construct a statement of comprehensive income using the below tax worksheet sheet showing as much detail as possible

supporting information is below

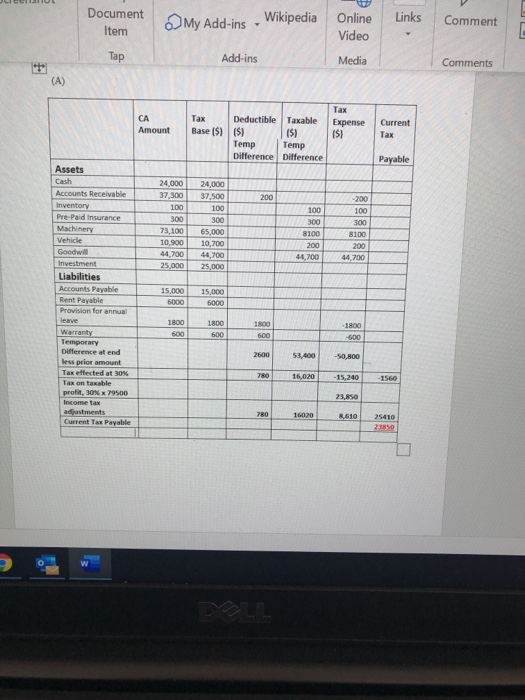

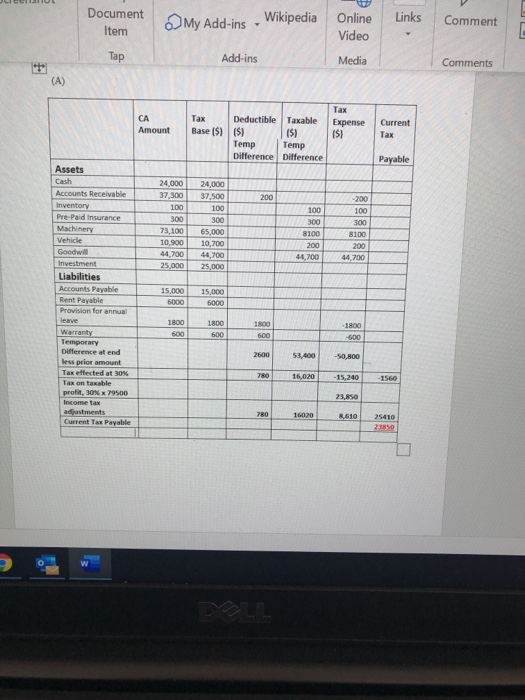

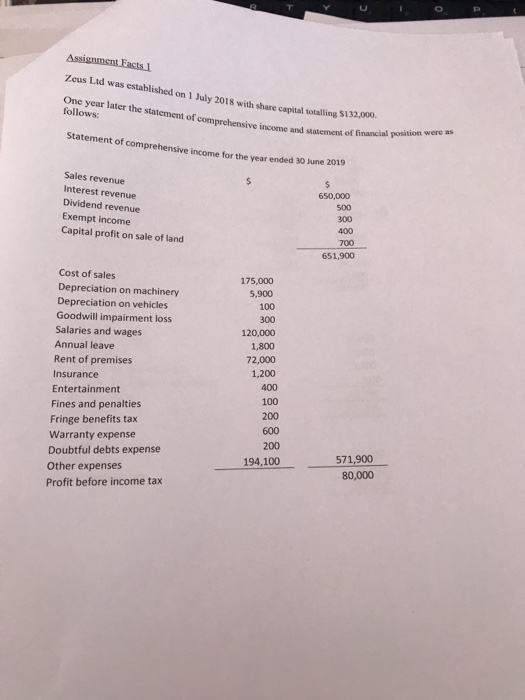

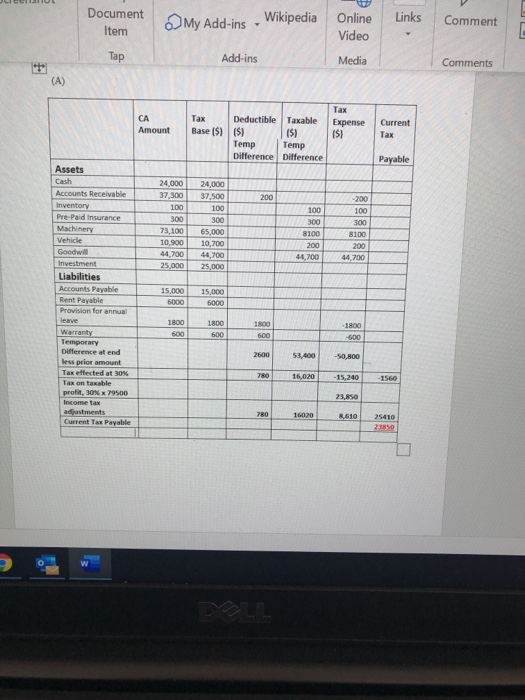

Document Item My Add-ins - Wikipedia Links Comment Online Video Tap Add-ins Media Comments Amount Tax Base ($) Deductible (5) Temp Difference Taxable (5) Temp Difference Expense (5) Current Tax Payable Assets 200 Accounts Receivable Inventory Pre-Paid Insurance Machinery Vehicle Goodwill Investment Liabilities 24,000 37,300 100 300 73,100 10.900 44,700 25,000 24,000 37,500 100 300 65,000 10,700 44,700 25,000 44,700 44.700 Accounts Payable 15,000 15,000 6000 Rent Payable Provision for annual 1800 -1800 Warranty Difference at end 53,404 -50.800 Tax effected at 30% -15,240 - 1560 21.050 16020 8,610 25410 ent Tax Payable Assignment Facts1 Zeus Ltd was established on 1 July 2018 with share capital totalling $132.000 One year later the statement of comprehensive income and statement of follows: Statement of financial position were as Statement of comprehensive income for the year ended 30 June 2014 a Sales revenue Interest revenue Dividend revenue Exempt income Capital profit on sale of land 650,000 500 300 400 700 651,900 Cost of sales Depreciation on machinery Depreciation on vehicles Goodwill impairment loss Salaries and wages Annual leave Rent of premises Insurance Entertainment Fines and penalties Fringe benefits tax Warranty