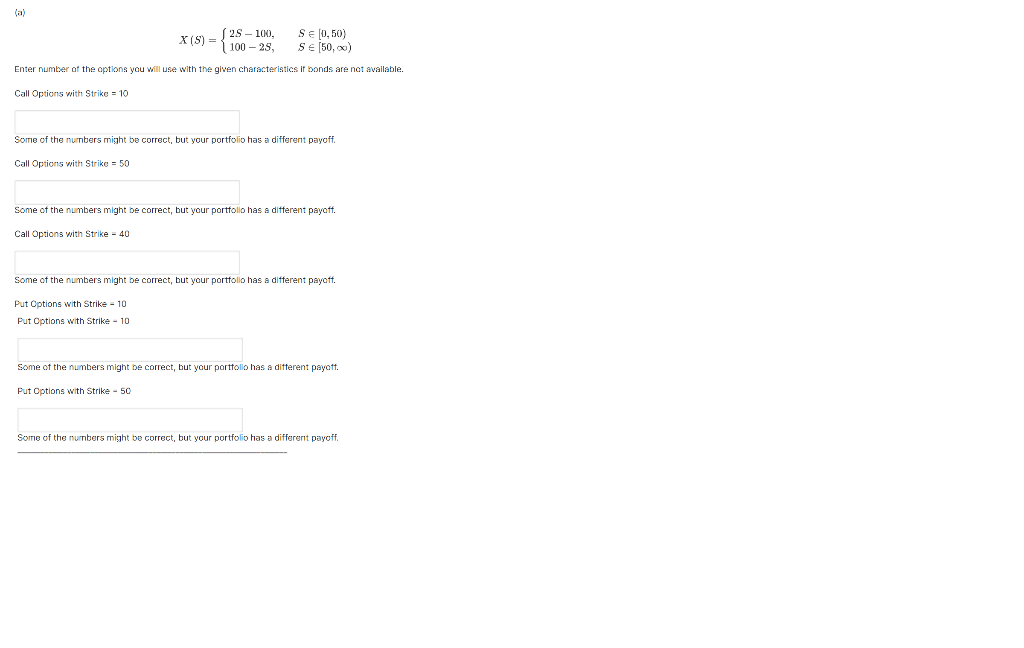

Construct a portfolio consisting of risk-free bonds, European call and put options to replicate the payoff function X(S) below. Be specific about how many options of each type are in your portfolio. Use + sign if you buy option and - sign if you short it. Use 0 if you do not use an option.

