1.250,391 1,144,775 1,816,287 1,398,790 1.199,617 1,110,451 904,264 778,465 38,525 705,836 456,001 421,152 9,414 3.997 1.577 715,250 459.998 422,729 231,449 201,336 119,348 $ 483,801 $ 258,662 $ 303,381 February 3, January 29, 2019 2017 100.0% 44.8 55.2 Fiscal Year Ended January 28, 2018 Percentages 100.0% 47.2 52.8 34.1 1.5 100.0% 488 33 Net revenue ........ Cost of goods sold. Gross profit ................ Selling, general and administrative expenses ...... Asset impairment and restructuring costs ............. Income from operations.. Other income (expense), net........ Income before income tax expense......... Income tax expense Net income....... .. 17.2 14.7% Income Statement 2019 2020 2021 2022 2023 2024 Sales Costs (64% of sales) EBIT Interest Taxes Net Income Dividends Additions to R/E Net revenue ... Cost of goods sold....... Gross profit............. ........... Selling, general and administrative expenses ...... Asset impairment and restructuring costs ............ Income from operations.......... Other income (expense), net...... Income before income tax expense......... Income tax expense............ Net income......... Fiscal Year Ended February 3, January 28, January 29, 2019 2018 2017 In showana) $ 3,288,319 $ 2,649,181 $ 2,344,392 1,472,032 1.250,391 1,144,775 1,816,287 1,398,790 1.199,617 1,110,451 904,264 778,465 38,525 705,836 456,001 421,152 9,414 3.997 1.577 715,250 459.998 422,729 231,449 201,336 119,348 $ 483,801 $ 258,662 $ 303,381 February 3, January 29, 2019 2017 100.0% 44.8 55.2 Fiscal Year Ended January 28, 2018 Percentages 100.0% 47.2 52.8 34.1 1.5 100.0% 488 33 Net revenue ........ Cost of goods sold. Gross profit ................ Selling, general and administrative expenses ...... Asset impairment and restructuring costs ............. Income from operations.. Other income (expense), net........ Income before income tax expense......... Income tax expense Net income....... .. 17.2 14.7%