expense Doubtful debts expense Other expenses Profit before income tax 175,000 5,900 100 300 120,000 1,800 72,000 1,200 400 100 200 600 200 194,100 571,900 80,000 Document Item My Add-ins - Wikipedia Links Comment Online Video Tap Add-ins Media Comments Amount Tax Base ($) Deductible (5) Temp Difference Taxable (5) Temp Difference Expense (5) Current Tax Payable Assets 200 Accounts Receivable Inventory Pre-Paid Insurance Machinery Vehicle Goodwill Investment Liabilities 24,000 37,300 100 300 73,100 10.900 44,700 25,000 24,000 37,500 100 300 65,000 10,700 44,700 25,000 44,700 44.700 Accounts Payable 15,000 15,000 6000 Rent Payable Provision for annual 1800 -1800 Warranty Difference at end 53,404 -50.800 Tax effected at 30% -15,240 - 1560 21.050 16020 8,610 25410 ent Tax Payable Assignment Facts1 Zeus Ltd was established on 1 July 2018 with share capital totalling $132.000 One year later the statement of comprehensive income and statement of follows: Statement of financial position were as Statement of comprehensive income for the year ended 30 June 2014 a Sales revenue Interest revenue Dividend revenue Exempt income Capital profit on sale of land 650,000 500 300 400 700 651,900 Cost of sales Depreciation on machinery Depreciation on vehicles Goodwill impairment loss Salaries and wages Annual leave Rent of premises Insurance Entertainment Fines and penalties Fringe benefits tax Warranty expense Doubtful debts expense Other expenses Profit before income tax 175,000 5,900 100 300 120,000 1,800 72,000 1,200 400 100 200 600 200 194,100 571,900 80,000