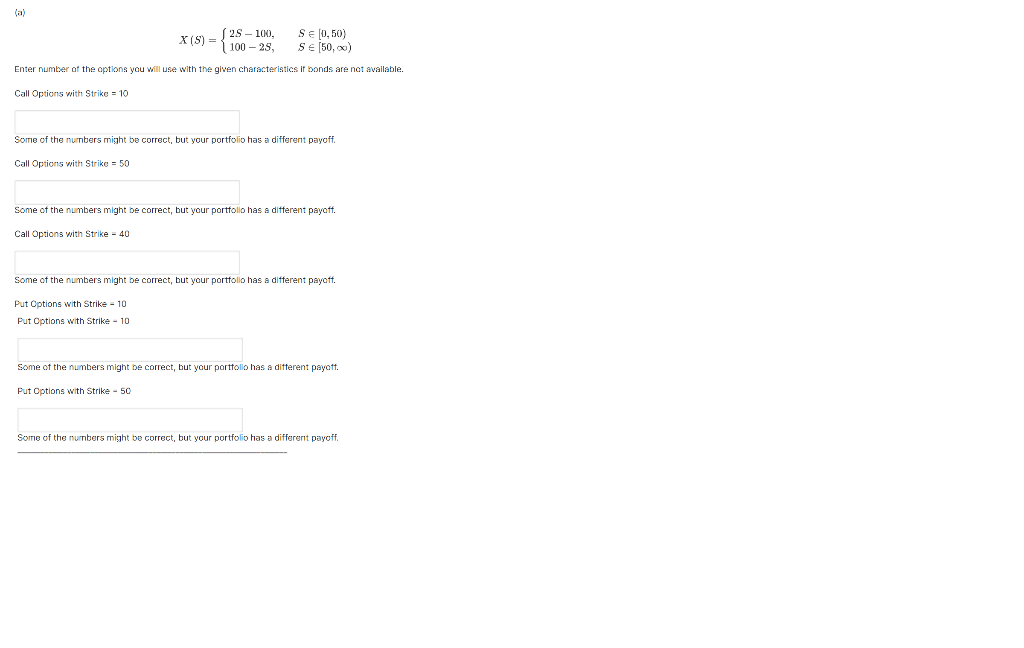

Construct a portfolio consisting of risk-free bonds, European call and put options to replicate the payoff function X(S) below. Be specific about how many options of each type are in your portfolio. Use + sign if you buy option and - sign if you short it. Use 0 if you do not use an option.

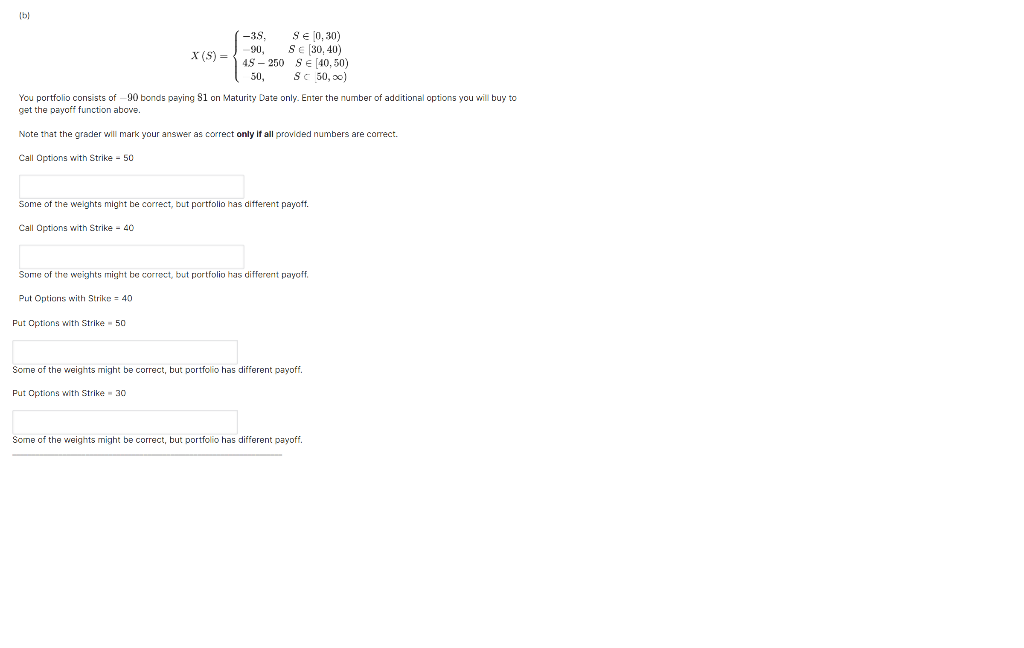

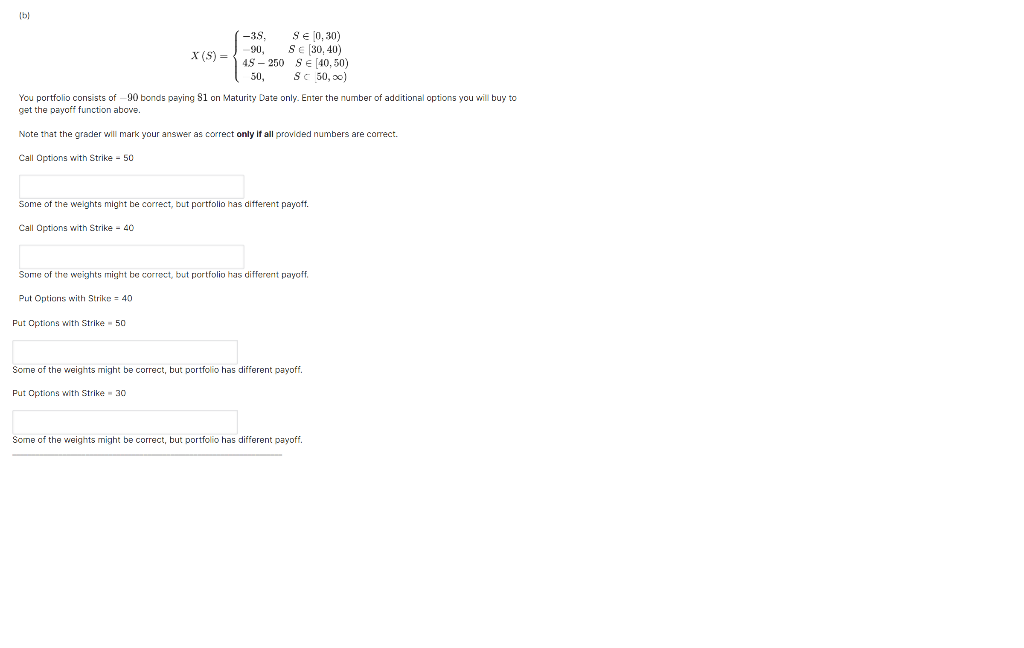

X(S)=3S,90,4S25050,S[0,30)S[30,40)S[40,50)S50,) You portfolio consists of 90 bonds paying 81 on Maturity Date only. Enter the number of additional options you will buy to get the payoff function above. Note that the grader will mark your answer as correct only if all provided numbers are correct. Call Options with Strike 50 Some of the welghts might be correct, but porttolio has different payott. Call Options with Strike - 40 Some of the weights might be correct, but portfolio has different payoff. Put Options with Strike =40 Put Options with Strike =50 Some of the weights might be correct, but portfolio has different payoff. Put options with Strike =30 X(S)={2S100,1002S,S[0,50)S[50,) Enter number at the options you will use with the given characteristics it bonds are not available. Call Options with Strike =10 Some of the numbers might be correct, but your portfolio has a different payoff. Call Options with Strike =50 Some of the numbers might be correct, but your portfollo has a different payoff. Call Options with Strike =40 Some of the numbers might be correct, but your portfollo has a different payoff. Put Options with Strike - 10 Put Options with Strike - 10 Some of the numbers might be correct, but your porttollo has a difterent payott. Put Options with Strike - 50 X(S)=3S,90,4S25050,S[0,30)S[30,40)S[40,50)S50,) You portfolio consists of 90 bonds paying 81 on Maturity Date only. Enter the number of additional options you will buy to get the payoff function above. Note that the grader will mark your answer as correct only if all provided numbers are correct. Call Options with Strike 50 Some of the welghts might be correct, but porttolio has different payott. Call Options with Strike - 40 Some of the weights might be correct, but portfolio has different payoff. Put Options with Strike =40 Put Options with Strike =50 Some of the weights might be correct, but portfolio has different payoff. Put options with Strike =30 X(S)={2S100,1002S,S[0,50)S[50,) Enter number at the options you will use with the given characteristics it bonds are not available. Call Options with Strike =10 Some of the numbers might be correct, but your portfolio has a different payoff. Call Options with Strike =50 Some of the numbers might be correct, but your portfollo has a different payoff. Call Options with Strike =40 Some of the numbers might be correct, but your portfollo has a different payoff. Put Options with Strike - 10 Put Options with Strike - 10 Some of the numbers might be correct, but your porttollo has a difterent payott. Put Options with Strike - 50

Construct a portfolio consisting of risk-free bonds, European call and put options to replicate the payoff function X(S) below. Be specific about how many options of each type are in your portfolio. Use + sign if you buy option and - sign if you short it. Use 0 if you do not use an option.

Construct a portfolio consisting of risk-free bonds, European call and put options to replicate the payoff function X(S) below. Be specific about how many options of each type are in your portfolio. Use + sign if you buy option and - sign if you short it. Use 0 if you do not use an option.